You need to sign in or sign up before continuing.

From Digital Gold to Digital Cash: Why the Lightning Network’s Moment Has Arrived

Posted 3 months ago by LN+

For years, the Bitcoin community has lived with a persistent dichotomy. On one hand, we have witnessed historic milestones—a sovereign nation, El Salvador, adopting Bitcoin as legal tender, and institutional giants like BlackRock signaling their approval. On the other hand, the vision of a "hyper-bitcoinized" world where you can walk into any coffee shop globally and pay for a latte with satoshis remains elusive.

Critics often point to this gap as evidence of failure. They argue that the Lightning Network—Bitcoin's layer-2 solution for instant payments—has been around long enough to have taken over, yet it hasn't. The narrative suggests that if it were going to happen, it would have happened by now.

However, this perspective misses the forest for the trees. Lightning hasn't failed; it has been waiting for its foundation to cure. Money does not evolve in a chaotic vacuum; it follows a strict evolutionary path. We are not witnessing a stagnation of the network, but rather the precise moment where we cross the bridge from

"Store of Value" to "Medium of Exchange."

The Evolution of Money: A Staged Approach

To understand why Lightning is only now ready for prime time, we must understand the lifecycle of money. A new form of money cannot simply spawn into existence with all the properties of a mature currency. It must go through distinct stages of development, and you cannot build the second floor of this house before the foundation is set.

Stage A: Store of Value (SoV)

This is the "Digital Gold" phase, and it is the prerequisite for everything else. Before an asset can be used to buy bread, it must be trusted to hold value over time. We can confidently argue that Bitcoin has largely secured this stage. The adoption by nation-states like El Salvador and Bhutan, the entry of institutional heavyweights like Fidelity and BlackRock, and the accumulation by public companies like MicroStrategy and Tesla have cemented Bitcoin's status. This stage was critical because, without the massive liquidity and trust established here, the network would remain too volatile to serve as a reliable payment rail for the world.

Stage B: Medium of Exchange (MoE)

This is the stage we are entering now. Once the asset is trusted (SoV), it can begin to circulate. This is where the Lightning Network enters the picture. It acts as the technological enabler that unlocks speed and lowers costs, making the asset viable for commerce. But crucially, Lightning requires the deep liquidity established in Stage A to function properly. It could not have succeeded before now because the underlying asset was still proving its permanence.

Stage C: Unit of Account (UoA)

This is the final frontier—a long-term vision where goods and services are priced natively in sats rather than fiat currency. This reality will only become possible once Stage B becomes the global norm.

Why the "Lull" Was Actually Preparation

The perception that the last few years were stagnant for Lightning is a misunderstanding of engineering cycles. While the media and the market were fixated on the price action of Layer 1, a massive construction phase was occurring quietly in the background. Three critical pillars were being built to support the transition to a Medium of Exchange.

1. The Foundation is Solid

Bitcoin’s base layer (Layer 1) had to survive its own existential threats before Layer 2 could flourish. Having weathered the "blocksize wars" and intense regulatory scrutiny, Bitcoin is now universally recognized as a robust settlement layer. The base is finally strong enough to support the "skyscraper" that is the Lightning Network.

2. The Tech Stack Has Matured

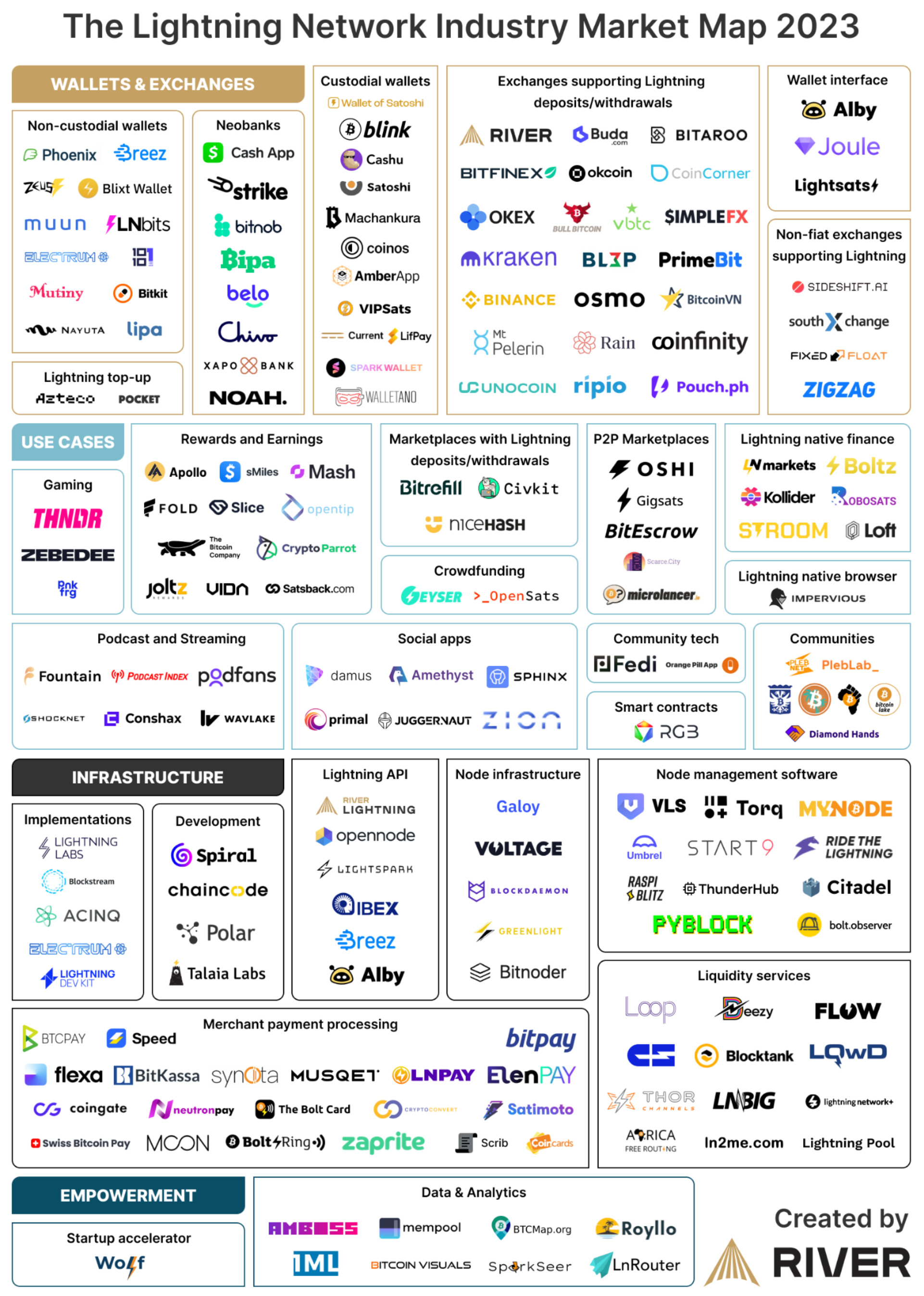

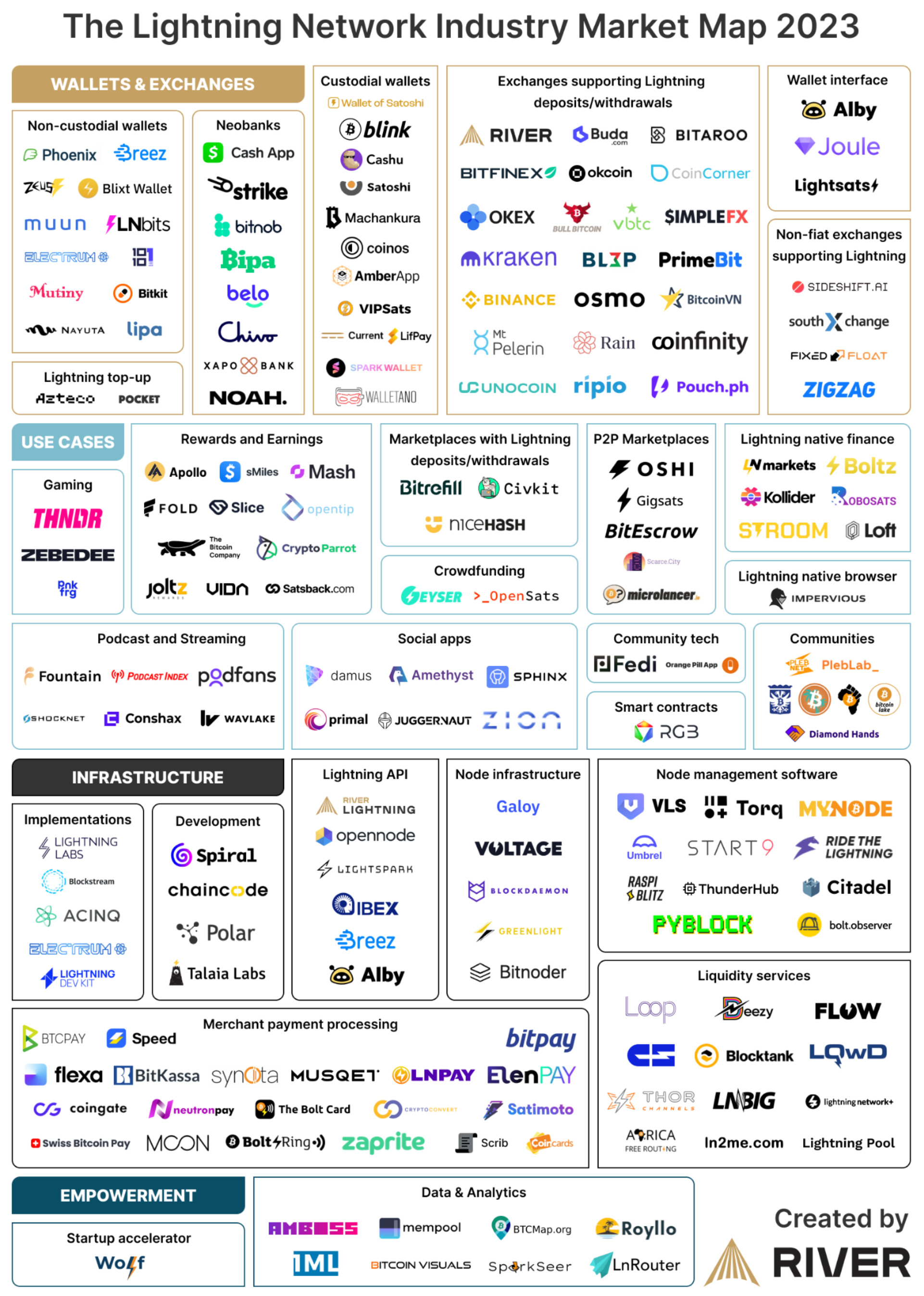

If you compare the Lightning Network of 2018 to the network of today, they are practically different technologies. Early Lightning was a playground for developers willing to work with command-line interfaces. Today, the protocol boasts massive improvements in reliability. Innovations like "splicing" (managing channel funds without closing them) and "blinded paths" (improving privacy) have solved critical user experience hurdles. The ecosystem now includes intuitive mobile wallets, automated Liquidity Service Providers (LSPs), and robust tools that make merchant onboarding seamless.

3. Human Capital is Ready

Technology is built by people, and the talent pool in the Bitcoin space has deepened significantly. We now have a critical mass of developers, engineers, and educators who specialize specifically in Lightning. There has been a noticeable "brain drain" from legacy finance and broader tech sectors into Bitcoin layers, equipping the industry with the professional capacity necessary to handle global scale.

The Signs of the Shift: Invisible Adoption

The most exciting aspect of the current phase is that mass adoption won’t necessarily look like millions of individuals downloading a new, complex app overnight. Instead, it looks like infrastructure integration. We are moving toward "invisible adoption," where Lightning powers payments in the background.

A prime example of this shift is Square. By working to enable Lightning for millions of merchants through their ecosystem, they are effectively turning on the lights for mass adoption without requiring every merchant to become a Bitcoin expert. When large aggregators—payment processors, exchanges, and fintech apps—integrate Lightning, the utility of the network grows exponentially rather than linearly. We are seeing the early signs of a network effect that is fueled not by hype, but by utility.

Time to Shine

The roadmap has always been clear, even if the timeline was debated. We have successfully built the Vault (Store of Value), and now we are officially opening the Register (Medium of Exchange). Lightning did not "miss the boat." It was being painstakingly assembled in the dry dock while the ocean was being charted.

With the technology mature, the experts ready, and the base layer secured, the Lightning Network is finally ready for its true purpose: making Bitcoin a global currency. The waiting game is over. It is time to build, integrate, and transact.

1 Comment

Shire Society Federation- wrote 19 days ago

Monero also works really well and their wallet is easier to get going that a lightning wallet.

I'd say XMR is somewhere between BTC and BTC lightning in long term desirability by end users at this point.

I'd say XMR is somewhere between BTC and BTC lightning in long term desirability by end users at this point.

Please login to post comments.

Lightning Network Node

LightningNetwork.Plus

Rank: 6 / Tungsten

Capacity: 40,370,000 SAT

Channels: 11

Latest news

Channel Rebalancing 101: Practical Strategies for Better Routing

Posted 3 months ago

Square Launches Lightning-Powered Bitcoin Payments: Zero Fees Until 2027

Posted 4 months ago

Introducing Telegram notifications

Posted 5 months ago

Introducing Nostr DM notifications

Posted 5 months ago