Is It Better to Open Few Large or Many Small Channels on Bitcoin Lightning?

Posted over 1 year ago by LN+

One crucial decision for a Lightning node operator is whether to open few large channels or many small ones. To assess this, we'll explore three hypothetical scenarios, each representing different channel configurations. These examples can be scaled up or down depending on the available funds, with the figures provided being solely for comparative purposes.

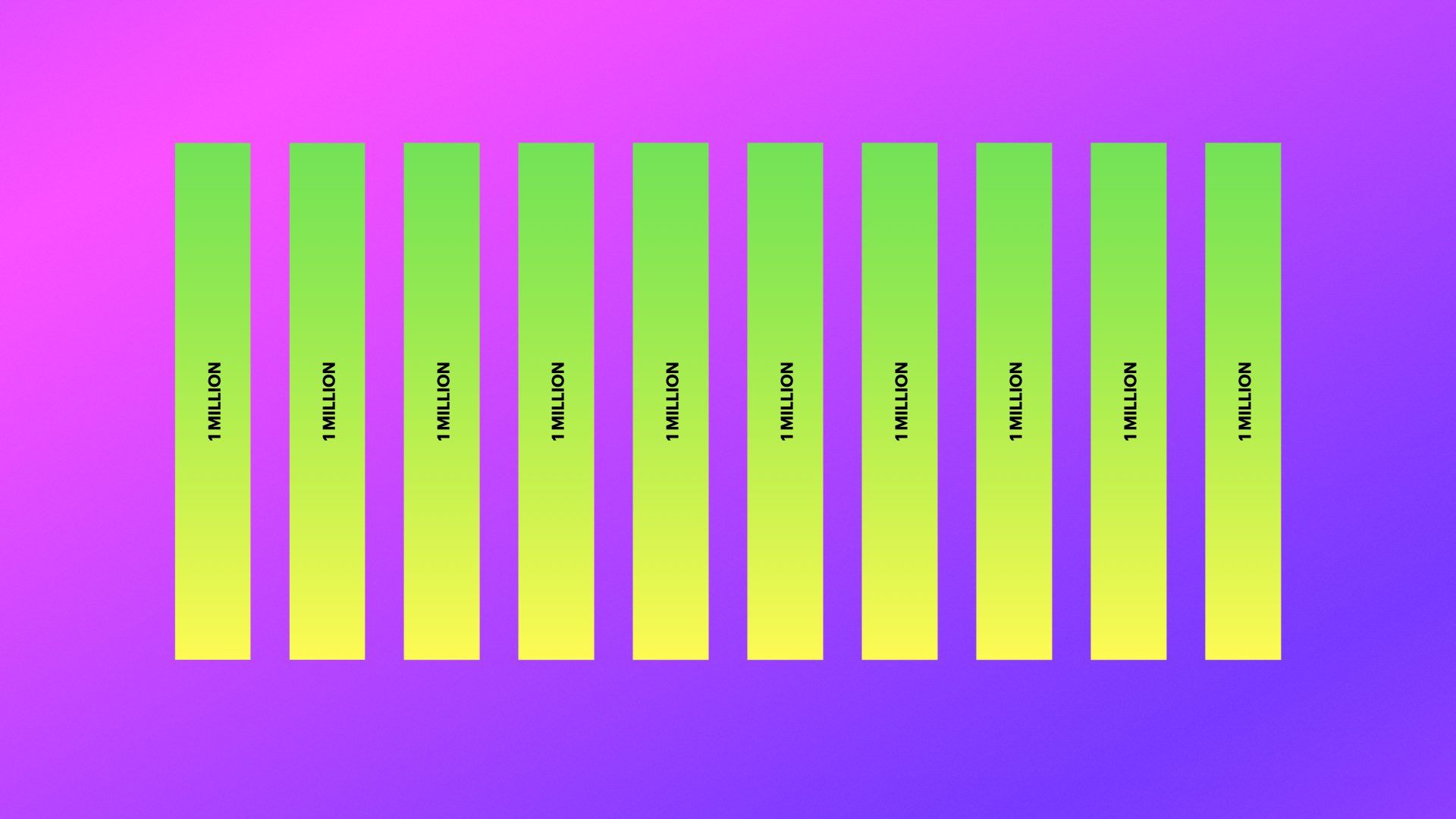

Scenario 1: Small Channels

Configuration: Ten channels with 1 million satoshis each.

Advantages:

Advantages:

- High Redundancy: With ten channels, there is a greater likelihood that at least one channel will have the necessary liquidity for a transaction, ensuring almost certain payment success.

- Potentially Lower Fees: With more routes to choose from there is a higher likelyhood to find a low fee route for incoming and outgoing payments.

- Ideal for Small Payments: This setup is particularly suited for small transactions such as tipping, paying for content, and other microtransactions.

Disadvantages:

- Limited to Small Payments: Larger payments require splitting across multiple channels, which can add complexity and potentially increase the transaction time.

- Higher Opening Costs: More channels mean higher costs due to the fees associated with opening each channel, although this can be mitigated by batch channel opening.

- Minimal Routing Income: Smaller channels are less likely to be used for routing, resulting in lower fees earned from this activity.

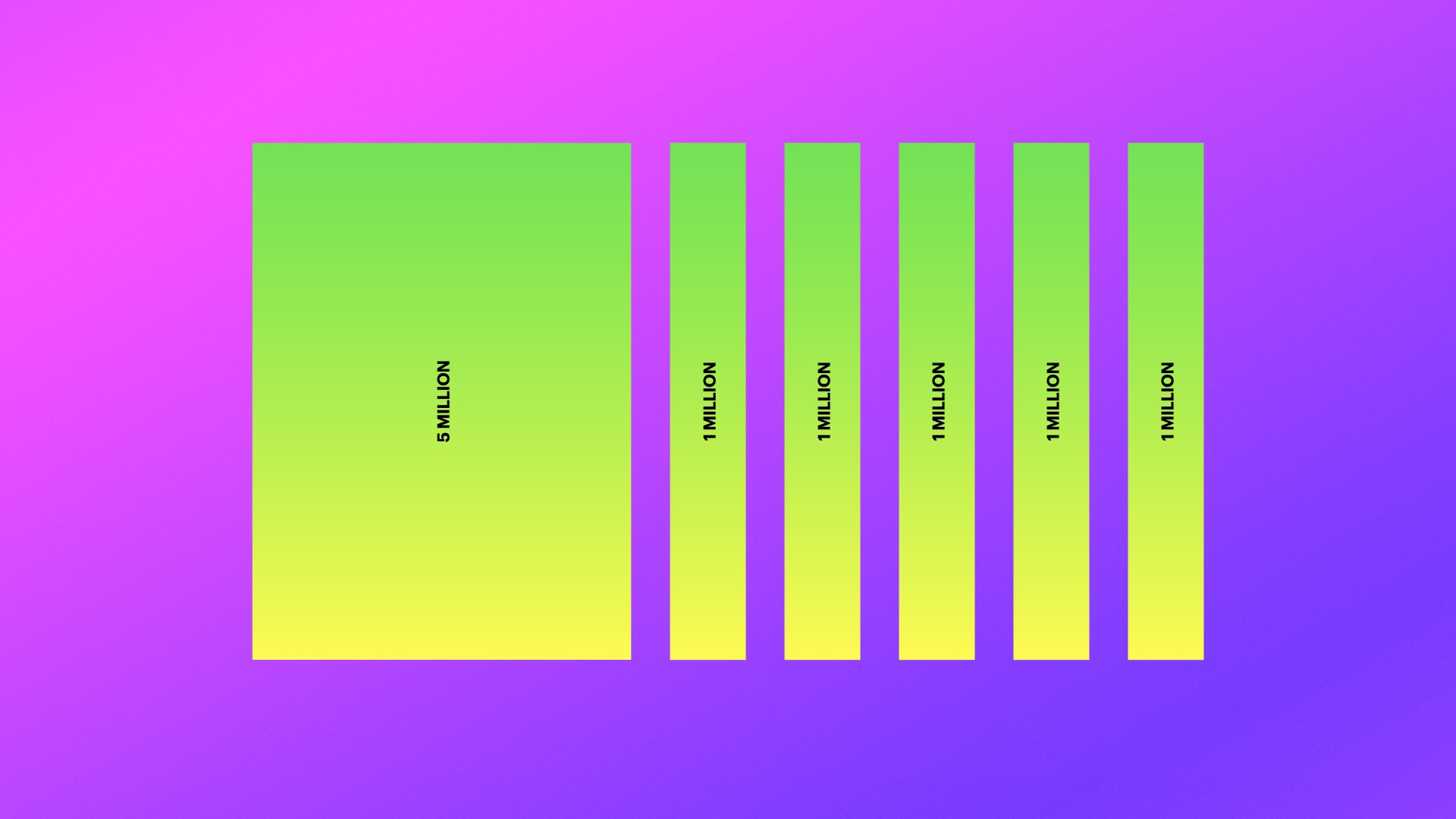

Scenario 2: Mixed Size Channels

Configuration: Five channels with 1 million satoshis each, and one channel with 5 million satoshis.

Advantages:

Advantages:

- Balanced Redundancy and Capacity: This setup provides a good mix of redundancy and the ability to handle larger payments through the 5 million satoshi channel.

- Versatility: Suitable for a variety of use cases, from small transactions to occasional larger payments.

- Moderate Routing Income: The larger channel may be used for routing, generating some income from transaction fees.

Disadvantages:

- Moderate Complexity: The mixed configuration may still face issues with liquidity in smaller channels, requiring careful management.

- Variable Costs: While there are fewer channels than in the small channels scenario, the cost savings are not as significant as in the large channels scenario.

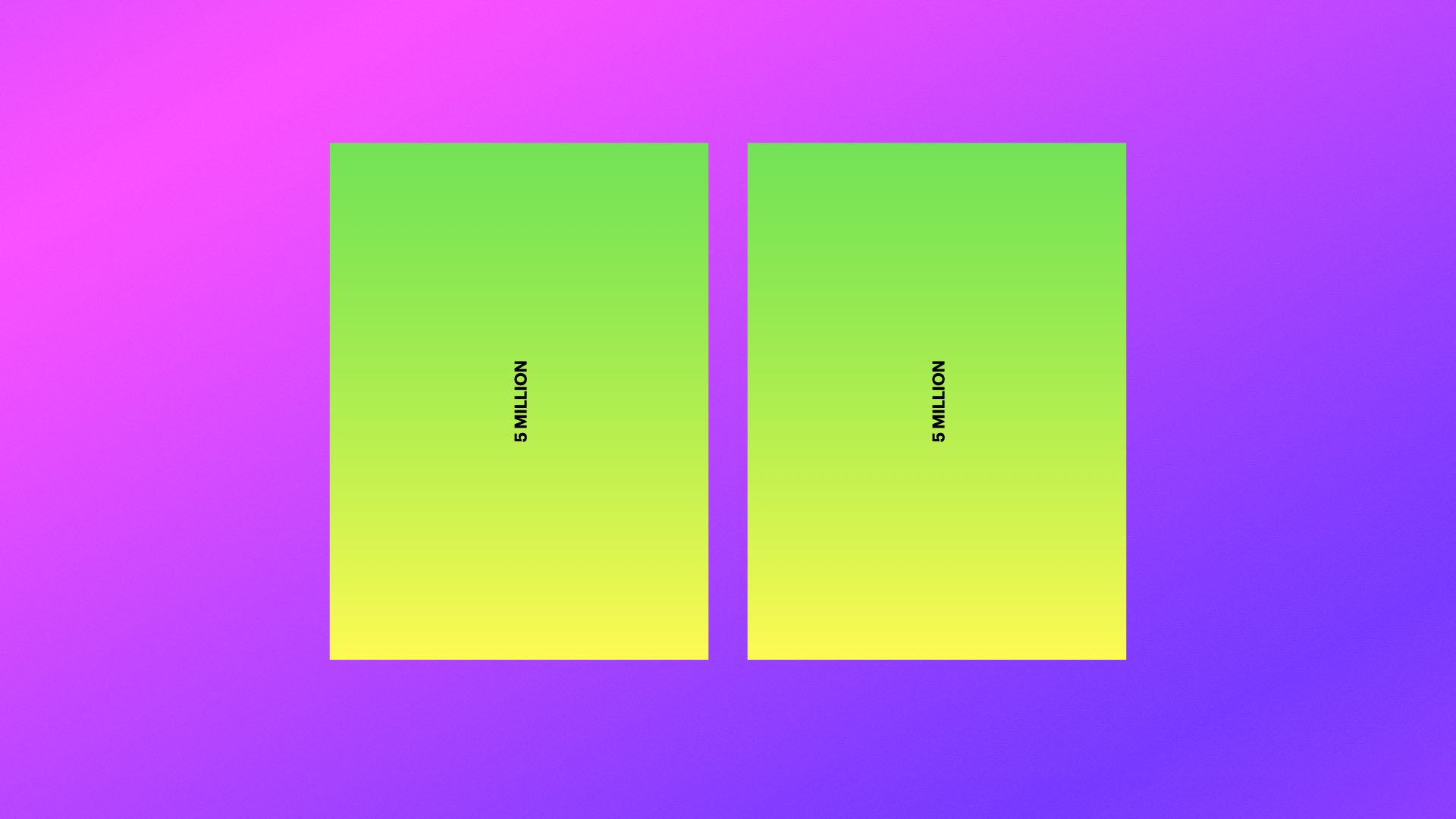

Scenario 3: Large Channels

Configuration: Two channels with 5 million satoshis each.

Advantages:

Advantages:

- Low Opening Costs: Fewer channels mean lower overall costs for opening and maintaining channels.

- Ideal for Large Payments: Larger channels can handle significant transactions without the need for splitting payments.

- Higher Routing Potential: These channels are more likely to be used for routing large transactions, generating higher fees.

Disadvantages:

- Low Redundancy: With only two channels, the setup is more vulnerable to failures or liquidity issues. If one channel goes down or lacks the necessary liquidity, transactions may fail.

- Centralized Dependency: Depending heavily on a few large channels can increase reliance on specific nodes, potentially leading to centralization issues.

Overall Considerations

When deciding on the optimal channel configuration, it's essential to consider several factors:

- Network Connectivity: Ensure connections to both highly connected large nodes and medium-sized nodes to avoid over-reliance on centralized entities.

- Frequent Connections: Establish channels with friends and businesses you frequently transact with, as direct connections can improve transaction efficiency for daily use.

- Use Case Suitability: Align your channel strategy with your intended use case. Small channels are best for microtransactions, mixed channels offer versatility, and large channels are suitable for handling significant payments and routing.

- Balanced Node: Ensure that you maintain a balanced node with channels that are at least partially empty on your side to receive payments and channels that are at least partially full on your side to send payments. This balance allows for smooth transaction flow in both directions. To achieve this, you may need other node operators to open channels to you. Consider using our Liquidity Swaps and Liquidity Pool services available on this site to easily and freely manage your liquidity needs.

- Partner Fees: While large and well connected nodes may seem like a great option to be well connected, consider that they also typically charge more for transaction routing. Medium and small sized nodes are usually cheaper to route through.

In conclusion, there is no one-size-fits-all answer to whether it is better to open few large or many small channels on the Bitcoin Lightning Network. The optimal strategy depends on the specific needs and transaction patterns of the node operator. By carefully considering the advantages and disadvantages of each configuration, operators can tailor their channel setup to maximize efficiency, redundancy, and potential routing income.

2 Comments

Kidlat⚡ wrote over 1 year ago

Educational!

SovereignSats wrote over 1 year ago

Thanks for this! I've been trying to see what would be the best but it seems like it's all just trial and error and continuously adjusting as needed.

Please login to post comments.

Lightning Network Node

LightningNetwork.Plus

Rank: 6 / Tungsten

Capacity: 40,370,000 SAT

Channels: 11

Latest news

Channel Rebalancing 101: Practical Strategies for Better Routing

Posted 2 months ago

Square Launches Lightning-Powered Bitcoin Payments: Zero Fees Until 2027

Posted 3 months ago

Introducing Telegram notifications

Posted 4 months ago

Introducing Nostr DM notifications

Posted 4 months ago