LN+'s Posts

Introducing LN+ Pro Membership: Elevate Your Node to New Heights

Posted almost 2 years ago

What is LN+ Pro Membership?

Exclusive Features for Pro Members

- Prime Node Liquidity Swaps: Start and participate in Liquidity Swaps that are exclusive to Prime nodes (explained more below) — users who have garnered 10+ positive reviews and maintain a 90%+ positive rating.

- Prominent Visibility: Gain unmatched visibility by appearing at the top of critical indexes and rotating on the front page of LN+.

- Ongoing Feature Access: As we continue to innovate, you’ll gain access to new features such as premium profile customization options, Pro API features, and exclusive courses offered through Layers Academy.

Support and Contribute

Flexible and Easy to Purchase

Users who previously purchased the Node Highlight feature will be automatically grandfathered into the Pro Membership. This adjustment comes as we replace Node Highlighting with our new, more comprehensive offering.

Join Today and Ascend the Ranks

Prime Nodes and Liquidity Swaps

MicroStrategy's Impact and Potential in the Bitcoin Ecosystem

Posted almost 2 years ago

What has MicroStrategy done for Bitcoin so far?

- Bitcoin on the Balance Sheet:

MicroStrategy (MSTR) strategically allocated a substantial portion of their balance sheet to Bitcoin (214,400 BTC at the time of writing), reaping significant gains on their investment. MSTR is setting a positive example for other companies, and educating them about this ultimate store of value. Moreover, this accumulation drives up Bitcoin's price, expanding its utility by enabling larger reserves and transactions. While some critique MSTR's concentration of Bitcoin holdings, the majority of Bitcoin enthusiasts view their influence as beneficial overall. - Lightning Rewards:

Recognizing the need to address underserved areas in business applications, MicroStrategy introduced the Lightning Rewards program. This initiative aims to incentivize workforce productivity by offering tangible rewards in Bitcoin. Launched just four months ago, the program utilizes the Lightning Network, known for its scalability, although its long-term success remains to be seen. Nevertheless, using Lightning as a platform was a wise idea, as LN has ample capacity to satisfy the needs of even large international companies. - Identity Solution (did:btc):

MicroStrategy's latest endeavor targets another pressing issue for their clients: email spam. Addressing the significant drain on resources and security concerns posed by spam, MicroStrategy launched MicroStrategy Orange, a decentralized identity solution. Utilizing the Bitcoin blockchain exclusively, this solution aims to combat spam by storing and retrieving DID information via UTXOs on-chain. By offering tools to deploy this solution on Outlook, MicroStrategy aims to streamline email security for businesses. However, if it's important to note that if this service takes off it may use significant amount of block space.

What's in MicroStrategy's Future for Bitcoin?

- Massive Lightning Service Provider (MLSP):

Having sufficient and reliable incoming liquidity is critical for large businesses to be able to accept LN payments. The community here at LN+, and many other services do their best to satisfy the need through various methods. MSTR is in unique position and could play a pivotal role in advancing Lightning Network adoption by becoming a Massive Lightning Service Provider (MLSP). Leveraging their substantial Bitcoin reserves, they could provide liquidity to large businesses seeking to accept Lightning payments globally. By doubling the Lightning Network's liquidity with just a fraction of their reserves (2%), MicroStrategy could significantly accelerate Lightning's growth and reliability of the network for all participants. - Bitcoin Liquid and Liquid Lightning Network:

As on-chain Bitcoin transactions become increasingly expensive, MSTR could support the adoption of Bitcoin's Liquid Sidechain and help build a new Liquid based Lightning Network that is compatible with the existing Lightning Network. By providing significant Bitcoin capital, MSTR could facilitate large and fast on-chain transactions on Liquid while also enabling the ability for people to run Liquid Lightning nodes supporting cheap and rapid channel management on their mobile devices. - Bitcoin Deep Cold Storage (BDCS):

MicroStrategy could enhance their Bitcoin storage security by developing a proprietary Deep Cold Storage service where clients can hold their own keys and are safe even in the event if the BDCS service were to disappear. This service would ensure MSTR can also hold their own keys independently of third parties, and offer similar self sovereignity to their clients. Making this service available to other companies and individuals would bolster Bitcoin adoption among high-net-worth individuals, large corporations, and financial institutions. - Bitcoin Development Fund (BDF):

Recognizing the underfunding of Bitcoin development, MicroStrategy could establish or contribute to a robust funding organization dedicated to sustaining Bitcoin's long-term development. By providing consistent financial support, organizing events, and incentivizing developers, such a fund would safeguard Bitcoin's future and unlock its vast potential.

MicroStrategy's substantial resources present numerous opportunities to further enhance the Bitcoin ecosystem and benefit both their clients and the broader community. What other ideas do you have for MicroStrategy to explore? Share your thoughts below!

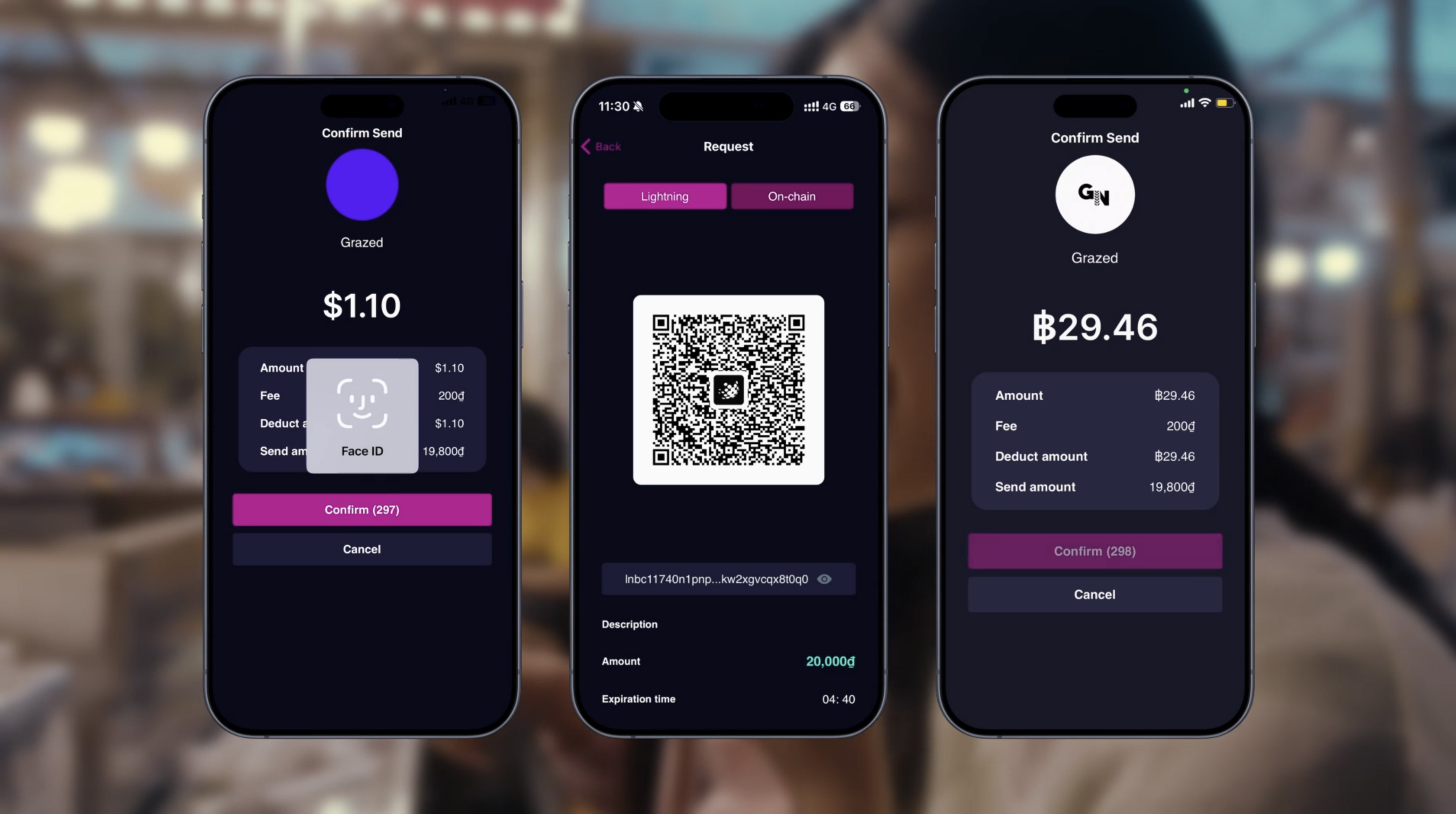

Neutronpay Expands to Southeast Asia, Harnessing Lightning Network for Advanced Payment Solutions

Posted almost 2 years ago

Harnessing Southeast Asia's Dynamic Market

Transforming Regional Payment Systems

- Introducing Bitcoin and Lightning as new payment methods, while enabling transactions in local currencies.

- Providing swift, affordable international payment options for small businesses and freelancers.

- Enhancing e-commerce through streamlined cross-border transactions.

- Reducing costs and transaction times for overseas workers sending remittances.

- Offering seamless payment options for international travelers in Southeast Asia.

Neutronpay App's Notable Features

- Instant Global Transfers: Allows users to send money globally almost instantaneously, directly into bank accounts.

- Business Growth: Facilitates international payments for businesses, bypassing traditional banking delays.

- Merchant POS Mode: Streamlines transactions for retailers serving both local and international clientele.

- Content Creators' Hub: Supports streamers and creators with LNURL, facilitating easy global payments.

- Remote Work Flexibility: Ensures freelancers and remote workers receive timely payments with minimal fees.

- Everyday Convenience: Simplifies daily financial tasks like bill payments, expense sharing, and online shopping.

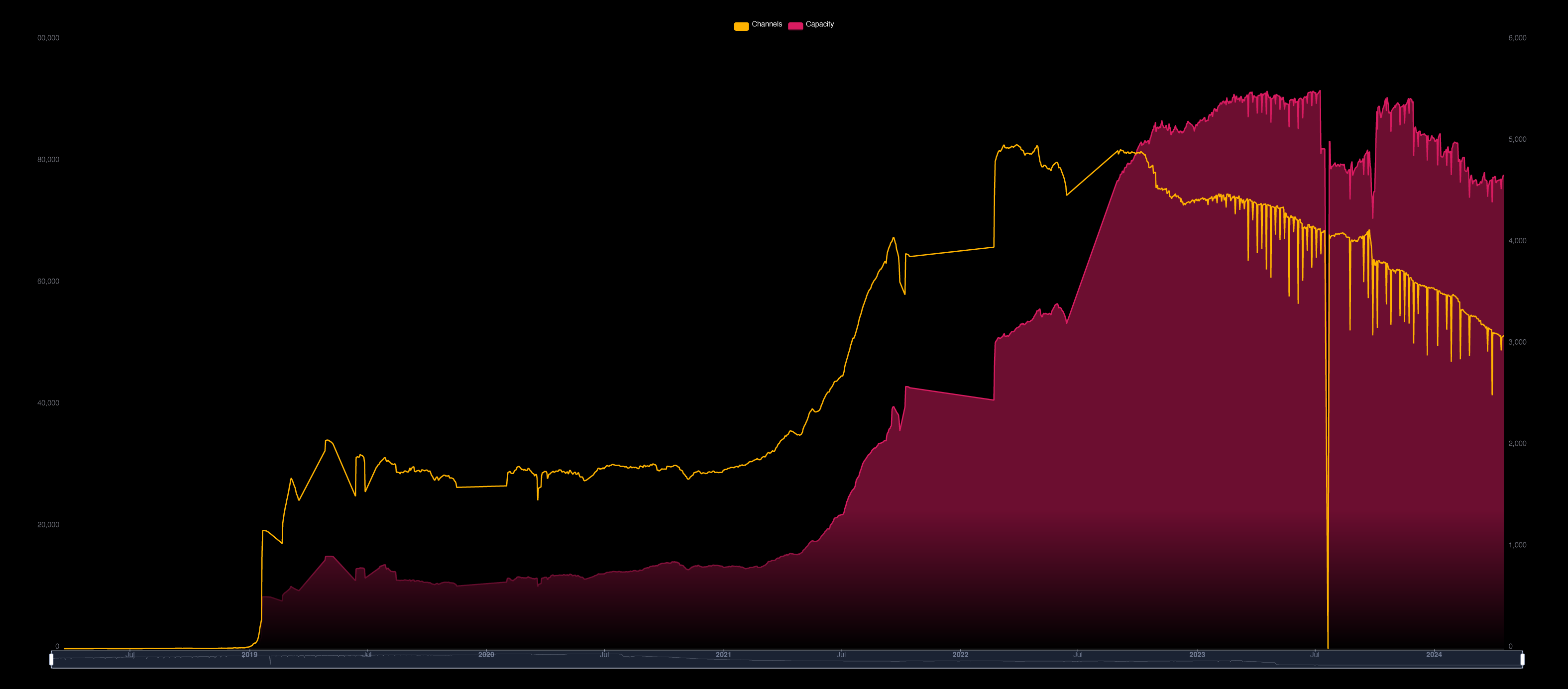

What the Drop in Lightning Nodes Means for LN's Future?

Posted almost 2 years ago

This contraction is surprising, especially considering the seeming all-time high popularity of LN by other metrics. A recent report by River highlighted a 12-fold increase in LN transactions in the last approximately two years. Most progressive exchanges support LN, and the others are planning to implement it soon. Nostr, a prominent decentralized social network, is entirely powered by Lightning. Moreover, merchants are reporting growth in LN payments.

So, what is happening? How can there be such a discrepancy between usage and node growth? Is LN still the future of payments on Bitcoin? Let me explain how I interpret the statistics of nodes and channel counts and why they might be misleading.

Overexcitement in 2021

Disillusion with Routing Earnings

High On-Chain Fees

Network Optimization

Experimentation by Companies

Private LN Networks

The Value of Bitcoin Increased

LN is Still Too Hard

Custodial LN is Easy

What the Future Holds

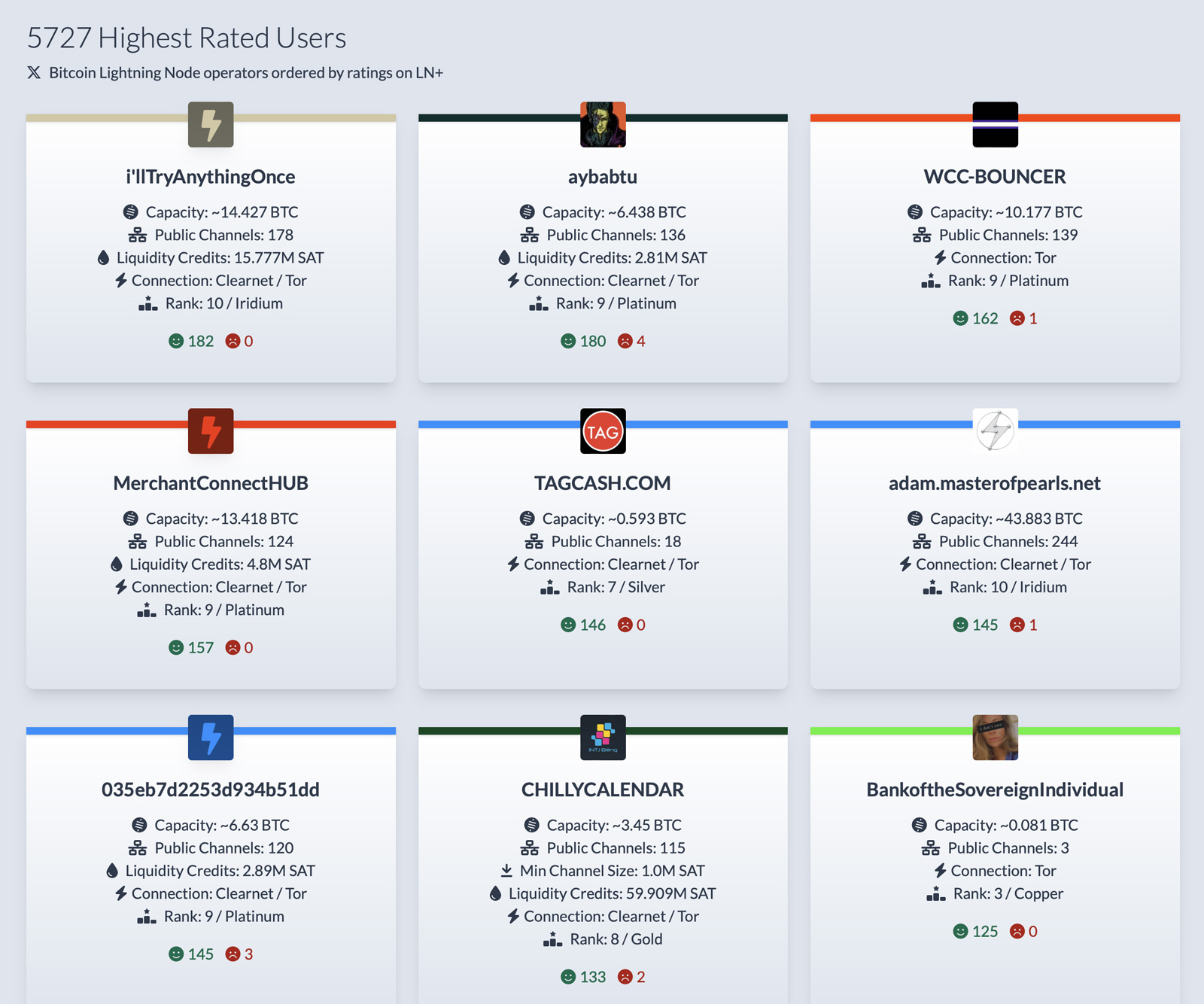

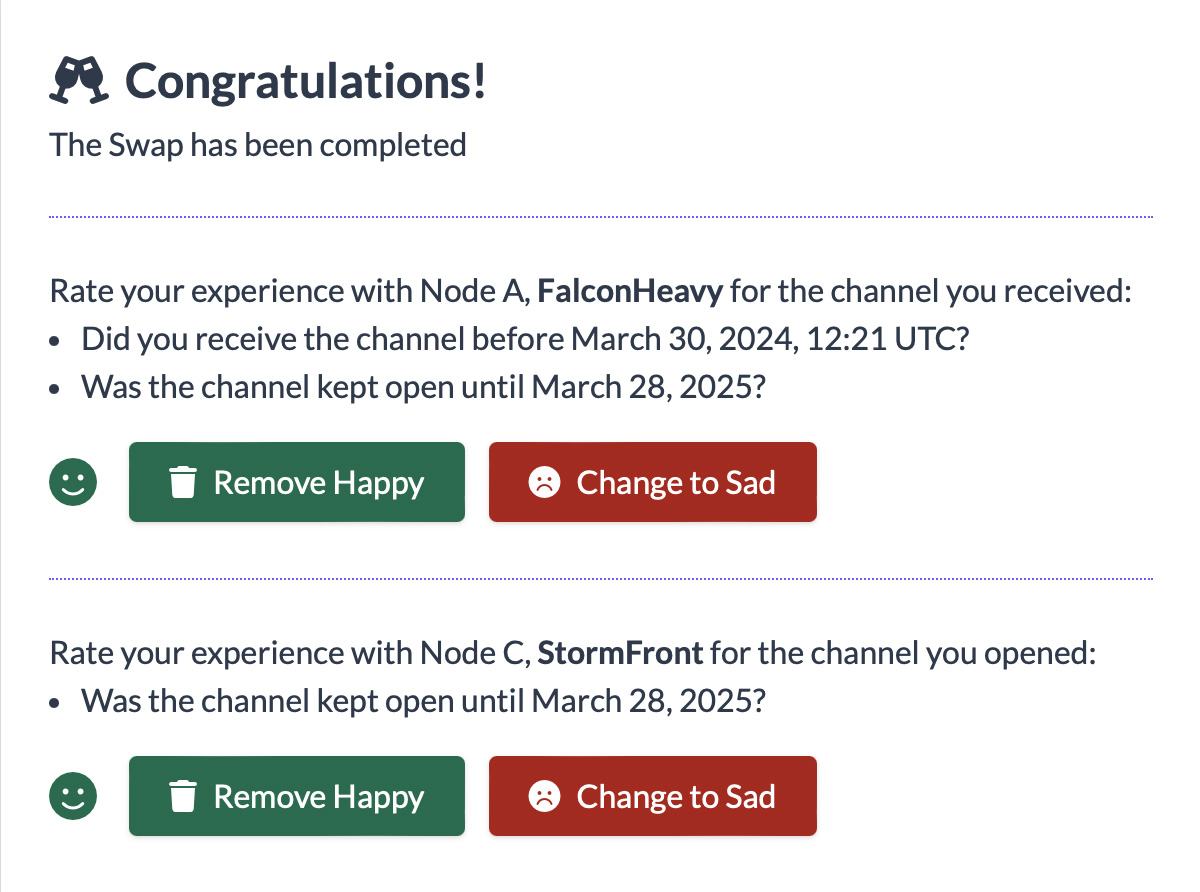

Improved Ratings and Top Rated Nodes Page

Posted almost 2 years ago

In addition, there now a new page in the Explorer for the Highest Rated Nodes.

Understanding the Lightning Network - Where Did My Sats Go?

Posted almost 2 years ago

Unveiling the Concept of Routing

How Routing Influences Your Sats

Clarifying a Common Misconception

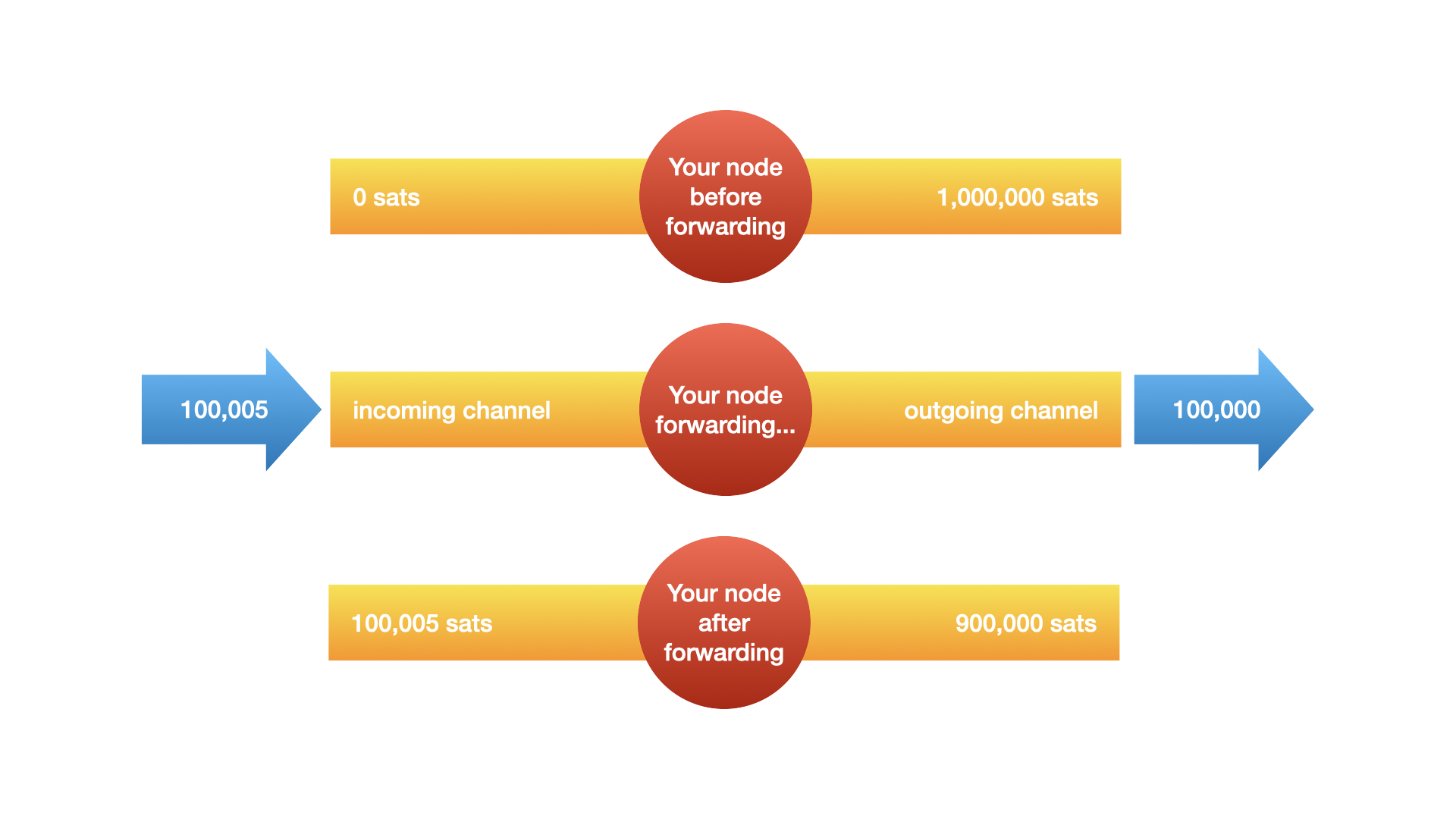

A Typical Routing Scenario

- Opening a Channel: You open a channel with 1 million sats. All these sats are initially on your side.

- Routing a Payment: Your channel routes 100,000 sats to another user, decreasing your balance to 900,000 sats. Meanwhile, this routed payment is received by another one of your channels, increasing its balance correspondingly.

- Earning Fees: By facilitating this transaction, you earn a small routing fee (ex. 5 satoshis). This fee is added to your balance, incrementally increasing the total sats across all your channels.

- Understanding the Overall Impact: Although the balance of the specific channel used for routing decreases, another channel's balance increases. Therefore, the total balance across all your channels remains the same, barring the fees you've earned, which slightly increase your total holdings.

- Closing a Channel: When you close a channel, you receive the final balance of that channel, which reflects all the routing and fee earnings. If, for instance, the closing balance was 900,000 sats, this does not account for increases in your other channels.

Monitoring Your Lightning Network Activity

The Routing Benefit: A Holistic View

Public / Private Channels

Private Channels, on the other hand, are not broadcast to the entire network. Visibility is restricted to the nodes directly involved in the channel, rendering them less prominent for routing on a broad scale. Despite this, private channels can still participate in routing payments. For routing through a private channel to occur, nodes outside the channel must be informed of its existence, typically through "routing hints" provided by one of the participating nodes.

Conclusion

Posted almost 2 years ago

What’s in the Name?

Work in Progress

What is a Bitcoin Lightning Network Channel Backup and How To Use It?

Posted about 2 years ago

Executive Summary

However, it's important to note that the channel backup does not allow the recovery of Lightning Network channels, but it increases the chance of recovering off-chain balances. The backup is created and managed through the Lightning Network node, and it is essential to download a copy of the SCB file when opening or closing any channels. The backup is a critical security measure, and it is advisable to have a proper backup strategy in place to ensure the safety of Lightning channel funds.

What is a Bitcoin Lightning Network Channel Backup?

What it Contains: Static (unchanging) channel information:

- The channel's funding transaction

- Channel capacity

- Public key of the other node in the channel

- Other relevant channel configuration details

What it Doesn't Contain: The current channel balance or its associated commitment transactions. This information changes often.

Types of Channel Backups

- Static Channel Backup (SCB): The core backup stored as a file (often channel.backup) or multiple entries within a file. You'll need your Lightning wallet seed phrase to use an SCB effectively.

- Database Backups: Lightning Network implementations save important channel information to a database. If you have a full database backup, you can restart your node without the need to use a SCB which would close channels.

How to Use a Bitcoin Lightning Network Channel Backup

- Node Failure: Your Lightning Network node experiences a major problem (e.g., corrupted hard drive, software failure).

- New Node Setup: You install a fresh Lightning Network node.

- Restore Wallet Seed: Restore your 24-word wallet seed phrase. This recreates your on-chain Bitcoin wallet.

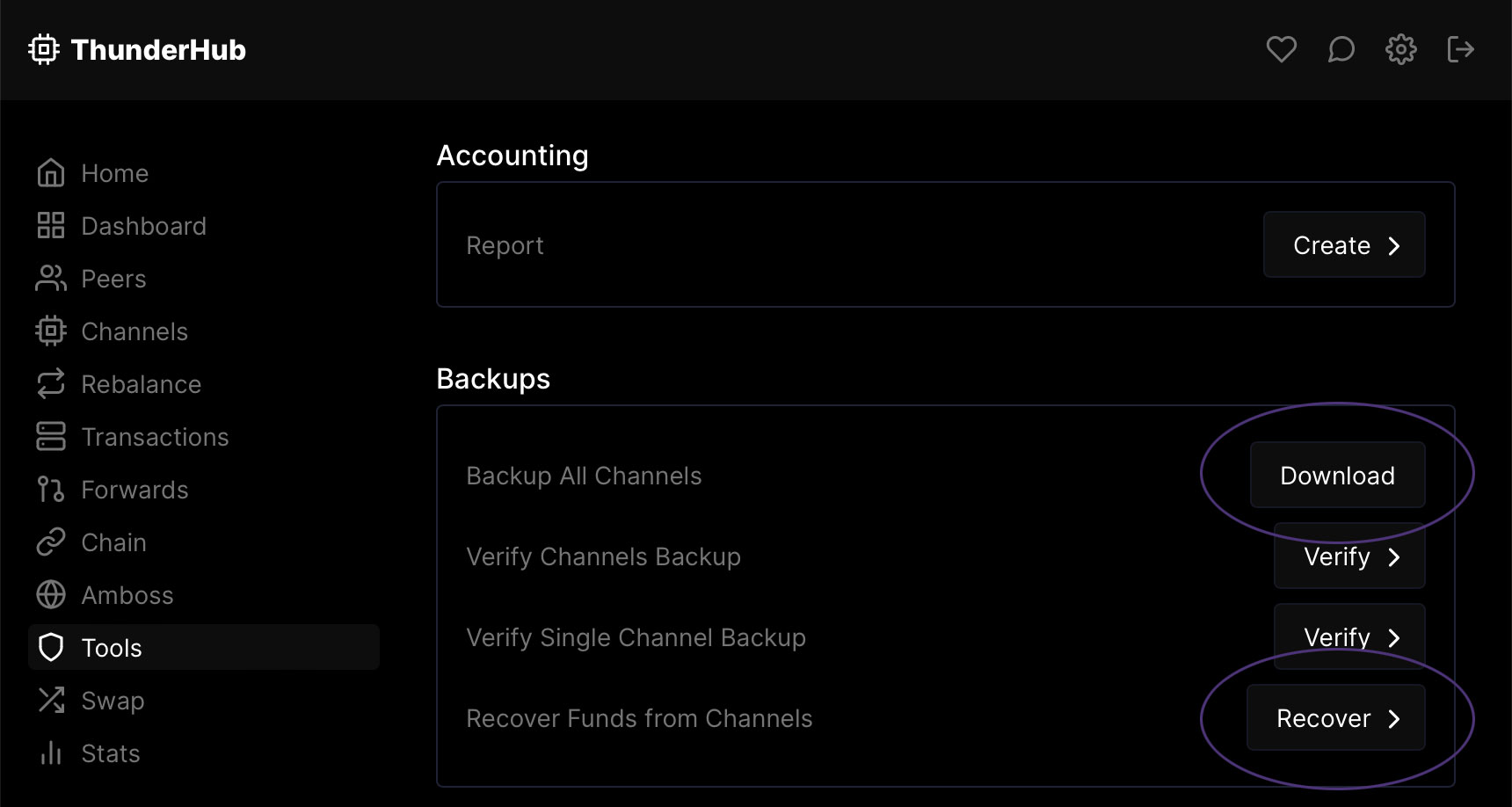

- Restore SCB: You transfer the SCB file to your new node or re-enter individual SCBs. Different wallets and LN tools provide the recover option in different places. In Thunderhub for example you can find it under Tools / Backups / Recover Funds from Channels / Recover.

- DLP Process:

- Your new node uses the SCB file(s) to discover the public keys of nodes you had channels with.

- Your node contacts your former channel partners, alerting them to your issue.

- Cooperative nodes will initiate force-closing the channels, returning your on-chain balance according to the last agreed-upon state in the backup.

Important Considerations

- Always Update Backups: Backup your SCB(s) whenever you open or close a Lightning channel. Outdated backups won't reflect the correct channel state.

- Secure Your Backups: Treat your SCB and wallet seed with extreme care. Anyone with access to both can steal your funds, because they can close the channels and then send out the on-chain funds to their own wallet. Store them securely, with copies in safe locations.

- Uncooperative Peers: In the worst-case scenario, where a channel partner becomes uncooperative, you risk losing some funds since the SCB doesn't hold the most recent channel state. This is rare, but highlights the importance of choosing reputable nodes as channel partners.

- Watchtowers: In order to ensure that your peers can't cheat you consider entering a Watchtower Swap.

Backup Strategies

- Automated Cloud Backups: Popular Lightning Network wallets often have built-in features to automatically back up your SCB to cloud storage (encrypted, of course). For example, if you are running an Umbrel node, they have your channel backup and you can contact them if needed.

- Manual Backups: You can periodically copy your SCB file to external drives or another computer. Different wallets and LN tools provide the link to download in different places. In Thunderhub for example you can find it under Tools / Backups / Backup All Channels / Download.

- Database Backups: If your implementation uses a database, include regular backups of it as part of your strategy.

Simple Introduction to Understanding Elliptic Curve Cryptography in Bitcoin

Posted about 2 years ago

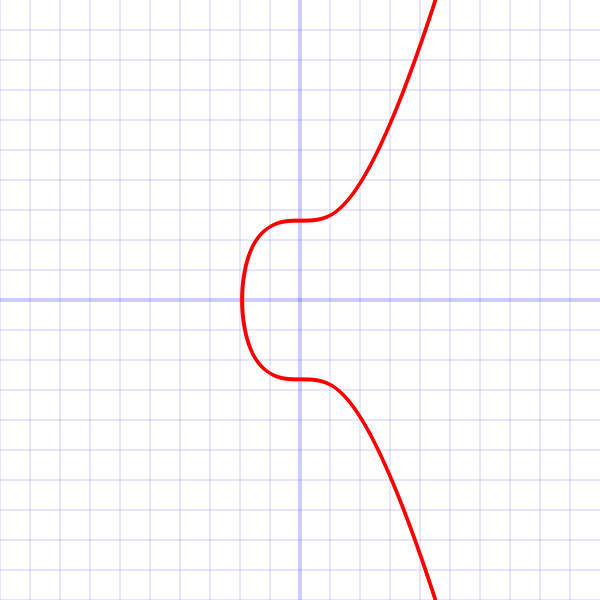

What is Elliptic Curve Cryptography?

The Role of ECC in Bitcoin

secp256k1: The Specific Curve Used in Bitcoin

Deriving the Public Key

This specific point is calculated using the elliptic curve and your Private Key, ensuring that each Public Key is unique.

Why Can’t We Reverse the Process?

This complexity arises from the Discrete Logarithm Problem in elliptic curves, a problem that is easy to compute in one direction but extremely hard in reverse.

Metaphor to Understand Irreversible Calculations

If you know the formula to create your unique green, mixing it from the primary colors again is straightforward and can be done over and over precisely without much effort. This process of mixing the colors is like generating a Public Key from a Private Key in ECC. Just like you combine specific amounts of 3 colors to get a unique green, in ECC, you perform specific mathematical operations on the Private Key to get a unique Public Key.

Similarly, in ECC, once you have the Public Key, it's computationally infeasible to reverse the process and find out the exact Private Key. The mathematical operations (like the paint mixing) ensure that while it's straightforward to go from the Private Key to the Public Key (mixing blue and yellow to make green), it's extremely hard to go in the reverse direction (separating the green back into blue and yellow).

Efficiency of ECC in Bitcoin

ECC's ability to offer equivalent security with smaller keys compared to other cryptographic methods like RSA makes it ideal for a system like Bitcoin, where speed and efficiency are crucial.

Conclusion

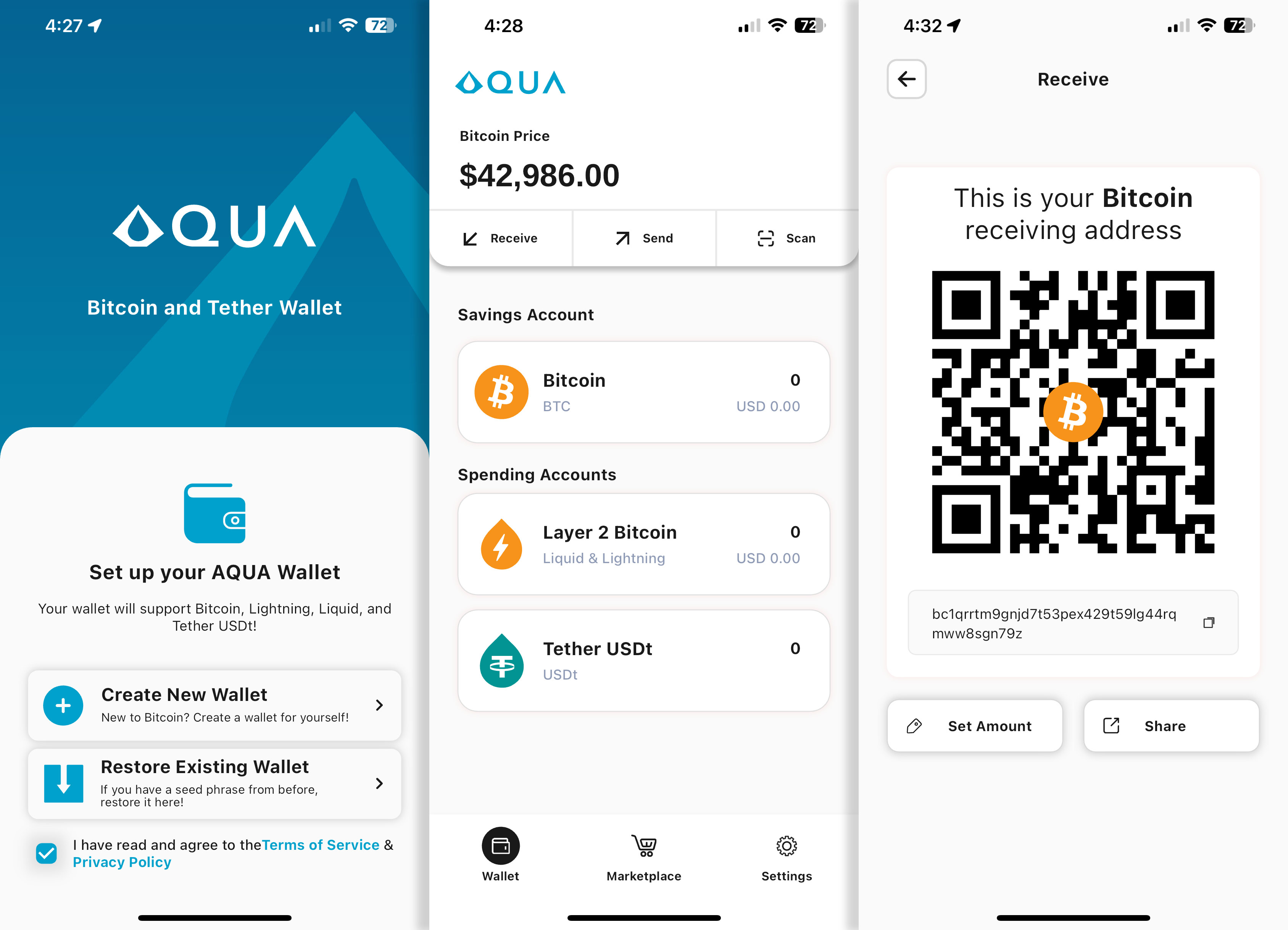

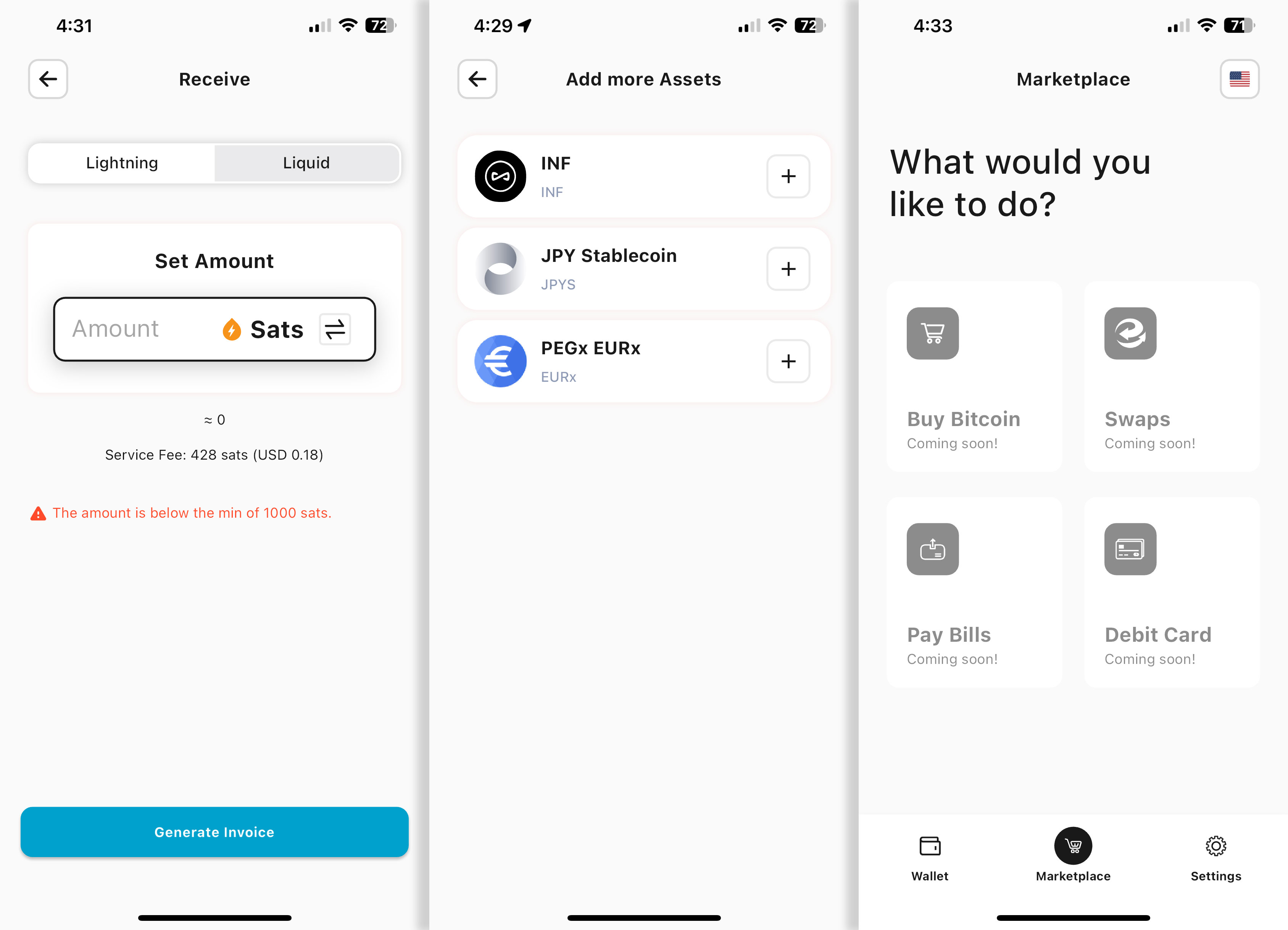

Aqua Wallet: A New Entrant in the Bitcoin Ecosystem

Posted about 2 years ago

Bitcoin Wallet

Lightning Wallet

Liquid Bitcoin Wallet

USDt Wallet

- Liquid Network: Allows native receiving with no minimum amount.

- Ethereum Network: Facilitates on-the-fly conversion from Ethereum USDt to Liquid USDt, with a minimum of around $22 and a maximum of $25K. Conversion fees, if any, are unspecified.

- Tron Network: Features a similar setup to the Ethereum chain.

Additional Assets

Backup

Bitcoin Chip

Marketplace

User Experience

Availability

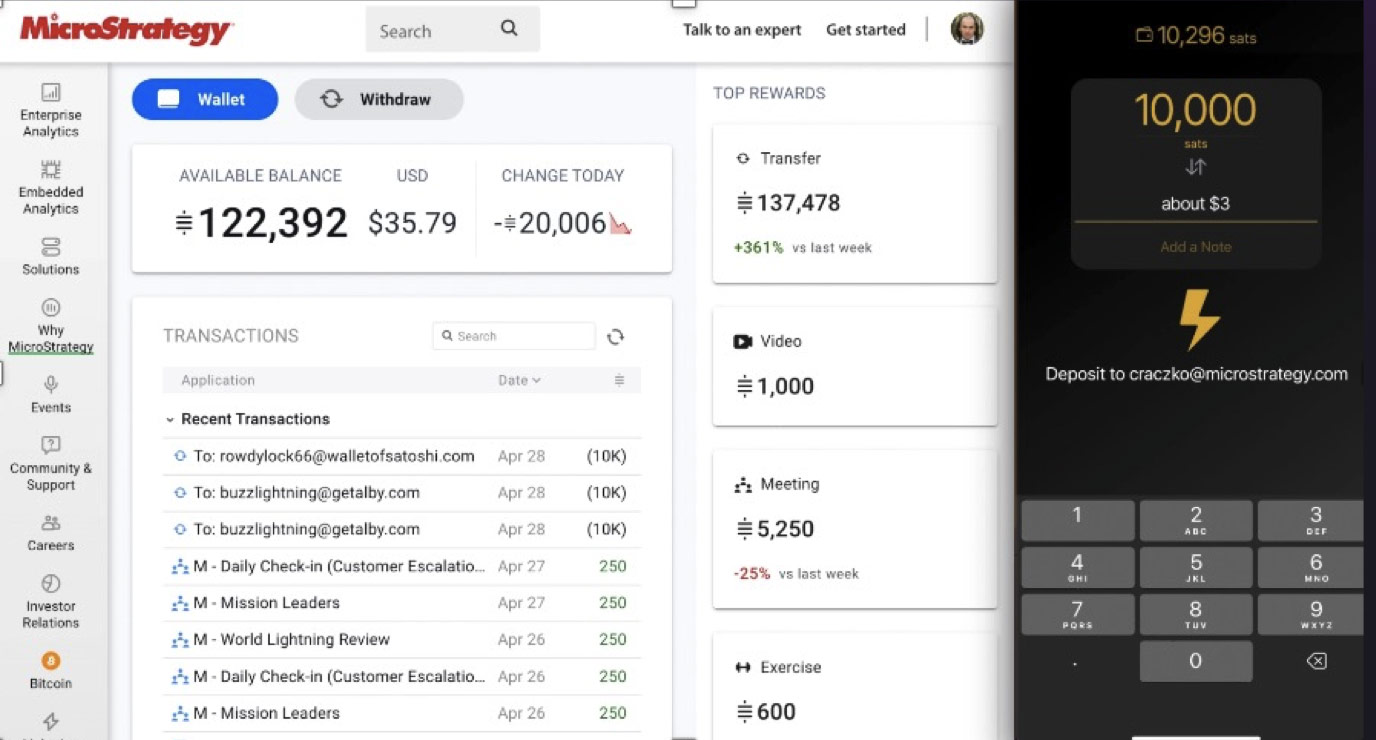

Bitcoins as Rewards: The MicroStrategy Edge

Posted about 2 years ago

Why is the Lightning Rewards Platform better than cash-based systems?

MicroStrategy's Lightning Rewards program offers several advantages over traditional cash-based systems. First, it utilizes Bitcoin, which can be more appealing and innovative, potentially increasing engagement. Second, the use of Bitcoin allows for instant, global rewards without the complexities and costs associated with cross-border cash transactions. Lastly, it leverages the security and scalability of the Bitcoin network, offering a more secure and efficient rewards distribution system compared to conventional cash-based rewards.

What actions can be rewarded with the Lightning Rewards Platform?

The MicroStrategy Lightning Platform allows for rewarding various actions such as customer purchases, referrals, participation in events or surveys, and online engagement. This versatility makes it a valuable tool for enhancing user interaction across different platforms and activities, potentially reducing spam and malicious bots by incentivizing genuine engagement.

Example Use Cases

Reward employees with Satoshis for publishing articles, selecting the best answers, answering questions. The platform offers out-of-the-box integration with Salesforce (SFDC).

Employee Education

Reward employees with Satoshis for completing learning modules, achieving certifications, and viewing educational videos. The platform offers out-of-the-box integration with Wistia and Adobe.

Employee Health

Reward employees with Satoshis for achieving daily exercise time goals, hitting step count targets, and maintaining consecutive days of exercise. The platform offers integration with MoveSpring.

Mechanics

MicroStrategy's Lightning Rewards platform stands out for its innovative use of Bitcoin to incentivize and reward actions. This approach enables instant, global, and secure transactions, appealing to a wide audience. It seamlessly integrates with enterprise systems, making it versatile for various business needs. The platform's ability to track and analyze reward impact adds significant value for businesses looking to enhance engagement and measure the effectiveness of their strategies.

Liquid Lightning: A 4-Tiered Scalable Bitcoin Ecosystem

Posted about 2 years ago

Brief Explanation of Liquid

The idea of Lightning Network on Liquid: "Liquid Lightning"

Liquid's functionality for a better lightning experience

- Lower Chain Fees and Faster Channel Management: Liquid's 1-minute block time can facilitate quicker and more cost-effective channel management compared to the main Bitcoin blockchain, especially during high on-chain fee times on the base Bitcoin layer.

- Advanced Op-Codes: Liquid's scripting system offers more flexibility than Bitcoin's. This could enable more advanced features in channel management.

- Privacy Enhancements: Liquid supports Confidential Transactions and Confidential Assets, which enhance privacy by hiding transaction amounts and asset types, though it should be noted that addresses are still visible.

Interoperation between Bitcoin Lightning and Liquid Lightning

Enhanced scalability through layered innovation

- Bitcoin Base Layer: Serving as the bedrock with maximal security and decentralization, ideal for large, non-urgent transfers, long-term storage and and an achor for other layers.

- Bitcoin Lightning Network: Offering faster, smaller transactions with reduced fees, suitable for everyday payments and microtransactions.

- Liquid Network: Enhancing efficiency for larger, rapid transfers and trading, with added privacy features and quicker settlement times.

- Liquid Lightning: The newest tier, combining the strengths of Liquid and Lightning Network, proposing a solution for instant, low-cost transactions, potentially with advanced features not currently feasible on the Bitcoin Lightning Network scalable to global levels.

This stratified approach allows users to choose the most appropriate layer for their transaction needs, aligning with their priorities whether it be speed, cost, or privacy, thereby unlocking a diverse range of applications and use cases within the Bitcoin ecosystem.

Risks associated with Liquid Lightning

Implementation challenges

- Developing an Ecosystem of Client Software: Robust client software needs to be developed for users to interact with Liquid Lightning, and ideally we should not rely on a single team. In Bitcoin Lightning we have at least 4 large teams working on client software. Liquid Lightning needs at least 2-3 teams as well. The good news is that Lightning in general is designed to run on any blockchain similar to Bitcoin, which is why it was relatively easy to start Lightning on Litecoin (an altcoin based on Bitcoin). Liquid Lightning was also relatively easy to implement according to Blockstream who has already created Lightning support for Liquid on Core Lightning.

- Bootstrapping Liquidity: Sufficient liquidity must be ensured for the network to function efficiently. This is possibly the biggest hurdle on the short term.

- Mobile Wallet Support: Wallets need to be developed or adapted to support Liquid Lightning and submarine swaps between it and Bitcoin Lightning. Blockstream has made good progress on this front with Greenwallet.