LN+'s Posts

Witness the First Lightning Payment at Pingu's Burger in Vietnam, Facilitated by Neutronpay

Posted about 2 years ago

Neutronpay, Pingu's chosen payment service provider, offers a range of products, including an API designed for businesses across various regions. In addition, it provides an app that caters to both businesses and individuals. There's a special emphasis on the mobile-centric markets of Asia and Southeast Asia, including Thailand, Vietnam, Indonesia, Malaysia, and the Philippines.

The integration of Bitcoin payments through the Lightning Network at Pingu's Burger is a testament to the evolving landscape of Bitcoin adoption in Vietnam. While not the first to embrace this technology, Pingu's Burger joins a growing list of forward-thinking businesses in the region that recognize the potential of Bitcoin and the Lightning Network as a payment rail. This move highlights a broader trend among Vietnamese enterprises to incorporate innovative payment methods, offering customers both convenience and a glimpse into the future of financial transactions. It also reflects Vietnam's commitment to establishing itself as a leader in technological innovation and digital finance within Southeast Asia.

Earn Satoshis Daily: Simple Ways to Stack Bitcoin and Get Paid Over Lightning

Posted about 2 years ago

Advertising

- Sign-Up Process: Register with these services using your Lightning Address.

- Earning Sats: Receive regular micro-payments in Satoshis for your engagement.

Leading Services:

Gaming

Game platforms to explore:

- THNDR Games: Engage in online gaming and earn a dozen or so sats daily.

- LN Games: Hyper-casual gaming platform that lets you earn Bitcoin while having a blast.

News & Content

- Slice: Browse with an extension and get paid for looking at ads.

- Fountain: Listen to podcasts and earn several hundred sats daily for an hour or so of your time.

- Bitcoin Magazine App: Stay updated with Bitcoin news and earn 5 sats per article.

- Stacker.news: Post content or comment and get paid by readers and the site itself daily. You can easily earn thousands of sats with popular content.

- VIDA: A platform that allows you to earn per message or per minute if someone wants to reach you.

Education

- Yzer: Learn about Bitcoin and earn hundreds of sats every day.

- Blink Wallet: This is a lightning wallet that offers bitcoin classes that pay you for viewing them.

- Binance / Coinbase: These major exchanges offer courses with rewards, but they often pay in altcoins, which may not be easy to exchange to Satoshis.

Shopping

Fitness

- sMiles: This app rewards your daily walking routine with Satoshis.

Earning Satoshis daily is an engaging way to immerse yourself in the Bitcoin universe. It's a win-win situation: You gain knowledge, support the Bitcoin community, and steadily build your Bitcoin holdings, all through simple, everyday activities.

Unconventional Use Cases of the Lightning Network

Posted about 2 years ago

- Permissionless Access: Anyone with internet access can utilize a Lightning wallet, regardless of age, social status, or geographical location.

- Efficiency: Transfers over the Lightning Network are remarkably cheap, often costing a mere fraction of a cent.

- Speed: Transactions are nearly instantaneous, typically completed in a second or two.

- Streamability: Payments can be extremely small and frequent.

- Hard Currency: The network deals in Satoshis, which are fractions of Bitcoin – the most robust form of digital money, highly sought after globally.

Here's a dive into the imaginative business applications enabled by these features:

Real-Time Data Streaming Payments

Pay-Per-Use Software Features

In-Game Actions and Events

IoT Device Interactions

Crowdsourced Research and Data Collection

Public Wi-Fi Access Time

Micropayment-based Charity Donations

Pay-Per-View Educational Content

Pay-as-You-Read E-Books

Automated Micropayments for Content Attribution

Micropayment-based Environmental Actions

Dynamic Pricing for Digital Advertisements

Pay-Per-Use Home Appliances

Decentralized Content Fact-Checking Platform

Each of these ideas leverages the power of micropayments to foster innovation across various sectors. From transportation to environmental sustainability, and healthcare to education, the Lightning Network opens new avenues for community engagement and benefit. This is a call to action: draw inspiration from these concepts, build on Bitcoin and the Lightning Network, and launch your venture in 2024.

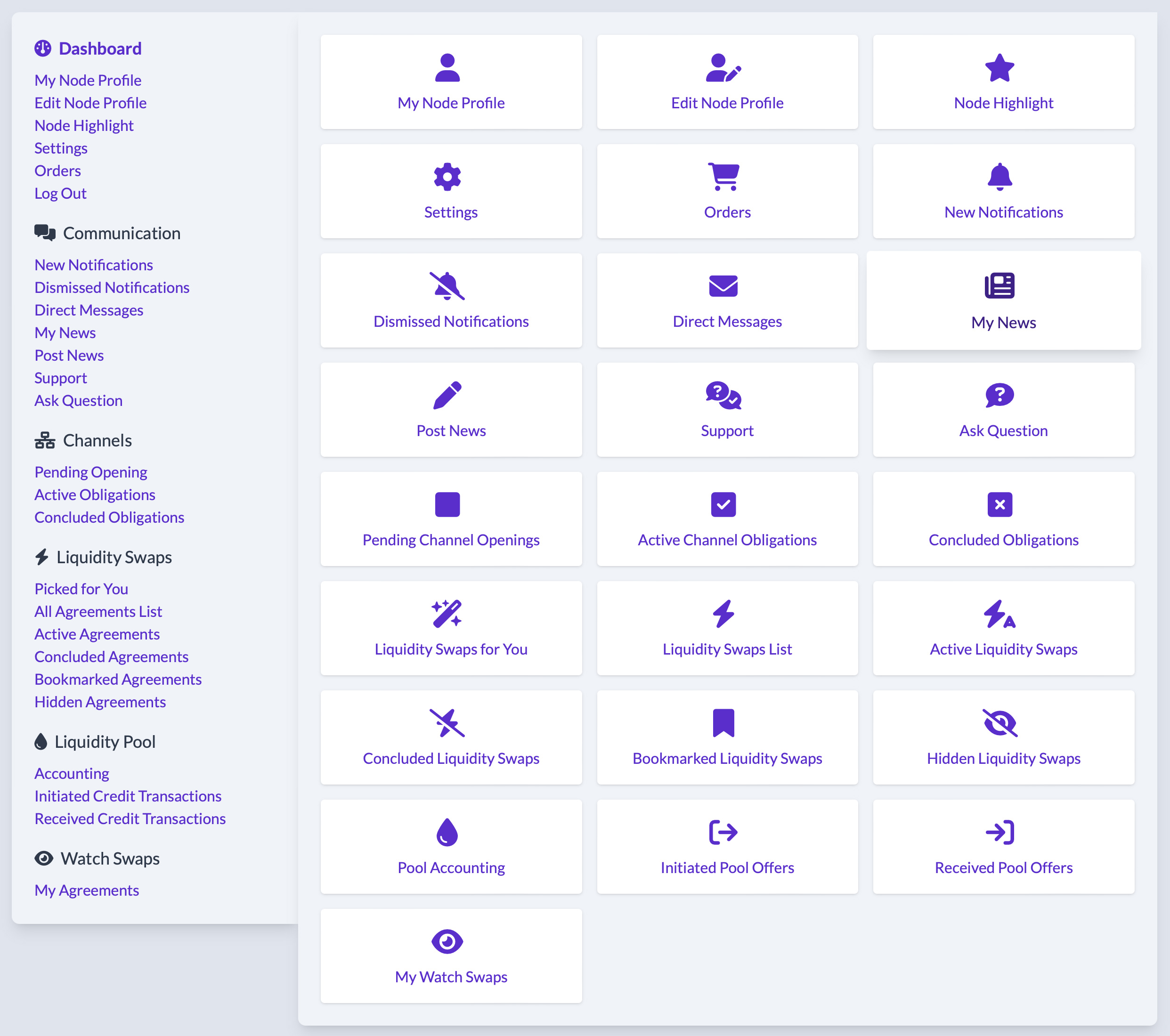

Introducing the New LN+ Dashboard

Posted about 2 years ago

Access the dashboard by clicking the "Dashboard" button on the top right if you're signed in to LN+.

New Page Descriptions:

- Channels: Pending Opening – This page provides a consolidated summary of all channels you are preparing to open on LN+, including those for Liquidity Swaps and Pool Credit Transactions. Instead of navigating through multiple individual pages, this one-stop page allows you to manage everything efficiently.

- Channels: Active Obligations – Here, you'll find a list of all channels that you need to maintain open to fulfill your commitments across different services on LN+. It helps ensure you do not breach any agreements.

- Channels: Concluded Obligations – This section displays all the channels you can optionally close, as the agreements' end times across various LN+ services have been met. While there's no need to close these channels immediately (in fact, keeping them open longer is beneficial), you have the option if you wish.

- Liquidity Swaps: All Agreements List – This page offers a detailed table of all your Liquidity Swap agreements, including information about the nodes involved in each swap. It's particularly helpful for locating specific liquidity swaps based on the node's alias.

- Liquidity Swaps: Active Agreements – View a grid of cards representing all active Liquidity Swaps, where the agreement's end date has not yet been reached. Keeping these swaps active involves maintaining the associated channels open.

- Liquidity Swaps: Concluded Agreements – Similar to the above, this grid of cards shows all Liquidity Swaps where the agreement has concluded, meaning the end date has passed. Channels in these swaps can be closed without negatively impacting your reputation.

We always appreciate your feedback, especially regarding any functionality issues. Please report any problems so we can promptly address them. Thank you for your continued support of LN+!

Bitcoin in Layers: An Overview of the Ecosystem

Posted about 2 years ago

Bitcoin On-Chain

- Function: Acts as the fundamental layer for monetary transactions, predominantly for savings and enabling payment layers through smart contracts.

- Users: Several million private and business entities.

- Technology: Basic Bitcoin full node.

- Benefits: Highly secure and straightforward to operate.

- Risks: Transactions can be costly and slow when the fees are high.

Side Chain Solutions

- Function: Offers an on-chain-like experience with fewer drawbacks. Example: Liquid and Rootstock.

- Users: Those needing confidential, offline and large bitcoin transactions.

- Technology: Simple wallets or a sidechain node.

- Benefits: Easy handling of any transaction amount. Cheap and relatively fast.

- Risks: Potential risks with the sidechain federation.

Routing Lightning Node

- Function: Facilitates payment routing across the Lightning Network.

- Users: Services numerous Lightning nodes for payment routing.

- Technology: A lightning node with hundreds of channels of varying sizes.

- Benefits: Quick, reliable, and potentially revenue-generating through routing fees and selling channels.

- Risks: Resource-intensive in terms of time and money. Lots of funds in hot wallets.

Non-Custodial Merchant or Exchange Lightning Node

- Function: Geared towards businesses for receiving and occasionally sending larger payments.

- Users: Businesses and bitcoin exchanges.

- Technology: Node with sizable channels to mostly routing nodes.

- Benefits: Low costs and risks, efficient and dependable payment for customers.

- Risks: Requires continuous maintenance.

Custodial Wallet and Merchant Payment Lightning Node

- Function: Optimized for high-frequency, bidirectional payments.

- Users: Businesses catering to millions of clients.

- Technology: Robust nodes linked to Routing Lightning Nodes and merchants run by professional node infra operators.

- Benefits: Revenue from transaction fees and value-added services.

- Risks: Security concerns due to large customer funds.

Family and Small Business Lightning Node

- Function: Provides Lightning Network connectivity for a closed user group.

- Users: Family or small business associates.

- Technology: Nodes with private or high-fee channels to discourage routing and associated risks. Uses LNBits or similar account management software to separate out accounts.

- Benefits: Low cost and risk, with stable performance.

- Risks: Partial trust required for users.

Hobby Lightning Node

- Function: Personal nodes for individual or small business use. For example Umbrel or Phoenix wallet.

- Users: Private individuals.

- Technology: Few channels connected to relevant nodes.

- Benefits: Trust-free operation and full control over capacity and funds.

- Risks: Limited receiving capacity unless incoming channels are purchased.

Fully Custodial Accounts

- Function: Instant wallets for sending and receiving payments. Ex. Wallet of Satoshi or Speed Wallet.

- Users: Private individuals and small businesses.

- Technology: Basic wallets without a dedicated node.

- Benefits: Easy to use, no maintenance required. Access to various value added services, such as a bridge to debit card systems, stable coins, gift cards, mobile top-up systems, subscription services, etc.

- Risks: Dependence on custodian security. All funds and payment related meta information is at risk.

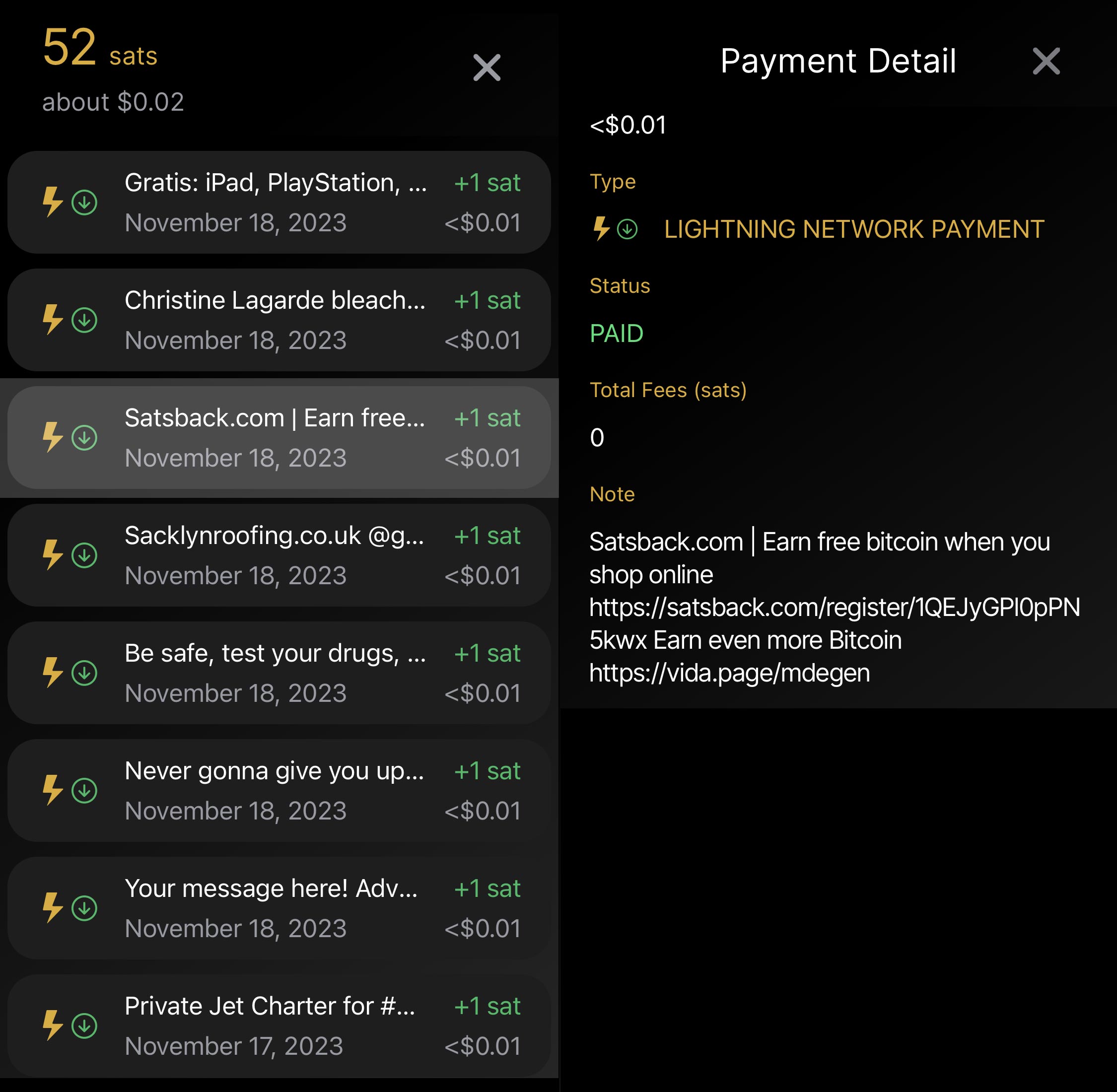

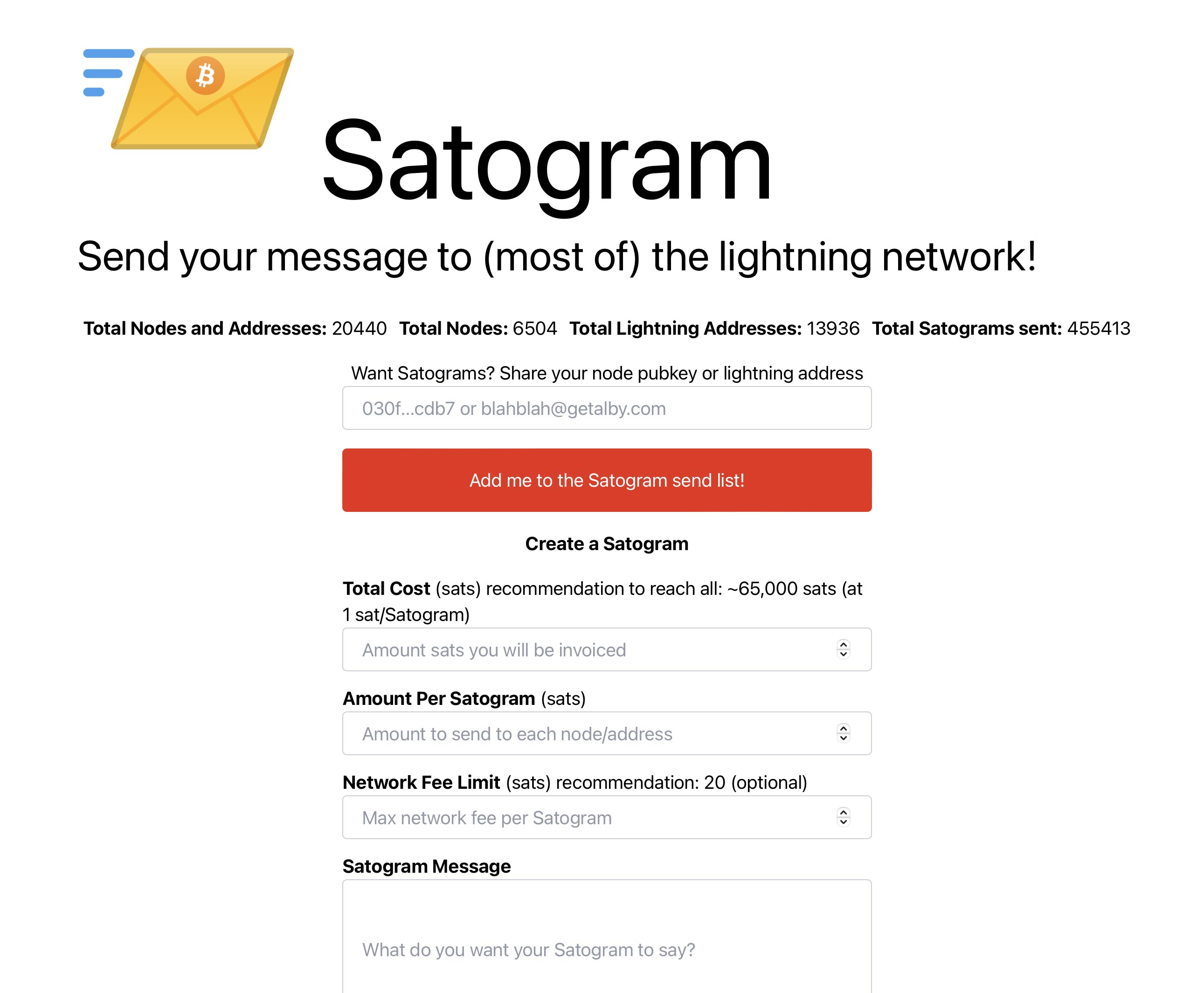

The Rise of Transaction Advertising on the Bitcoin Lightning Network

Posted about 2 years ago

Introduction to Bitcoin

Introduction to the Lightning Network

Lightning Network Transactions

Memo Field in Transactions

Keysend and Lightning Addresses

Keysends allow for on-the-fly transactions, requiring no invoice, and can include these custom record fields which are being used to store the advertisement message. For paying to lightning addresses, and invoice gets generated by the lightning address provider such that it will contain the advertisement message in the comment field. Many wallets and services allow the creation of Lightning Addresses, including Orangepilled.Email.

Low-Value Transactions and Spam Prevention

Length of the Memo Field

The memo field in Lightning Network transactions can accommodate up to 639 bytes of information. The number of characters this translates to depends on the UTF-8 encoding, where characters can vary in size:

- For the first 128 characters (US-ASCII), each character is encoded in one byte. Therefore, you could fit up to 639 characters from this set in the memo field.

- For characters that require two bytes, such as those in many Latin alphabets, Greek, Cyrillic, and others, up to 319 characters can be accommodated. This is because each character takes up two bytes.

- For characters from the rest of the Basic Multilingual Plane, which includes most commonly used characters, including many Chinese, Japanese, and Korean characters, three bytes per character are needed. This allows for up to 213 of these characters in the memo field.

- Characters from other planes of Unicode, which include less common symbols, historic scripts, mathematical symbols, and emojis, require four bytes each. In this case, the memo field can hold up to 159 characters.

In summary, the actual number of characters that can fit into the 639-byte memo field depends on the specific characters used, as they have different byte sizes in UTF-8 encoding. The simplest characters (US-ASCII) allow for the highest count, while more complex characters, such as certain emojis, allow for fewer characters due to their larger byte size.

Transaction Advertising

Satogram.xyz is planning to release a compelling new feature where advertisers will be able to select what audiences they want to reach to adjust their target audience, including people who specifically signed up for receiving advertising messages. So ultimately the options will be:

- All

- Lightning Addresses only

- Nodes only

- Signups only

As a node operator, if you want to connect to Satogram's lightning node and benefit from their traffic, here is their node.

If you want to learn more about the tech behind Satogram watch the site creator's presentation.

Effectiveness of Lightning Transaction Advertising

The effectiveness of this advertising method varies, and understanding its impact can be gleaned from user experiences. For instance, one user (note: this is a sample size of one) reported the following results from their advertising campaign using Lightning Transaction Advertising:

- Reach and Engagement: The campaign resulted in 40 unique visitors and 188 page clicks. This indicates a certain level of engagement, suggesting that the messages were noticed and prompted action.

- Conversion and Sales: Despite the engagement, the campaign led to 0 sales. This lack of conversion highlights a potential gap in the effectiveness of this advertising approach in driving actual sales.

These results suggest that while Lightning Transaction Advertising can generate interest and drive traffic to a page, converting that interest into sales is another challenge. This form of advertising may be more suitable for raising awareness or disseminating information rather than directly boosting sales. As with any advertising medium, its effectiveness will likely depend on various factors, including the nature of the product or service, the target audience, and the messaging itself.

View Lightning Advertising Companies

Ethical Questions Around Lightning Transaction Advertising

Unsolicited Yet Compensated Communication

One of the primary ethical dilemmas revolves around the unsolicited nature of these transactions. Users on the Lightning Network may receive these messages without prior consent, akin to receiving spam email. However, unlike traditional spam, these messages are accompanied by a small payment. This compensation adds a layer of complexity to the ethical evaluation: is it acceptable to send unsolicited messages if the recipient is compensated?

The Balance of Convenience and Annoyance

Another aspect to consider is the balance between convenience and annoyance. While some may view these paid messages as a novel way of earning small amounts of Bitcoin, others might see them as intrusive or even exploitative. The fact that these messages can be sent to a vast number of users with relative ease raises concerns about the potential for overuse or misuse of this advertising method, leading to a digital environment cluttered with unwanted communications.

Consent and User Autonomy

The issue of consent is paramount in this discussion. Traditional advertising models usually, but not always operate within a framework of implied or explicit consent, where audiences opt-in to receive messages. In the case of Lightning Network advertising, the consent is less clear. While receiving payment for these messages might imply a form of tacit agreement, it doesn't necessarily equate to explicit consent, raising questions about user autonomy and the right to choose one's digital interactions.

The Impact on Network Dynamics

From a broader perspective, there's also a need to consider how this form of advertising might impact the overall dynamics of the Bitcoin Lightning Network. If transaction advertising becomes prevalent, it could alter the way the network is used and perceived, potentially affecting its efficiency and the user experience. This shift could lead to a reevaluation of the network's primary purpose and functionality.

The Role of Regulation and Governance

Finally, the question of regulation and governance comes into play. Should there be mechanisms in place to control or regulate this form of advertising? The decentralized nature of the Bitcoin Lightning Network makes centralized regulation challenging, but there might be a need for community-driven standards or guidelines to ensure that this advertising method doesn't become problematic or harmful to the network and its users. At the very least, services like Satogram.xyz should allow users to remove themselves from their database, so they wouldn't receive spam messages. This is also a service to advertisers, since no advertiser wants angry potential customers, who are annoyed by spam transactions.

Opting Out of Lightning Transaction Advertising

- Adjust the Minimum HTLC Setting: By increasing the min_htlc setting on your channels, you can effectively filter out these low-value transactions. This setting controls the minimum size of transactions that your node will process, allowing you to exclude the smaller, likely advertising-related transactions.

- Implement a Base Fee: Setting a small base fee for forwarding transactions can ensure you're compensated for the resources used in processing and storing these forwards. This approach turns the increased traffic into a potential source of revenue, albeit small.

- Disabling Keysend: If you're running your own node, you can disable keysend. This will prevent your node from receiving these unsolicited advertising transactions, giving you control over the messages you receive.

For Custodial Wallet Users

- Setting a Minimum Notification Threshold: Some wallets allow users to set a threshold for transaction notifications. By setting this threshold above the typical value of advertising transactions, you can avoid being notified about them. You'll still receive the payments, but you won't be disturbed by promotional messages that fall below your set limit.

Future of Lightning Network Transaction Advertising

Growth in User Reachability

The number of users reachable via the Lightning Network is expected to grow. As more people adopt Bitcoin and become familiar with the Lightning Network, the audience for these transaction advertisements will expand. This increased user base will offer advertisers a broader, more diverse audience, enhancing the reach and potential impact of their campaigns.

Emergence of Niche Services

Just like Satogram.xyz has carved a niche in transaction advertising, it's likely that more services will emerge, each catering to different aspects of Lightning Network advertising. These services could offer specialized features, target specific demographics, or provide unique advertising formats, thus enriching the ecosystem with more options and flexibility for advertisers.

Wallet and Node Updates for Spam Management

With the rise in transaction advertising, it's probable that wallets and Lightning Network node implementations will release updates to better manage what could be perceived as spam. These updates might include more sophisticated filtering options, enhanced user control over what types of messages are received, and improved notification settings. Such features will aim to balance the needs of advertisers with the preferences of network users.

Increase in Advertising Fees

As transaction advertising becomes more popular and the network grows in user density, it's likely that the fees for sending advertising messages will increase. This could be a result of market dynamics where higher demand leads to higher prices or as a measure to regulate the volume of advertising traffic on the network. Higher fees might also improve the quality of advertisements, as advertisers will need to ensure a good return on investment, potentially reducing low-effort or less relevant advertising content.

Exploring AI Innovations in the Bitcoin Lightning Network

Posted about 2 years ago

Enhanced Routing Algorithms with AI

AI-Aided LN Wallets for Personalized Experience

Optimizing Node Liquidity and Connections

AI-Generated Promotional Messaging

Predictive Analysis for Liquidity Management and Fee Setting

Fraud Detection and Network Security

Automated Compliance and Regulatory Adherence

Summary

Lightning Network Explained with Real World Analogies

Posted over 2 years ago

What is the Bitcoin Lightning Network?

Basic Lightning Network Facts

- Foundation on Bitcoin Network: Primarily operates on the Bitcoin network, occasionally on others like Litecoin.

- Security from Bitcoin: Utilizes the robust security of the Bitcoin blockchain for its underlying agreements.

- Currency Used: Employs Bitcoin's smallest unit, Satoshis, and can handle even smaller units for precise accounting.

- Widespread Adoption: Millions worldwide, including major corporations, are rapidly adopting the Lightning Network.

How Does the Lightning Network Work?

- Lightning Nodes: These are like checkpoints managing transactions.

- Payment Channels: Private pathways between nodes for quick exchanges.

- Off-Chain Transactions: Transactions in these express lanes bypass the congested Bitcoin blockchain.

- Settlement: Transactions are finalized on the Bitcoin blockchain when channels are closed.

Benefits of the Lightning Network

- Speed: Near-instant transactions.

- Reduced Costs: Lower fees due to reduced blockchain congestion.

- Enhanced Scalability: Handles a higher volume of transactions, addressing Bitcoin's scalability issues.

Real-World Parallels to Understand the Lightning Network

- Debit Cards: Loading a debit card with funds is akin to receiving a transaction on a lightning channel. You can spend repeatedly until the balance depletes, similar to a lightning channel.

- Bar Tabs: Opening a bar tab is like opening a lightning channel. You settle the total at the end, just as you would settle a lightning channel.

- Two-Town Train Track: Imagine a train track connecting two towns with a limited number of carts. This illustrates how lightning channels have a fixed capacity for transactions.

- Two-Way Bridge Toll: Think of islands connected by toll bridges. Crossing these bridges (channels) involves fees (routing fees), illustrating how transactions incur costs on the Lightning Network.

The Debit Card Analogy

However, this analogy isn't perfect, as there are several nuances unique to each system. Let's explore these similarities and differences to gain a clearer picture of how the Lightning Network functions.

Similarities:

- Spending Limits: Like a debit card, a Lightning channel doesn't allow you to spend more than its balance. There's no concept of 'credit' in this scenario.

- Reloadable Nature: Both your debit card and a Lightning channel can be reloaded and used repeatedly.

- Closure and Withdrawal: Just as you can close your bank account and withdraw the remaining balance on your debit card, a Lightning channel can be closed, allowing you to transfer the remaining Satoshis back to your Bitcoin wallet.

- Multiplicity: Owning multiple debit cards is similar to having several Lightning channels at your disposal.

- Physical and Digital Forms: Debit cards can be physical, like cards or NFC-enabled devices, and Lightning channels can also be operated with similar physical tools, enhancing usability.

- Fee Structure: Typically, direct transactions with a debit card don't incur visible fees. Similarly, direct channel transactions on the Lightning Network are always fee-free.

Differences:

- Currency Type: Debit cards are typically loaded with fiat currencies like dollars or yen, whereas Lightning channels primarily use Bitcoin. Future developments like Taproot Assets and RGB might introduce stable coins, but their adoption is yet to be seen.

- Upper Limit: Unlike debit cards, which usually don't have an upper spending limit, Lightning channels have a predetermined maximum capacity, akin to a gift card.

- Lower Limit on Spending: Debit cards often have a minimum spending limit, while Lightning channels can facilitate transactions as small as a single Satoshi, offering far greater granularity.

- Intermediaries in Transactions: Using a debit card often involves third parties like banks and card processors. In contrast, Lightning transactions can occur directly between parties if they share a channel, omitting any intermediaries.

- Privacy of Transactions: Debit card transactions are typically visible to banks and card companies, but Lightning transactions offer significantly more privacy, with minimal information available to third parties.

- Security Risks: Traditional cards can pose security risks, as they contain all information needed for a transaction. Lightning payments, secured cryptographically, are inherently safer.

- Combining Balances: Unlike debit cards, where combining balances for a single large purchase is uncommon, Lightning channels allow for the aggregation of balances for larger payments, although this is not a widespread practice yet.

The Bar Tabs Analogy

First Night: Opening a Tab and Channel

Imagine walking into your favorite bar. The bartender allows you to open a tab, saying you can enjoy drinks up to $100 before settling the bill. Throughout the night, you add drinks to your tab without the need to pay for each one immediately. At the night's end, you pay the total amount owed. This system simplifies transactions, as you only settle once, not after every drink.

Drawing a parallel with LN, opening a bar tab is akin to opening a lightning channel. When you first open this tab (or channel), you're essentially setting a limit - in this case, a certain amount of Satoshis. As you order drinks, the bartender keeps a record of your consumption, just like each transaction you make is recorded on both ends of a Lightning channel. This ongoing record tracks the balance, although no actual currency exchange happens until the tab (or channel) is closed. When you're ready to leave, you settle your tab with cash, similar to closing a Lightning channel and settling the final balance in Satoshis.

Second Night: Payment Forwarding

The scenario evolves on your second visit. You bring a friend who is unknown to the bartender and therefore can't open a tab. However, you use your established $100 tab to cover their expenses, and they repay you privately.

This scenario mirrors having two Lightning channels. You have one channel with the bartender (node) and another with your friend (another node). Your friend can't directly pay the bartender due to the lack of a direct channel. Instead, they route their payment through you, and you forward it to the bartender. This is a practical demonstration of payment forwarding in LN, enhancing the network's functionality beyond simple one-to-one channel transactions.

Third Night: A Network of Channels and Circular Economy

On your third visit, the complexity increases. Your friend, now recognized by the bartender, agrees to supply him with pretzels on a $1,000 tab. Additionally, you extend a financial advisory tab to your friend: "Stay humble. Stack sats." This forms a triangle of economic activity among you, your friend, and the bartender, creating what's known as a circular economy. Money exchanges are deferred until there's a need to balance the tabs.

In LN terms, this is analogous to three interconnected nodes, each with a channel to the others. Transactions flow in a circular manner: from the first node to the second, the second to the third, and the third back to the first. This interconnectedness allows for a seamless flow of funds without the immediate need to close channels, illustrating the network's sophisticated capacity for multi-node transactions and the balancing of channels.

The Two-Town Train Track Analogy

Setting Up the Scenario:

Imagine Aliceville and Bobburg decide to build a train track linking their towns. Initially, there are 100 train carts, all stationed in Aliceville. These carts symbolize a newly opened LN channel, with Aliceville's node possessing 100 Satoshis.

Transactions as Train Movements:

When Aliceville decides to send 20 carts filled with oranges to Bobburg, this mirrors a LN transaction where 20 Satoshis are transferred. After this 'shipment,' Aliceville has 80 carts (or Satoshis) remaining, while Bobburg now has 20. This allocation represents the current capacity of each town (node) within the channel: Aliceville can send up to 80 more carts, and Bobburg can receive up to 80 carts. Conversely, Bobburg can send back up to 20 carts, and Aliceville can receive up to 20.

Channel Capacity and Liquidity:

The critical factor here is the fixed total of 100 carts, analogous to the total Satoshis in the channel. Neither town can add nor remove carts from the track, mirroring the fixed liquidity in a LN channel. This setup allows for a dynamic back-and-forth movement of value (carts/Satoshis) between the towns.

Long-Term Channel Usage:

As Aliceville and Bobburg continue to transact over time, they exemplify the long-term utility of a Lightning Network channel. The towns keep shuttling carts back and forth, similar to how LN channels facilitate the continuous exchange of Satoshis. This process can be sustained indefinitely, reflecting the enduring nature of many LN channels which remain active for years, facilitating the regular flow of transactions.

Channel Closure:

Caveats and Extended Realities:

While this analogy illustrates the basic mechanics of LN channel capacity, there are a few caveats and expansions to consider:

- Nature of the Carts/Value: In our analogy, carts carry value (oranges). However, in LN, the 'carts' (Satoshis) are the value themselves. Imagine the carts as being made of gold.

- Scale of the Network: The LN isn't limited to two nodes (towns) but includes thousands, interconnected in a vast network.

- Forwarding Across Nodes: Like in the real world, LN allows for the forwarding of value through intermediary nodes. If Aliceville wants to send value to a town beyond Bobburg without a direct channel, it can forward Satoshis through Bobburg. This is only feasible if Bobburg has sufficient capacity (carts) to facilitate this forwarding.

By visualizing the LN as a network of interconnected towns with a fixed number of carts, we gain a clearer understanding of how channel capacity, liquidity, and transaction forwarding operate in this innovative financial ecosystem.

The Two-Way Bridge Toll Analogy

Setting the Scene: The Country of Islands and Bridges

Picture a vast country made up of many islands. These islands are interconnected by a network of bridges. For anyone wishing to travel from one island to another, crossing these bridges is essential. However, each bridge crossing incurs a fee at the toll stations. To add a layer of realism to this scenario, consider that the toll fees are structured in two parts: a fixed fee for every vehicle, and a variable fee based on the vehicle's capacity. For instance, a small sports car with two seats incurs a lower fee compared to a large bus carrying a dozen passengers.

Drawing Parallels with the Lightning Network

In this analogy:

- Islands represent Lightning nodes: Each island is a standalone entity but connected to others in the network.

- Bridges symbolize Lightning channels: These are the pathways that connect the nodes, enabling the movement (transactions) between them.

- Cars are akin to Satoshis: The currency that moves through the network, facilitated by the channels.

- Base Fee: This is a fixed charge applied to every transaction, regardless of its size. This fee can often be set to zero on many nodes, making small transactions particularly economical.

- Fee Rate: This is a variable charge, calculated as a percentage of the transaction's size, measured in parts per million (ppm). It varies widely, from as low as one ppm to several thousands, and can dynamically adjust based on market conditions and network demand.

Understanding the Fee Structure

Just as the toll fees in our island country vary based on the vehicle type and its capacity, in the Lightning Network, the fees depend on the transaction size and the policies of the nodes involved. This system incentivizes the maintenance and provision of channels (bridges), ensuring the smooth operation of the network while also allowing node operators to be compensated for their services.

Through this analogy, the complex concept of routing and fees within the Lightning Network becomes more tangible, illustrating how transactions are facilitated across the network and how fees are structured to support this intricate system of financial exchange.

Getting Started with the Lightning Network

- Select a Bitcoin Lightning Wallet: Choose an implementation like LND or CLN.

- Fund Your Wallet: Transfer Bitcoin, considering channel openings and transaction fees.

- Open a Payment Channel: Establish a channel with another node.

- Commence Transactions: Start sending and receiving Bitcoin payments.

Conclusion

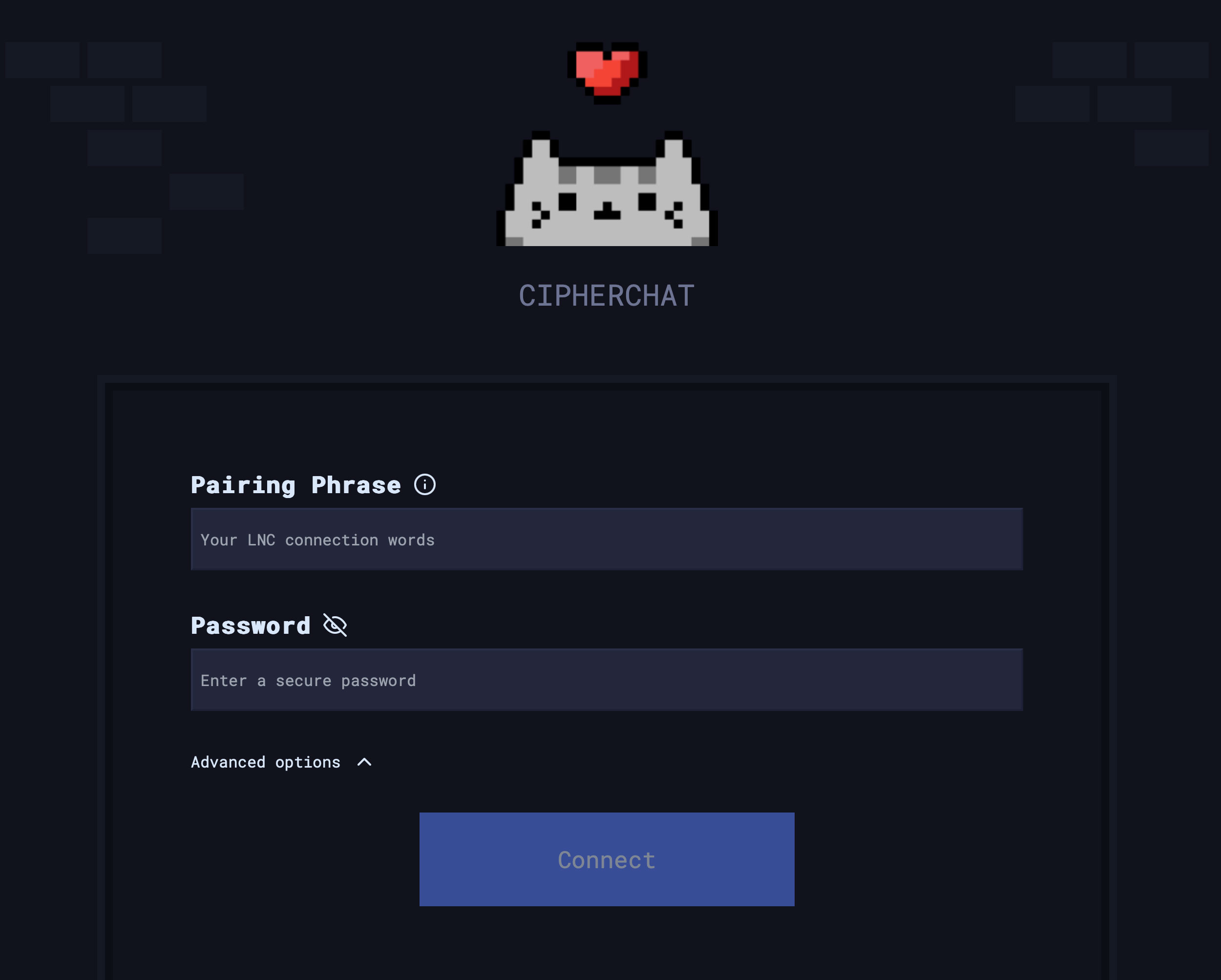

Cipherchat: A New Era of Private Messaging on the Lightning Network

Posted over 2 years ago

How Cipherchat Functions

Upholding Privacy and Security

Getting Started with a Lightning Node

Installing and Using Cipherchat

Innovative Features for Enhanced Experience

Optimal Usage and Technical Insights

Self-Hosting and Compatibility

Community and Development

Final Thoughts

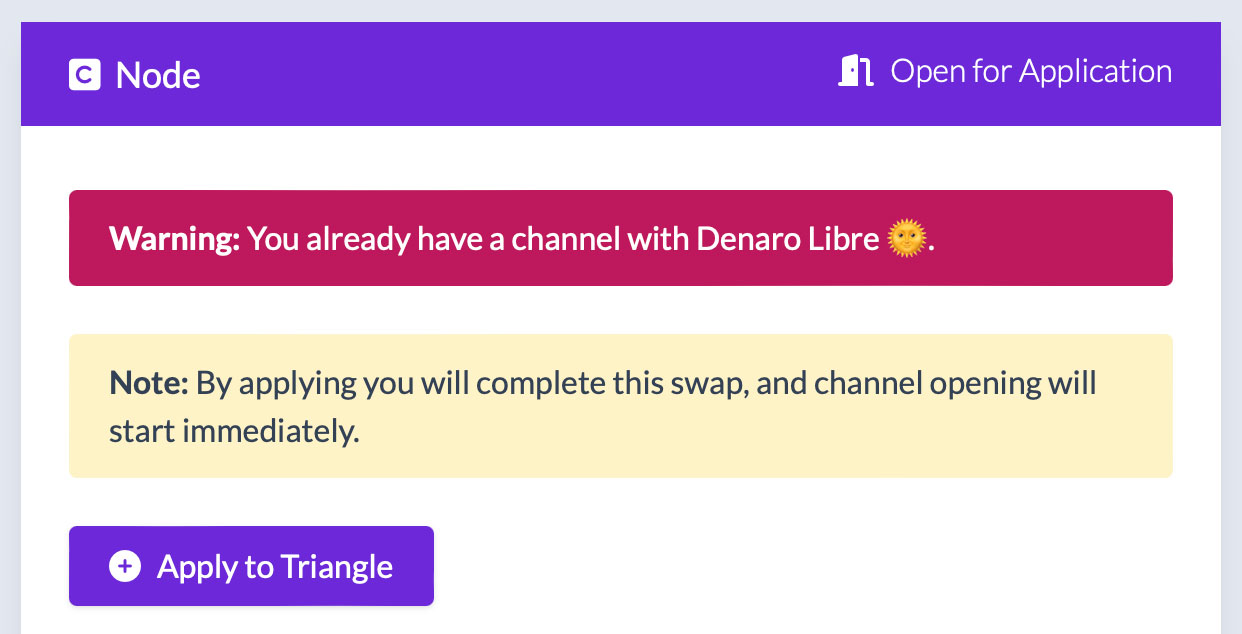

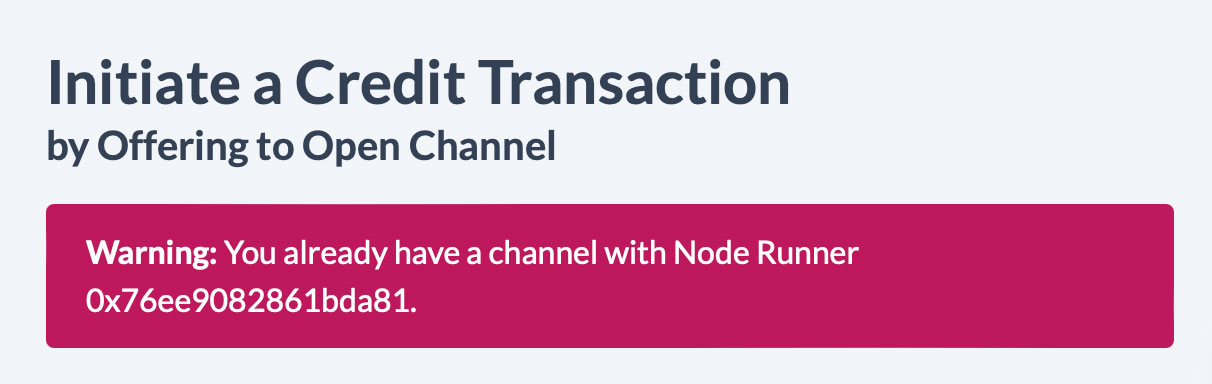

Introducing Advanced Warnings to Prevent Duplicate Channels

Posted over 2 years ago

Liquidity Swaps

- If you already have an active channel with the node from which you're about to receive a channel.

- If you already have an active channel with the node with the node you're about to commit to open a channel to.

- If you have a pending Liquidity Swap with the node from which you're about to receive or with whom you're about to open a channel.

- If you have a pending Pool Credit Transaction with the node from which you're about to receive or with whom you're about to open a channel.

Liquidity Pool

- If you already have an active channel with the node to whom you're about to offer a channel.

- If you have a pending Liquidity Swap with the node to whom you're offering a channel, whether you're receiving or opening.

- If you have a pending Pool Credit Transaction with the node to whom you're about to offer a channel.

This warning system is designed to streamline your interactions and ensure efficient management of your channels.

Navigating High Mining Fees as a Bitcoin Lightning Network Node Operator

Posted over 2 years ago

Strategic Channel Management in Looming High-Fee Climates

LND Nodes: Adaptability in the Fee Storm

Mastery of BOS in High-Fee Environments

CLN Nodes: A Calculated Approach to Channel RBF

The Practicalities: From Uptime to Wallet Management

Closing Thoughts

Lightning Strikes Twice: How Taproot Assets Electrify Bitcoin's Future

Posted over 2 years ago

Issuance of Assets

Lightning Network Synergy

Privacy & Scalability

Multi-Asset Functionality

Developer-Friendly Ecosystem

Community Engagement

Learn Through Visuals

Taproot Assets Playlist by Lightning Labs

The Road Ahead

As we tread along this exciting path, the amalgamation of community efforts, continuous enhancements, and the relentless quest for innovation will undoubtedly play a crucial role in realizing Bitcoin's potential as the global routing network for the internet of money.