LN+'s Posts

Channel Rebalancing 101: Practical Strategies for Better Routing

Posted 3 months ago

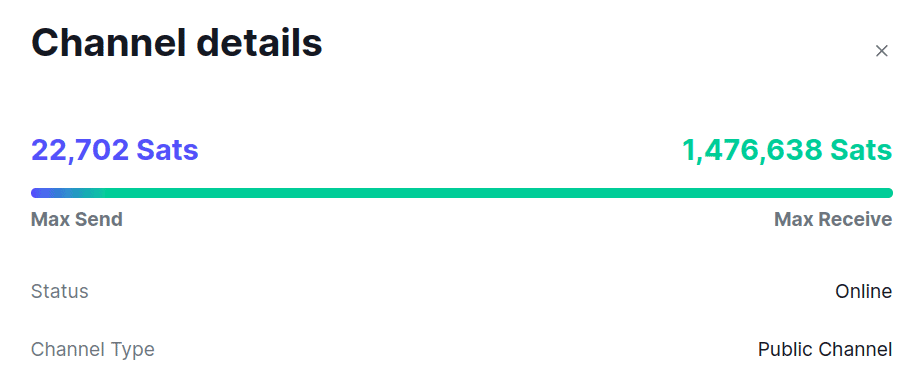

Why rebalance at all?

Rebalancing basics in one mental model

Signs your node needs a rebalance

Set a target before you move sats

Strategy A: Circular rebalances

Strategy B: Let the market rebalance you with fees

Strategy C: Peer and channel management is a rebalance tool too

Strategy D: External liquidity moves when loops aren’t enough

Choosing what to rebalance first

A lightweight routine that works

Common mistakes to avoid

A note for LN+ Liquidity Swaps users

Takeaway

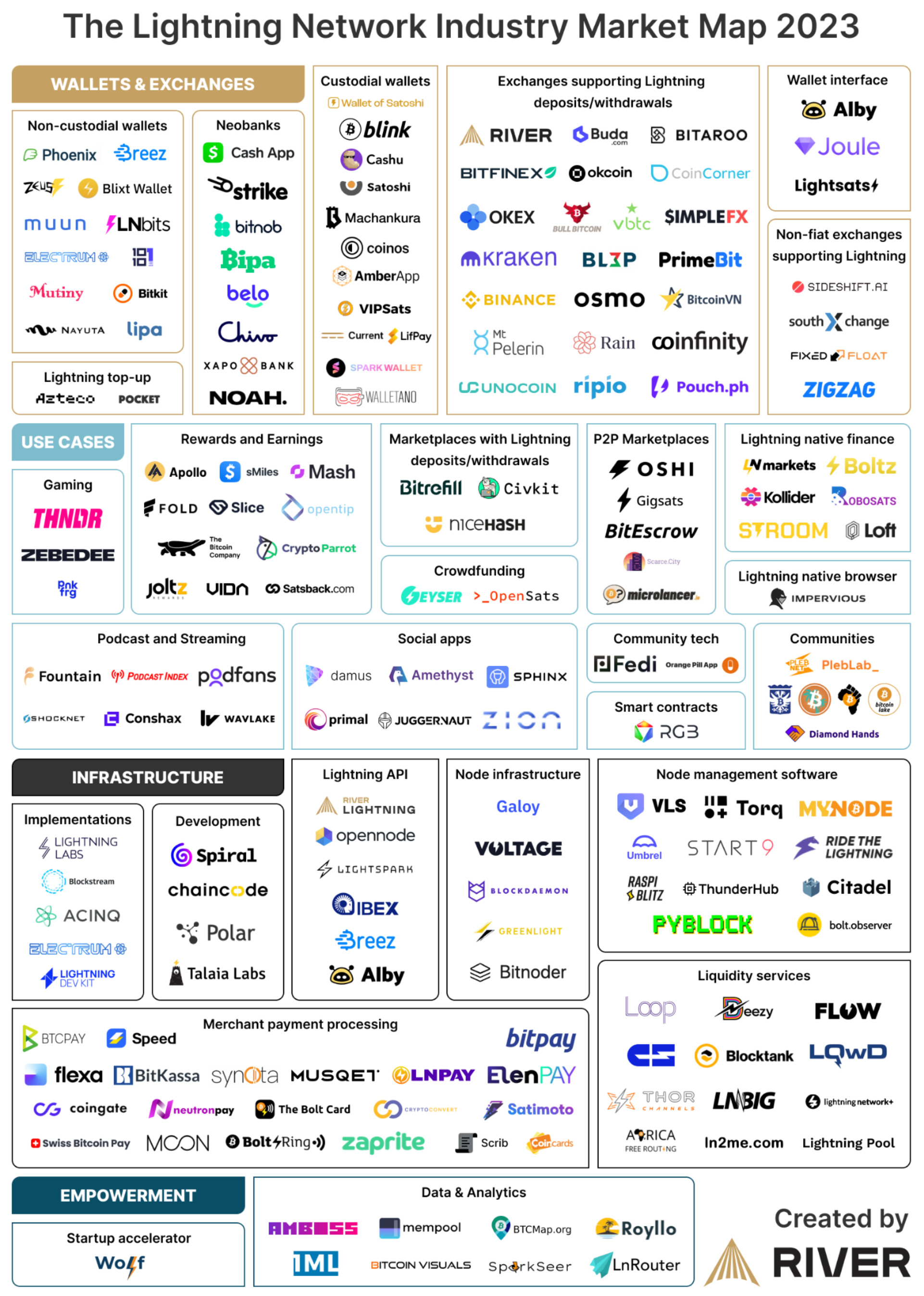

From Digital Gold to Digital Cash: Why the Lightning Network’s Moment Has Arrived

Posted 3 months ago

"Store of Value" to "Medium of Exchange."

Stage B: Medium of Exchange (MoE)

Stage C: Unit of Account (UoA)

Why the "Lull" Was Actually Preparation

3. Human Capital is Ready

The Signs of the Shift: Invisible Adoption

Time to Shine

Square Launches Lightning-Powered Bitcoin Payments: Zero Fees Until 2027

Posted 4 months ago

“The future of payments starts November 10. Accept bitcoin with zero processing fees until 2027 and keep more of what you earn.”— Square on X (@Square)

How It Works

- Merchants enable Bitcoin Payments in their Square Dashboard or POS app.

- At checkout, Square generates a QR-code Lightning invoice.

- Customers scan and pay using any Lightning-enabled wallet.

- Payments settle in seconds and appear in the merchant’s Square Dashboard.

- Merchants can choose to keep bitcoin or convert it instantly to USD at the time of sale.

Fees and Timeline

Availability and Limitations

- U.S. sellers only at launch.

- Not available to New York sellers or international merchants.

- Physical locations only for now; online bitcoin payments will follow later.

- Refunds: Square has not yet published details on bitcoin-payment refund mechanisms, though Lightning transactions are inherently irreversible.

Why It Matters

The Broader Picture

What Comes Next

- Expansion to online sellers and international markets.

- Clear guidance on refund and settlement policies.

- Data on merchant uptake and real-world transaction volumes.

Final Thoughts

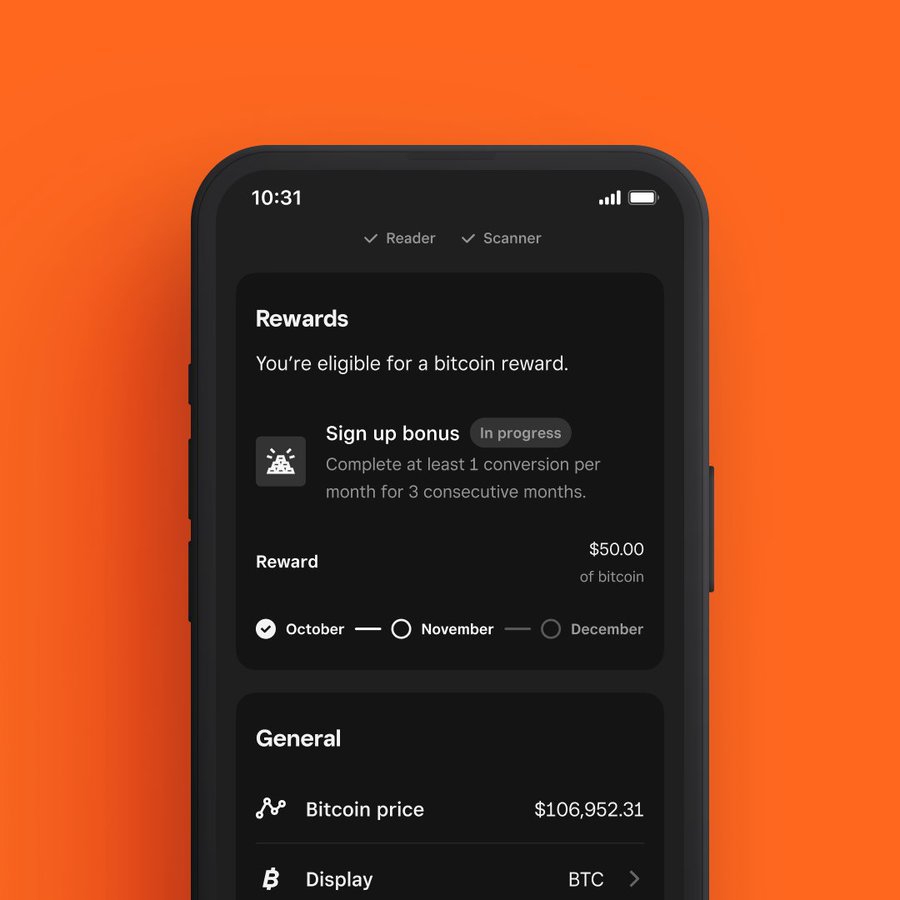

Introducing Telegram notifications

Posted 5 months ago

To set this up:

- Visit Telegram Linking in your LN+ Dashboard

- Click the "Generate Verification Code" button

- Click the "Link Telegram" button

The @LN_plus_bot will be added as a contact and will send you notifications. You can stop notifications or remove the Telegram link at any time through LN+ settings or directly in Telegram.

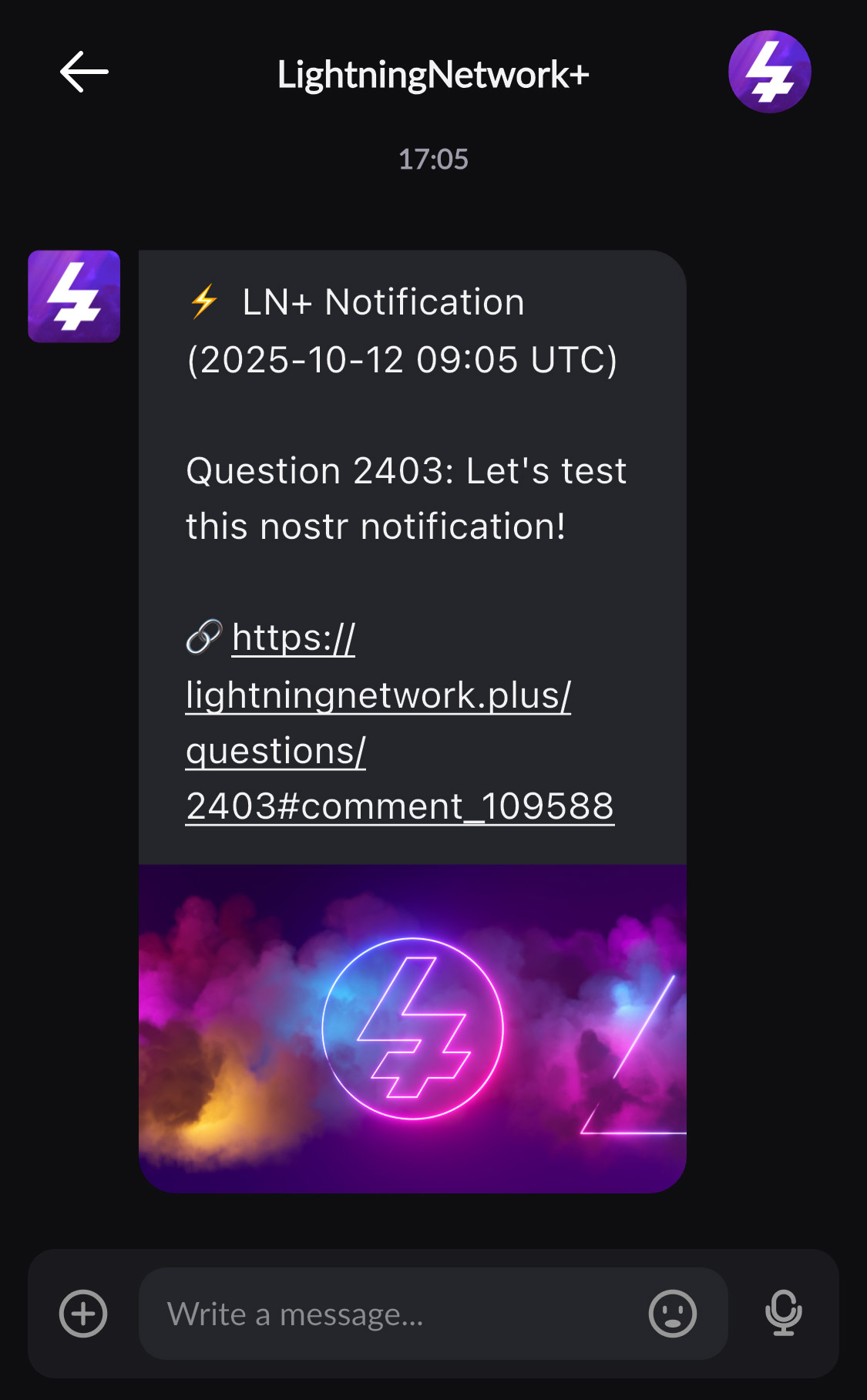

Introducing Nostr DM notifications

Posted 5 months ago

To enable Nostr DM notifications, follow these two simple steps:

- Go to your Nostr Linking within your Dashboard and link your Nostr npub with LN+.

- Enable Nostr DM notifications on the same page.

Notes:

- If you already use Nostr to log in to LN+, you’ve completed step 1.

- To receive notifications, choose a Nostr app, such as 0xchat, from the list of available Nostr Apps.

- Some apps may require you to follow our Nostr account to receive DMs, helping to reduce spam.

If you haven’t explored the Nostr ecosystem yet, now is a great time to start.

Coming soon: Telegram notifications.

Introducing Nostr Sign-In for LN+

Posted 8 months ago

Big News for Bitcoin Lightning in Southeast Asia: Neutronpay Teams Up with Aliniex

Posted about 1 year ago

Aliniex, one of Vietnam’s biggest crypto exchanges, has just plugged into the Lightning Network using Neutronpay’s infrastructure. This move puts Southeast Asia on the map for LN adoption and could kick off a whole new wave of growth in the region.

Why This Matters for Southeast Asia

LN’s magic lies in making Bitcoin transactions instant and dirt cheap. By leveraging Neutronpay’s infrastructure, Aliniex users can send and receive Bitcoin or stablecoins and convert them directly to local currency. Imagine transferring funds to a friend in another country or paying a merchant without dealing with high fees or long waits. That’s the kind of seamless experience LN is bringing to the table.

What Neutronpay and Aliniex Are Bringing to the Party

- Streamline Off-Ramp Services: Users can now directly convert Bitcoin and Stablecoins into fiat and transfer it to local bank accounts in 16+ countries, enhancing convenience and reliability.

- Deliver Fast Bitcoin Transactions: With Lightning Network integration, Aliniex offers near-instant Bitcoin transfers at lower costs.

- Expand Across Asia and Africa: This integration allows Aliniex to scale its operations to emerging markets, meeting the demand for accessible financial tools.

Why This Is a Big Deal

This could also push other exchanges and companies in the region to adopt LN. The more businesses that jump on board, the more valuable and widespread LN becomes. It’s a domino effect that benefits everyone in the Bitcoin ecosystem.

Albert Buu - Founder and CEO of Neutronpay said:

"I am thrilled to welcome Aliniex as they integrate our Lightning Network API solution into their platform. This reflects a shared vision of the future of digital payments, where businesses can offer their customers the speed, efficiency, and innovation that Bitcoin's Lightning Network enables. Aliniex's decision to embrace this technology demonstrates their commitment to staying at the forefront of the evolving payments landscape. As new generation of users driving demand for advanced digital payment solutions, I'm proud to provide the infrastructure that helps forward-thinking companies like Aliniex deliver cutting-edge payment experiences to their customers."

A Glimpse at What’s Next

For those of us who’ve been waiting to see LN take off globally, this is a big step forward. It’s proof that Bitcoin’s second layer isn’t just a cool idea—it’s solving real problems and making crypto easier to use for everyone.

The Lightning Network: Bitcoin’s Supercharged Secret Weapon

Posted about 1 year ago

Micropayments at Scale

Instant Transactions

Reduced Fees

Privacy

Scalability

Atomic Multipath Payments (AMP)

Decentralization of Routing

Applications Beyond Payments

- Gaming: Real-time microtransactions for in-game purchases.

- Messaging: Secure and private chat services.

- Marketplaces: Peer-to-peer platforms for trading goods and services.

- Streaming: Pay-per-second video or audio content.

Smart Contracts

Rapid Growth

Layer 2 Technology

Community-Driven

Introducing Group Channel Opens on LN+

Posted over 1 year ago

The Benefits

- Only one bitcoin transaction is used to open 3, 4, or 5 channels. This saves block space and consequently makes the channel opening cheaper. Significantly cheaper in fact. In a triangle, square and pentagon the block space and cost savings are appr. 52%, 58%, and 62% respectively.

- All channels are balanced on opening. This means both the outgoing and your incoming channel will have 50% capacity, which is ideal for routing payments, and allows you to both send and receive on both channels.

- All channels are only opened if all participants in the swap sign the transaction. It's all or nothing.

The Disadvantages

- Only works with LND nodes.

- Requires BOS (for now) and terminal (command line interface).

- All participants need to keep their terminal window open until all participants joined and the transaction is broadcasted, which is why triangles are the best bet in most cases.

Requirements

- LND (Lightning Network Daemon) node.

- BOS (Balance of Satoshi) command line tool.

- Being comfortable copy pasting terminal (command line interface) commands.

How to Do It?

- Read the requirements above.

- On LN+ go to Liquidity Swaps.

- Filter the Swaps for Platform: LND/BOS Only, and join one you like.

- If you can't find any matching swaps, start one and within the form select the checkbox: LND/BOS group funded channel open users only. It's recommended to do a triangle, because it's easier for all 3 participants to be online roughly at the same time.

- Enable email notifications with a valid email, and watch your inbox.

- Invite your friends and followers to the swap.

- Follow the instructions and commands provided by LN+.

- Wait for the bitcoin transaction to confirm and enjoy your two new channels.

- Profit!

This is how the Terminal window will look like from A's point of view, who initiates the transaction. The first command is generated by LN+ for A, and the rest is automated:

bos create-channel-group --allow <pubkey B> --allow <pubkey C> --size 3 --capacity 100000 --fee-rate 5 group_invite_code: <long random string> at: Tue Oct 15 2024 09:08:35 GMT+0800 (<Country> Time)ready: <alias B> <pubkey B> at: Tue Oct 15 2024 09:08:50 GMT+0800 (<Country> Time)ready: <alias C> <pubkey C> ready: <alias B> <pubkey B>, <alias C> <pubkey C> peered: trueproposed: truesigned: true publishing: <bitcoin transaction hex> transaction_id: <bitcoin transaction id> broadcast_transaction_at_height: 865675

This is how the Terminal window will look like from B's point of view who joined the swap. The first command is generated by LN+ for A and B, and the rest is automated:

bos join-channel-group <group invite code> connecting_to: <A pubkey> requesting_group_details_from: <A pubkey> joining: 3 member group coordinated by <A alias> <A pubkey> channels and paying 5/vbyte chain fee waiting_for_other_members: true peering_with: <A alias> <A pubkey>, <C alias> <C pubkey> refund: <long string> signed: <long signature string> transaction_id: <bitcoin transaction id>

For more info, also read this previous post explaining batch channel opens, the technology behind Group Channel Opens.

As always, if you see anything broken or you have an idea for an improvement, please comment or send me an email through the contact form.

Atomic Multipath Payments (AMP): Splitting Payments Across Multiple Channels

Posted over 1 year ago

1. Introduction

2. Understanding Atomic Multipath Payments (AMP)

3. Technical Mechanics of AMP

4. Benefits of AMP

- Increased Payment Reliability: AMP increases the reliability of payments by enabling the use of multiple channels. Even if one channel lacks sufficient liquidity, the transaction can succeed through alternative paths.

- Ability to Send Larger Payments: One of AMP’s key benefits is that it allows users to send payments larger than the capacity of any single channel. This feature directly addresses one of the main limitations of the traditional Lightning Network.

- Reduced Transaction Fees: By utilizing more efficient routing across multiple channels, AMP can reduce overall transaction fees, as payments are split across paths with better fee structures.

- Enhanced Network Liquidity: Node operators benefit from AMP by improving liquidity management. Since payments are divided among several channels, the network’s liquidity is utilized more effectively, allowing nodes to process a larger number of transactions.

- Increased Routing Opportunities: With AMP, node operators gain more opportunities to route payments, thereby earning additional routing fees. The division of payments opens up more potential paths, increasing node participation in the routing process.

- Improved Channel Utilization: AMP helps optimize the use of channels, balancing liquidity across multiple channels more effectively, leading to better channel health and longevity.

5. Limitations and Challenges of AMP

6. Software and Implementations Supporting AMP

- LND (Lightning Network Daemon): LND was one of the first Lightning implementations to support AMP. Its robust feature set and extensive developer community have made it a popular choice for AMP users.

- Core Lightning (CLN): Core Lightning, previously known as c-lightning, has integrated AMP support, offering flexibility and configurability for advanced users.

- Eclair: Eclair has also introduced AMP capabilities, enhancing its role as a Lightning implementation aimed at mobile and lightweight node operators.

7. Enabling AMP on Supported Platforms

Configuration Settings: In your lnd.conf file, add or verify the following settings:

[protocol] amp=1

sudo systemctl restart lnd

lncli sendpayment --pay_req=<invoice> --amp

lncli addinvoice --memo="Payment for services" --value=1000 --amp

lightning-cli pay <invoice>

lightning-cli invoice <amount_msat> <label> <description>

7.3. Troubleshooting Common Issues

Understanding Bitcoin Lightning Network Forwarding Fee Earnings

Posted almost 2 years ago

Base Fee

Fee Rate

Nomenclature

Here is an example of a report on a channel in LND:

"base_fee_msat": "1000", "fee_per_mil": "500", "fee_rate": 0.0005

Let's break it down:

- base_fee_msat is the base fee set in msat (milli Satoshis). Thus, 1,000 msat means 1 satoshi earned per successfully forwarded transaction.

- fee_per_mil is the fee rate in PPM (parts per million). Thus, for every 1,000,000 satoshi forwarded, you earn 500 satoshis.

- fee_rate is the same as the fee_per_mil expressed in percentages for convenience.

- Base Fee is set in satoshis (not msat!)

- Fee Rate is set in PPM. The percentage is calculated for you on the fly next to the label.

Here is an example of a report on a channel in CLN:

"fee_base_msat": 1000, "fee_proportional_millionths": 500,

Let's take it line by line:

- fee_base_msat is the base fee set in msat (milli Satoshis).

- fee_proportional_millionths is the fee rate in PPM (parts per million).

- CLN doesn't provide the fee rate in percentage terms.

Examples of Fee Calculation

- Base Fee: 1 satoshi per transaction = 1 satoshi

- Fee Rate: 500 PPM means you get 500 satoshis per million satoshis forwarded. Thus, the fee earned is 500 satoshis.

- Total: 1 + 500 = 501 satoshis fee

Example 2: Five Transactions of 200,000 Satoshis Each

- Base Fee: 1 satoshi for 5 transactions = 5 satoshis

- Fee Rate: 500 PPM for 200,000 sats is 100 satoshis each, times 5 is 500 satoshis.

- Total: 5 + 500 = 505 satoshis fee

Handling Very Low Fees

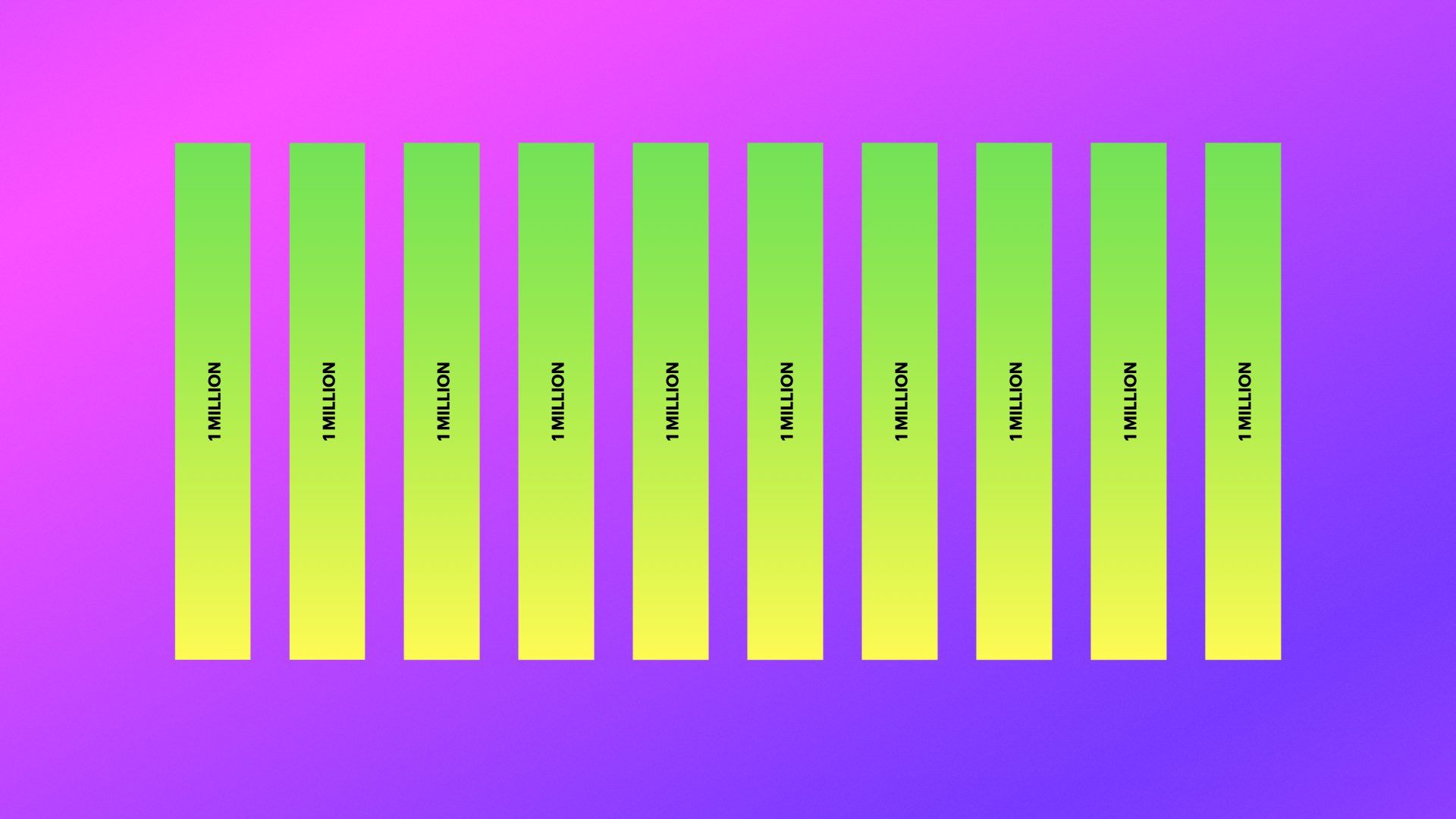

Is It Better to Open Few Large or Many Small Channels on Bitcoin Lightning?

Posted almost 2 years ago

Scenario 1: Small Channels

Advantages:

- High Redundancy: With ten channels, there is a greater likelihood that at least one channel will have the necessary liquidity for a transaction, ensuring almost certain payment success.

- Potentially Lower Fees: With more routes to choose from there is a higher likelyhood to find a low fee route for incoming and outgoing payments.

- Ideal for Small Payments: This setup is particularly suited for small transactions such as tipping, paying for content, and other microtransactions.

Disadvantages:

- Limited to Small Payments: Larger payments require splitting across multiple channels, which can add complexity and potentially increase the transaction time.

- Higher Opening Costs: More channels mean higher costs due to the fees associated with opening each channel, although this can be mitigated by batch channel opening.

- Minimal Routing Income: Smaller channels are less likely to be used for routing, resulting in lower fees earned from this activity.

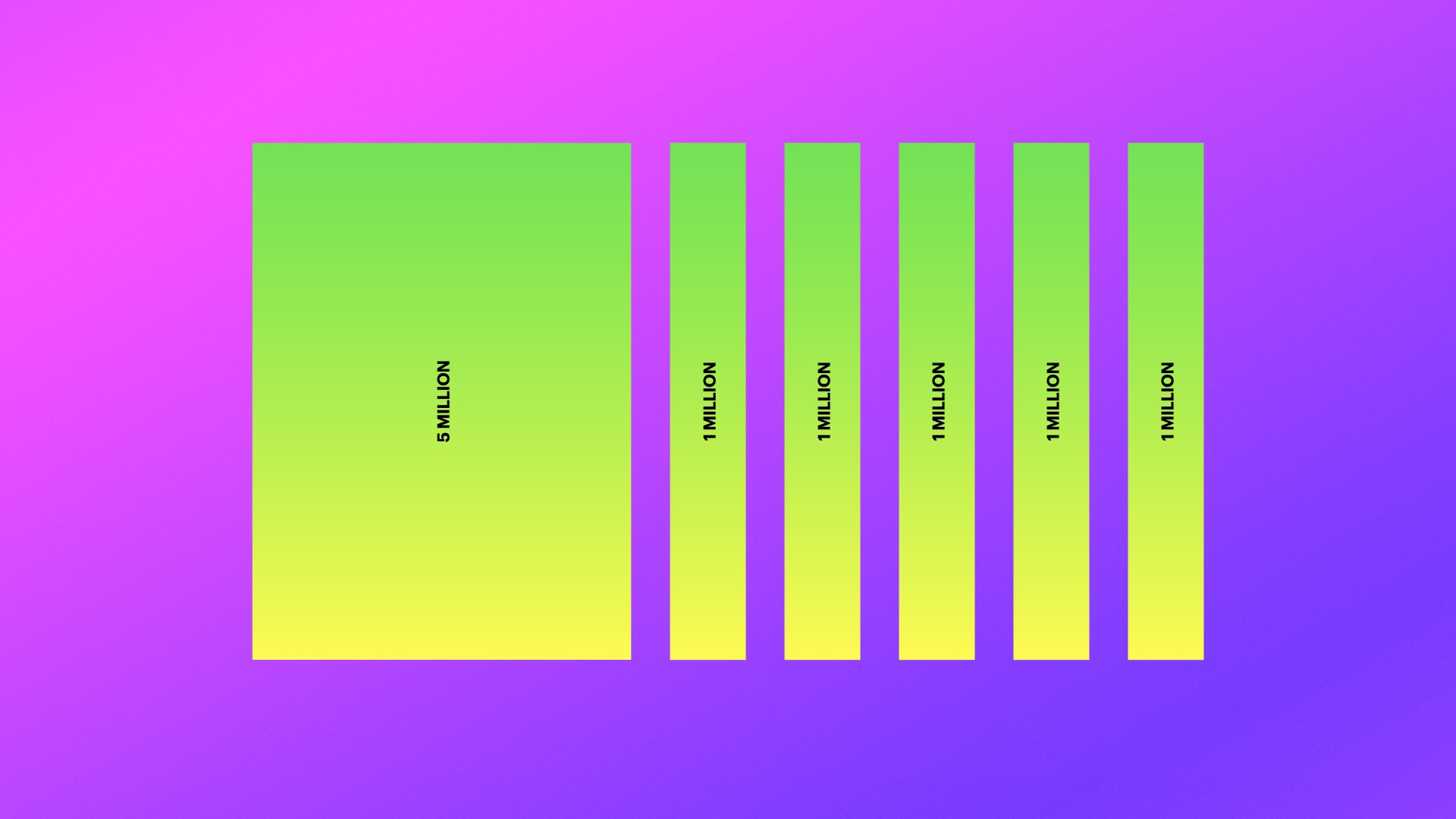

Scenario 2: Mixed Size Channels

Advantages:

- Balanced Redundancy and Capacity: This setup provides a good mix of redundancy and the ability to handle larger payments through the 5 million satoshi channel.

- Versatility: Suitable for a variety of use cases, from small transactions to occasional larger payments.

- Moderate Routing Income: The larger channel may be used for routing, generating some income from transaction fees.

Disadvantages:

- Moderate Complexity: The mixed configuration may still face issues with liquidity in smaller channels, requiring careful management.

- Variable Costs: While there are fewer channels than in the small channels scenario, the cost savings are not as significant as in the large channels scenario.

Scenario 3: Large Channels

Advantages:

- Low Opening Costs: Fewer channels mean lower overall costs for opening and maintaining channels.

- Ideal for Large Payments: Larger channels can handle significant transactions without the need for splitting payments.

- Higher Routing Potential: These channels are more likely to be used for routing large transactions, generating higher fees.

Disadvantages:

- Low Redundancy: With only two channels, the setup is more vulnerable to failures or liquidity issues. If one channel goes down or lacks the necessary liquidity, transactions may fail.

- Centralized Dependency: Depending heavily on a few large channels can increase reliance on specific nodes, potentially leading to centralization issues.

Overall Considerations

- Network Connectivity: Ensure connections to both highly connected large nodes and medium-sized nodes to avoid over-reliance on centralized entities.

- Frequent Connections: Establish channels with friends and businesses you frequently transact with, as direct connections can improve transaction efficiency for daily use.

- Use Case Suitability: Align your channel strategy with your intended use case. Small channels are best for microtransactions, mixed channels offer versatility, and large channels are suitable for handling significant payments and routing.

- Balanced Node: Ensure that you maintain a balanced node with channels that are at least partially empty on your side to receive payments and channels that are at least partially full on your side to send payments. This balance allows for smooth transaction flow in both directions. To achieve this, you may need other node operators to open channels to you. Consider using our Liquidity Swaps and Liquidity Pool services available on this site to easily and freely manage your liquidity needs.

- Partner Fees: While large and well connected nodes may seem like a great option to be well connected, consider that they also typically charge more for transaction routing. Medium and small sized nodes are usually cheaper to route through.