Analyzing the Bitcoin Lightning Network: Top Nations

Posted over 2 years ago by LN+

The decentralized world of Bitcoin and its off-chain scaling solution, the Lightning Network, has taken the world by storm. One of the ways to gauge its acceptance is by examining the number of Lightning Network nodes across different countries. By understanding the distribution, we can grasp a better picture of adoption rates and regional tendencies. Here, we'll delve deep into the data to unveil patterns and insights.

This data is collected from nodes with public IPs from 1ML. The total network is significantly larger if we could include nodes running over Tor. It's also important to note that a resident of one country may run their node in a different geographic location. Regardless, the data provides a rough indication of the state of affairs.

This data is collected from nodes with public IPs from 1ML. The total network is significantly larger if we could include nodes running over Tor. It's also important to note that a resident of one country may run their node in a different geographic location. Regardless, the data provides a rough indication of the state of affairs.

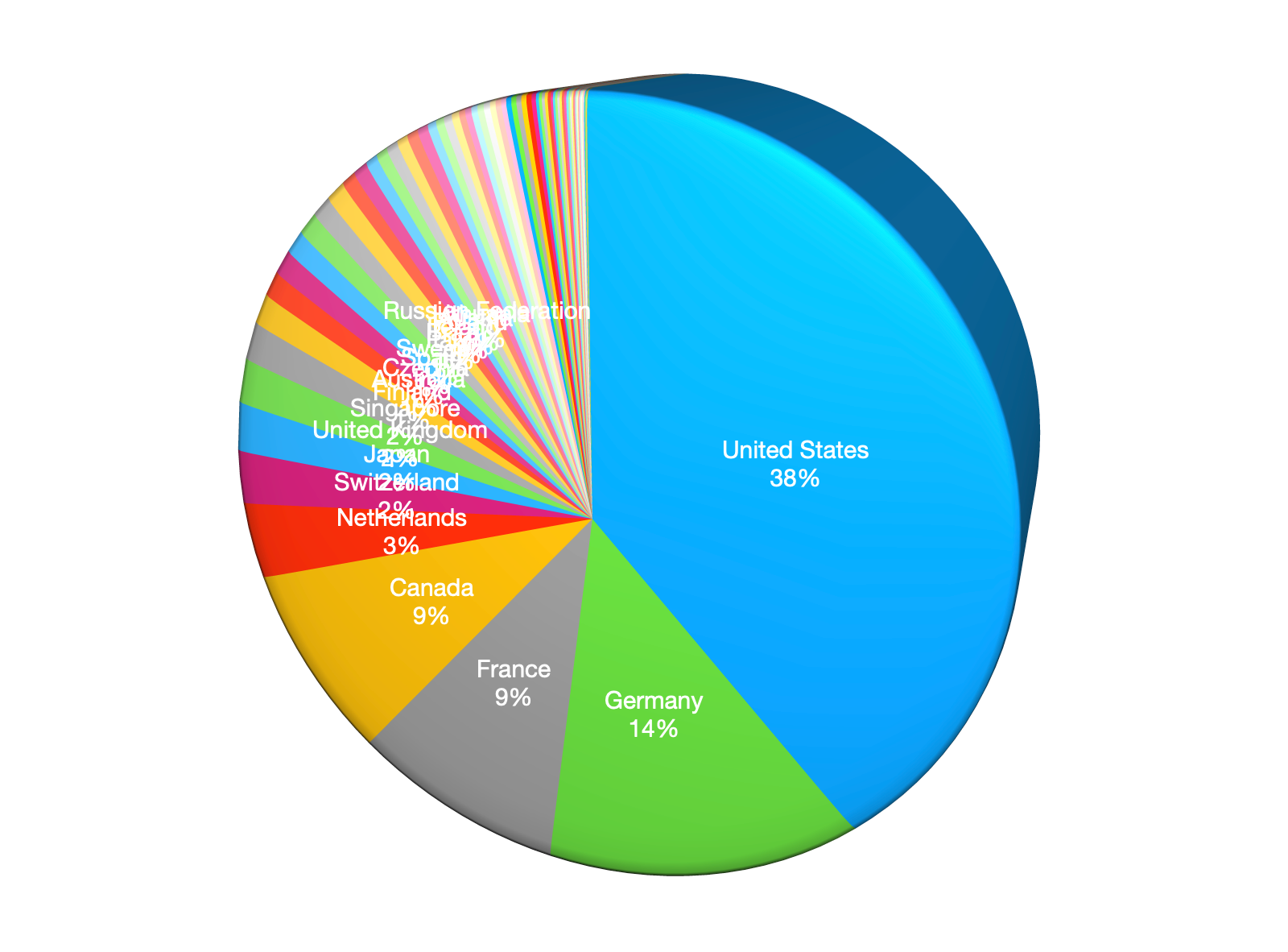

Top 5 Countries by Node Count

- United States: 1,332 nodes

- Germany: 488 nodes

- France: 331 nodes

- Canada: 304 nodes

- Netherlands: 119 nodes

It's evident from the data that North America leads by a significant margin in terms of absolute node count. European countries, particularly Germany, France, and the Netherlands, are also prominently represented, suggesting a strong European interest in the Lightning Network.

Top 5 Countries Adjusted for Population

To gauge relative adoption, we must account for population size. By evaluating nodes per million people, we can identify countries with a disproportionate interest in the Lightning Network compared to their size. I excluded smaller countries, as their limited population can lead to unreliable data.

- Iceland: 41.90 nodes/million

- Singapore: 10.29 nodes/million

- Switzerland: 9.35 nodes/million

- Finland: 8.28 nodes/million

- Canada: 7.81 nodes/million

While Iceland takes the crown, it's crucial to note that it has a relatively small population, which may allow for such high numbers with fewer nodes. However, this doesn't negate the country's keen interest in Bitcoin's scaling solution. The appearance of Singapore and Switzerland on this list suggests these nations' roles as global finance and tech hubs.

Other Noteworthy Observations

Asian Discrepancy: Japan and South Korea, often considered tech-forward nations, show surprisingly low nodes per million (0.60 and 0.17 respectively). This might suggest a cultural or regulatory hurdle, or perhaps other technologies and financial solutions are more prominent.

Emerging Economies: It's interesting to note countries like Brazil and China, with vast populations, showing a low adoption rate. As these nations are known for their rapidly growing tech sectors, it would be intriguing to monitor how these figures change in the coming years. It's important to highlight that, according to anecdotal data, numerous node operators in emerging economies utilize Tor, and thus, they aren't reflected in the numbers provided above.

Dark Horse: North Korea's appearance on the list is surprising, given its geopolitical situation and strict regulations. While the node count isn't high, the fact that it's on the list at all is noteworthy. It is also possible that this result is a fluke of data collection.

Emerging Economies: It's interesting to note countries like Brazil and China, with vast populations, showing a low adoption rate. As these nations are known for their rapidly growing tech sectors, it would be intriguing to monitor how these figures change in the coming years. It's important to highlight that, according to anecdotal data, numerous node operators in emerging economies utilize Tor, and thus, they aren't reflected in the numbers provided above.

Dark Horse: North Korea's appearance on the list is surprising, given its geopolitical situation and strict regulations. While the node count isn't high, the fact that it's on the list at all is noteworthy. It is also possible that this result is a fluke of data collection.

What's Next?

The Lightning Network's adoption is spreading worldwide, with specific nations spearheading the movement. As with any technology, its acceptance and implementation are influenced by regional, cultural, and economic factors. As Bitcoin and the Lightning Network progress, it will be intriguing to observe the changes in these numbers and identify which countries emerge as the frontrunners in this decentralized financial revolution.

Short-term predictions for the next 5 years:

Short-term predictions for the next 5 years:

- Custodial LN wallets, such as Wallet of Satoshi and Speed Wallet, will see increased adoption, and this increased userbase will not be reflected in node count.

- For some time, corporate adoption will largely come through custodial services like OpenNode and Speed. Consequently, this surge in corporate adoption may not significantly impact the node count.

- With the launch of Taproot Assets and the introduction of stablecoins on Lightning, countries like Turkey will significantly boost their Lightning adoption.

- With the rollout of user-friendly Lightning node solutions like Umbrel Home and Start9's Servers, we can expect a noticeable uptick in hobby node operations in developing countries.

- Lightning Network implementations are becoming more streamlined and faster, making it feasible for even legacy devices. This will enable individuals, especially in South American countries, with modest means to run nodes for their small businesses and personal needs.

Long-term predictions for the next 10 years:

- Millions will operate Lightning nodes on their mobile devices. These won't be full nodes but rather pruned nodes, depending largely on external servers to strike a balance between privacy and decentralization. If we include these streamlined nodes, we might see a total of 1 million nodes.

- The Lightning Network will also operate on Liquid, with submarine swaps allowing people to seamlessly pay Liquid LN invoices using Bitcoin LN nodes, and vice versa. Liquid LN will come in handy in scenarios necessitating frequent and economical channel management.

- While stablecoins will remain relevant, Bitcoin will begin to dominate in many contexts, negating the need for the complexity and custodial nature of stablecoins.

- Custodial LN wallets will persist but will likely be reserved for minor amounts, akin to pocket money for children. In contrast, salaries will predominantly be disbursed to self-custody wallets.

0 Comments

Please login to post comments.

Lightning Network Node

LightningNetwork.Plus

Rank: 6 / Tungsten

Capacity: 40,370,000 SAT

Channels: 11

Latest news

Channel Rebalancing 101: Practical Strategies for Better Routing

Posted 3 months ago

Square Launches Lightning-Powered Bitcoin Payments: Zero Fees Until 2027

Posted 4 months ago

Introducing Telegram notifications

Posted 5 months ago

Introducing Nostr DM notifications

Posted 5 months ago