LN+'s Posts

Introducing liquidity swap bookmarking and hiding

Posted over 3 years ago

Today we are launching two highly requested minor feature updates, which will make it easier for you to sort through the available swaps on LN+.

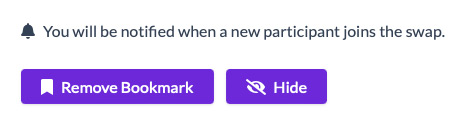

Bookmarking, as the name suggests, allows you to add a bookmark to a swap, so you can easily find it later by clicking the bookmark icon in the top right navigation or the bookmark button in your profile dashboard (as long as you're signed in.) If you bookmark a swap you will be notified if a new participant joins the swap. You would want to bookmark a swap if you're interested in the swap, but also want to wait and see which other participants are joining before committing. You can of course remove a bookmark if needed.

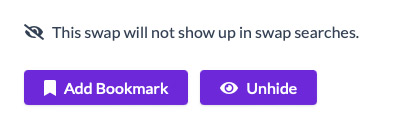

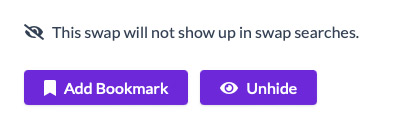

Hiding is the opposite of bookmarking. It lets you hide a swap from all swap index pages. You would typically use hiding if you're confident that you are not interested in a swap, and you want to hide it from searches, so you can focus on the swaps you haven't reviewed yet. If you want to see the swaps you have hidden, click the Hidden button in your profile dashboard. You can unhide swaps if needed.

You can bookmark or hide a swap by clicking the relevant buttons on swap pages in the left sidebar below all the swap information.

As always, let me know if you notice any issues or if I can help you in any way.

You can bookmark or hide a swap by clicking the relevant buttons on swap pages in the left sidebar below all the swap information.

As always, let me know if you notice any issues or if I can help you in any way.

Critical alert for lnd users: Update your node to v0.15.4

Posted over 3 years ago

An update for lightning network daemon (lnd) has been released that fixes a critical bug that was triggered by an unusually large transaction. This is the second time such a bug has surfaced within the last 2 weeks, but hopefully it's been now resolved for good thanks to the quick work by the btcd and lnd teams. 🙏

If you're running a managed node on Voltage.Cloud or with Umbrel, the services provide you with a one click update. Otherwise, you need to update yourself.

It's very important to update, otherwise your node will be stuck on Bitcoin block 761248. Without the update, funds in your channels may be at risk, and you will not be able to send, receive or route payments.

If you have a friend or collegue who doesn't attent to their node frequently, reach out to them and advise them to update as well.

Photo: Artur Wayne

If you're running a managed node on Voltage.Cloud or with Umbrel, the services provide you with a one click update. Otherwise, you need to update yourself.

It's very important to update, otherwise your node will be stuck on Bitcoin block 761248. Without the update, funds in your channels may be at risk, and you will not be able to send, receive or route payments.

If you have a friend or collegue who doesn't attent to their node frequently, reach out to them and advise them to update as well.

Photo: Artur Wayne

Introducing Clearnet and Tor only liquidity swaps

Posted over 3 years ago

Up untill now all liquidity swaps allowed both nodes with Clearnet and Tor connections (addresses) to join. This option will remain as is. However, we will now have two more options for special circumstances.

Now, you have the option to create swaps that only allow nodes with either Clearnet connection or only allow nodes with Tor connection.

Clearnet only swaps are beneficial to node operators who want to minimise the problems stemming from the slowness of the Tor network. I'm not entirely sure what the benefit of Tor only swaps are (privacy?), but they are here for you if ever needed.

On the swap index page, you can filter for All, Clearnet Only, and Tor Only swaps.

If your account is set to "Show Only Applicable" swaps, you will not even see the swaps that you can't apply to anyway based on the type of your available addresses. For example, if you only have a Tor address, you will not see Clearnet only swaps.

This new feature is exposed through our API as well.

As always, please let me know if you see any issues with this or any other feature on the site, or if I can help you with anything.

⚡️ BUIDL ON!

Now, you have the option to create swaps that only allow nodes with either Clearnet connection or only allow nodes with Tor connection.

Clearnet only swaps are beneficial to node operators who want to minimise the problems stemming from the slowness of the Tor network. I'm not entirely sure what the benefit of Tor only swaps are (privacy?), but they are here for you if ever needed.

On the swap index page, you can filter for All, Clearnet Only, and Tor Only swaps.

If your account is set to "Show Only Applicable" swaps, you will not even see the swaps that you can't apply to anyway based on the type of your available addresses. For example, if you only have a Tor address, you will not see Clearnet only swaps.

This new feature is exposed through our API as well.

As always, please let me know if you see any issues with this or any other feature on the site, or if I can help you with anything.

⚡️ BUIDL ON!

Posted over 3 years ago

The version 2 of the API was launched a couple of month ago. In an effort to provide a full API to the community, I'm bringing version 2.1 with even more features as follows:

- You can rate participants

- You can get and update your account information

- Get and clear notifications

- Get node information including reputation scores

Some use cases for the LN+ API:

- Upcoming full featured Umbrel app, so you can run your own install of LN+ in the privacy of your own server.

- Automate your swap operations using a custom script of your own. For example, join a swap automatically when new channel capacity has been freed up because of recent channel closures.

- Suggest relevant and useful swaps related to a given node, as some LN services and Telegram channels already do.

- Pull reputation scores of a given node to improve the user experience on your LN service.

- Pull the avatar, social image, twitter, website, and bio fields of a node on your LN service to make richer node profiles.

Posted over 3 years ago

I'm happy to announce that a fully functional API for Lightning Network Plus has been released.

The objective of the API is to allow you to authenticate with your lighting node, request for existing swaps, create new swaps, apply to swaps, mark channels as opened, and post comments. Learn about all the details of the API.

Let me know if you need any fixes or improvements.

Can't wait to see what you will do with the API.

The objective of the API is to allow you to authenticate with your lighting node, request for existing swaps, create new swaps, apply to swaps, mark channels as opened, and post comments. Learn about all the details of the API.

Let me know if you need any fixes or improvements.

Can't wait to see what you will do with the API.

New outfit for our first birthday

Posted over 3 years ago

LN+ was started a year ago, and we celebrate this ocassion with an updated design for our swaps featuring neon lights enveloped in clouds.

The bitcoin ecosystem and especially the lightning network within it is growing fast, by any metric measured. I'm glad to be able to play a small role helping lightning network node operators collaborate and learn from each other. We're thankful for your support and encouragement.

Here is to another year of continued success! 🥂

The bitcoin ecosystem and especially the lightning network within it is growing fast, by any metric measured. I'm glad to be able to play a small role helping lightning network node operators collaborate and learn from each other. We're thankful for your support and encouragement.

Here is to another year of continued success! 🥂

The 5 stages of getting orange pilled

Posted almost 4 years ago

No matter the subject, it's never easy to accept the realization that one's world view is incorrect. For many smart and educated people like Michael Saylor it took years to get it. Bitcoin's underlying philosophy itself, and its implementation challenge many well engrained ideas. It's also not a minor subject, it shakes the foundation of what you hold to be true all your life.

Bitcoiners often get disappointed with nocoiners (people who don't have Bitcoin) when trying to orange pill them (open their minds to Bitcoin), because they don't seem to understand the obvious. I urge us to be patient and understanding.

Learn to recognize the "5 stages of grief" most people go through while detoxing from fiat, and help them through the hurdles with patience and with compassion.

Bitcoiners often get disappointed with nocoiners (people who don't have Bitcoin) when trying to orange pill them (open their minds to Bitcoin), because they don't seem to understand the obvious. I urge us to be patient and understanding.

Learn to recognize the "5 stages of grief" most people go through while detoxing from fiat, and help them through the hurdles with patience and with compassion.

1. Shock and denial 😲

Initially people can't accept that fiat money and the global monetary system is not what they thought it is. They can't accept that the official narrative they have been thought in school and have been fed by mass media doesn't tell the full story. It's shocking to realize one has been manipulated.

People also can't accept that a pseudunomous economist / programmer(s) (Satoshi Nakamoto) can discover digital scarcity, and reboot the world economy with a more efficient and more just monetary system that doesn't rely on centralized powers.

This stage can take a relatively long time, because one has to learn a quite a bit about bitcoin while being in denial.

People also can't accept that a pseudunomous economist / programmer(s) (Satoshi Nakamoto) can discover digital scarcity, and reboot the world economy with a more efficient and more just monetary system that doesn't rely on centralized powers.

This stage can take a relatively long time, because one has to learn a quite a bit about bitcoin while being in denial.

2. Anger 😡

Once people get over the shock, they often get angry.

They are angry for being lied to by the system, but they are also upset because they assume they missed out on buying bitcoin early.

Some construct or buy into various narratives that Bitcoin is actually dangerous because it will replace the old established monetary systems, or because it uses too many resources to run, etc.

At one point though, people do come to accept that this is happening no matter what.

They are angry for being lied to by the system, but they are also upset because they assume they missed out on buying bitcoin early.

Some construct or buy into various narratives that Bitcoin is actually dangerous because it will replace the old established monetary systems, or because it uses too many resources to run, etc.

At one point though, people do come to accept that this is happening no matter what.

3. Bargaining 🧐

The next step for intelligent people typically is bargaining.

They will ask: can we roll back time, and instead of bitcoin use another crypto coin that they can buy into early, or can we make the properties of bitcoin different so they would fit one's personal preferences (that typically turn out to be shortsighted)?

This stage is very important because people will learn through questioning about legacy systems, the engineering decisions made for bitcoin, about complex incentive structures, and other deeper aspects of the subject.

They will ask: can we roll back time, and instead of bitcoin use another crypto coin that they can buy into early, or can we make the properties of bitcoin different so they would fit one's personal preferences (that typically turn out to be shortsighted)?

This stage is very important because people will learn through questioning about legacy systems, the engineering decisions made for bitcoin, about complex incentive structures, and other deeper aspects of the subject.

4. Depression 😕

As people understand more about the economy, financial systems, political powers, money in general, inflation, etc. they get depressed.

There is a lot of uneccessary injustice, unfairness and cruelty going on in the world, and bitcoin doesn't seem to offer a quick solution to all these problems right away. Most people in the world haven't adopted bitcoin to any level in their lives. There are massive powers who are opposed to change. How will we ever get over these hurdles?

Fortunately, most people are strong in heart and not willing to give in or give up. Many move on to the last and most important stage.

There is a lot of uneccessary injustice, unfairness and cruelty going on in the world, and bitcoin doesn't seem to offer a quick solution to all these problems right away. Most people in the world haven't adopted bitcoin to any level in their lives. There are massive powers who are opposed to change. How will we ever get over these hurdles?

Fortunately, most people are strong in heart and not willing to give in or give up. Many move on to the last and most important stage.

5. Acceptance and hope 🤩

Once people realize bitcoin is not an instant or perfect solution to all ills in the world, but it is our only fair shot to fix things, they reach the final stage. They start to see bitcoin's true value and ingenuity, and how it can be the foundation for a new fair monetary and economic system. The future doesn't seem bleak no more. Hope returns.

At this point, people start to do what they can to help to push bitcoin forward:

At this point, people start to do what they can to help to push bitcoin forward:

- Most adopt it in their lives for savings and for payments

- Some start to run a node and provide liquidity to the Lightning Network

- Some can't hold back the good news and start to talk to their friends about bitcoin

- Some transition into jobs where they can work on bitcoin and its ecosystem

This entire process is difficult, yet extremely rewarding. It not only gives back hope in the future and improves one's financials, but that hope cascades into other areas of life like health, relationships, improved moral values, etc. People start to feel empowered to take charge and embetter themselves and their communities.

If you're a bitcoiner, I don't have to convince you about the above. If you're a nocoiner, you won't believe me until you experienced the change yourself. Good luck on your journey no matter where you stand! 🚀

Photo: Aditya Vyas

21 ways to get incoming capacity for your Bitcoin Lightning Network node

Posted almost 4 years ago

Whether you're a merchant, freelancer, employee or any other entity hoping to receive SATs through the Bitcoin Lightning Network, incoming liquidity is critically important for you. To be able to receive funds you need to have channels that are partially or full empty from your side.

Here are 21 ways you can generate incoming liquidity in no particular order.

Here are 21 ways you can generate incoming liquidity in no particular order.

1. LightningNetwork+

Right here on LN+ you can participate in a liquidity swap, a dual funded channel or join the liquidity pool. These are the only free options, but you need to open a channel to receive a channel of equivalent size. These are good options if you wanted to open channels to be able to send funds anyway.

2. LN Big

LN Big is one of the most well connected OG node operator offering large incoming channels for a fee.

3. Thor by Bitrefill

Bitrefill is also an OG lightning service. They offer incoming channels via their lightning product called Thor.

4. Yalls.org

Yalls is an OG Lightning social bookmarking site by Alex Bosworth, Lightning Labs developer, who offers channels for a fee.

5. Blocktank by Synonym

6. Coincept

Coincept is a brand new service that offers incoming channels for a relatively low fee, much like options 2 to 5.

7. LOOP by Lightning Labs

LOOP by LL allows you to send out SATs from your lightning node and receive them back on chain. You can use this service to create incoming capacity in two simple steps. First, open to any well connected node, check the node explorer right here on LN+. Second, loop out part or the entire channel capacity using Thunderhub or other tools that support looping out. You end up with a channel that is empty on your side, thus you can receive SATs immediately.

8. Flow by Voltage

Voltage is a cloud lightning node service. They offer easy purchase of channels from other nodes on the network. Flow leverages Lightning Lab's Pool.

9. Free channel by Voltage

If you have a node on Voltage.Cloud, you can request a free channel with a click of a button, which will allow you to receive 500,000 SATs once the channel is open.

10. Liqidity Marketplace by LnRouter

On the lightning analysis website LNRouter you can get an incoming channel for a fee from the Liquidity Ad Marketplace.

11. Magma by Amboss

On the lightning explorer website Amboss you can buy a channel for a fee at the Magma Marketplace. You can even automate your liquidity with the Hydro product.

12. Boltz

Boltz is a trustless (that's a positive thing) exchange that uses submarine swaps to exchange LN-BTC to on-chain BTC at low 0.5% fees.

13. Bitfinex

Bitfinex is a Bitcoin exchange that supports Lightning. You can create incoming capacity by opening a channel to BFX's node, and then sending a part or all of the SATs to Bitfinex, exchange the LN SATs to on-chains SATs at the exchange, and finally send the funds back to yourself on chain. This is a rather expensive option because exchanges charge fees when moving funds.

14. Kraken

Kraken is another major Bitcoin exchange that supports lightning deposits. You can do the same trick as described above for Bitfinex. Here is Kraken's node if you wish to connect to them.

15. FixedFloat

FixedFloat is a non-KYC exchange that allows you to swap lightning sats to on-chain sats easily for a fee of 0.5-1% depending on your settings. You can also swap any altcoins you may have lying around for fresh bitcoin sats at the same place.

16. ZigZag

ZigZag is also a non-KYC exchange similar to FixedFloat offering the same service for similar fees. This exchange is focused on BTC and LN, but it supports handful of altcoins too.

17. SideShift

SideShift is also a non-KYC exchange similar to the two above. Their fees are on the high end between 1-2%.

18. Deezy

On Deezy.io you can swap out your local lightning capacity for on-chain sats. This way, just like in the options 12-17 you will end up with incoming capacity on your existing channels and more sats in your on-chain wallets to open new channels.

19. Muun

You can create a mobile Muun wallet, and then send sats from your lightning node to it. Muun will charge for this service but somewhat similar to the options above 12-18, you will end up with a partially empty (from your side) channel on your lightning node.

20. ln2me

With ln2me you can establish a balanced channel by pushing half the capacity to their side on channel open and then requesting half back on-chain. This solution requires you to trust ln2me, so be careful.

21. Spend

The most obvious and perpaps somewhat overlooked way to generate incoming liquidity is to open a channel to a merchant who accepts Lightning payments and spend your SATs with them. Besides the already mentioned Bitrefill, which offers phone top ups and various gift cards, you can also spend your sats at hundreds of online merchants. Buy a hardware wallet at the Blockstream store, get plane tickets or book a hotel at Travala, gamble with Lightning Roulette, etc. Browse for more at LN Stores.

If you're aware of any other method to create incoming liquidity, please comment.

Introducing Dual Funded Channel Agreements

Posted almost 4 years ago

Dual Funded Channels (DFC) are a special and efficient way to open Bitcoin Lightning Network channels. They are now available on LN+. We call them Dual Funded Channel Agreements (DFCA) or "Dual Swaps". These are special "swaps" that are created between two parties and involves only a single channel. Let me explain (to the best of my ability) what dual funded channels are and how they can benefit you, and what are its downsides compared to swaps.

Benefits

The three benefits of dual funded channels:

- You can create a channel that is twice the capacity of the funds you have available. For example if you have 1M SAT available, you can open a 2M channel.

- Your newly opened channel is instantly balanced. So, following the above example, you will be able to send 1M and receive 1M on your new 2M channel.

- You split the channel opening costs.

How to open dual funded channels?

In order to open a dual funded channel, you need to use special tools at this time. It's not available by default in LN wallets. For the popular lightning implementation LND there is an additional tool available called BOS (Balance of Satoshi) by LND developer Alex Bosworth, which helps you open dual funded channels. This is the tool we require you to use on LN+ in order to participate in the new Dual Funded Channel Agreements (DFCA).

Other lightning implementations like CLN also have experimental support for dual funded channels, but we're not yet supporting them. We will wait until the code is more mature, and we can potentially open dual funded channels cross implmentations. Until then, please only open or apply to DFCAs if you run LND and you're able to use the BOS tool.

Other lightning implementations like CLN also have experimental support for dual funded channels, but we're not yet supporting them. We will wait until the code is more mature, and we can potentially open dual funded channels cross implmentations. Until then, please only open or apply to DFCAs if you run LND and you're able to use the BOS tool.

Downsides

The three downsides of DFCAs compared to regular swaps:

- You only get connected to one node, thus you have less direct and indirect connections.

- You need to use a specialized tool like BOS, which could be potentially difficult for users, and thus there are less node operators you can work with.

- You need to cooperate closely with the other party, because when you initiate a DFC a Terminal session needs to be kept open until the other party accepts the request.

How does it work on LN+?

On LN+ the user who starts the DFCA (participant A) will set the conditions for this special kind of "swap", including the capacity. For dual funded "swaps", A should only specify their your side of the capacity (half of total channel capacity). The total capacity will be the double of the capacity A specifies. For example, if the DFCA is for 1M SAT, the channel will be 2M SAT.

The cards showing the capacity show only the funding capacity (half the total) in order to be consistent with the triangle, square and pentagon swaps. When you search for swaps you want to find swaps that match the amount of SATs you have available to open a channel.

On LN+ as soon as participant B joins, A will be notified to get ready to accept the invitiation.

B initiates the channel open invitation in BOS. Once the invitation is sent out, participant A is notified again to go ahead an accept the invitation in BOS.

Once the invitation is accepted the channel opening transaction is sent out and the DFCA is complete.

If you are familiar with BOS, open or join some DFCAs!

The cards showing the capacity show only the funding capacity (half the total) in order to be consistent with the triangle, square and pentagon swaps. When you search for swaps you want to find swaps that match the amount of SATs you have available to open a channel.

On LN+ as soon as participant B joins, A will be notified to get ready to accept the invitiation.

B initiates the channel open invitation in BOS. Once the invitation is sent out, participant A is notified again to go ahead an accept the invitation in BOS.

Once the invitation is accepted the channel opening transaction is sent out and the DFCA is complete.

If you are familiar with BOS, open or join some DFCAs!

Posted almost 4 years ago

Following up on a popular request, I'm announcing a new feature: LN+ Messages.

LN+ Messages is similar to DMs on other platforms with one notable exception: you can only send and receive if you have logged in using your Bitcoin Lightning Network node to LightningNetwork.plus. LN+ Messages is designed specifically only for Lightning Network operators to cooperate and communicate with each other in a private and safe way.

With LN+ Messages, you don't have to reveal your Twitter, Telegram or Email address to other parties. You can message each other without revealing any personal information. You don't have to spend SATs message embedded into a lightning transaction, and hope the other party knows how to read it. LN+ Messages works in any brower and supports rich formatting and sending images too (ex. screenshots to help each other if needed). You can even send a message to node even if they are not registered on LN+. They will get your message once they claim their node.

LN+ Messages is similar to DMs on other platforms with one notable exception: you can only send and receive if you have logged in using your Bitcoin Lightning Network node to LightningNetwork.plus. LN+ Messages is designed specifically only for Lightning Network operators to cooperate and communicate with each other in a private and safe way.

With LN+ Messages, you don't have to reveal your Twitter, Telegram or Email address to other parties. You can message each other without revealing any personal information. You don't have to spend SATs message embedded into a lightning transaction, and hope the other party knows how to read it. LN+ Messages works in any brower and supports rich formatting and sending images too (ex. screenshots to help each other if needed). You can even send a message to node even if they are not registered on LN+. They will get your message once they claim their node.

Features of LN+ Messages

- New and read messages are clearly marked as such

- You can usend a message before it's been read

- You can flag messages that you consider spam or undesireable

- You can block nodes from sending you messages

- Optionally you can be notified by new messages on your email

How to Send

To message other node operators, go to their node profile (search under the Nodes navigation) and click the Message button with the envelope icon.

How to Receive

To read your messages click the Messages navigation item. You will be notified (bell icon) about any new messages you received in the navigation.

Happy messaging!

I'm eager to hear your ideas on how we can improve the service further.

Happy messaging!

I'm eager to hear your ideas on how we can improve the service further.

Why central banks are terrified of Bitcoin?

Posted about 4 years ago

Central banks and international organizations like the IMF are well informed and most definitely not stupid. They understand macro economics, game theory and technology. They are gigantic organizations and thus slow to act, but they make up for this with their immense reach and power. Despite this they are terrified of Bitcoin. Why is that?

When Bitcoin goes 10x or more from the current price, it will reach the range of market capitalization of the largest currencies in the world including Pound Sterling, Japanese Yen, Euro, US$ and Chinese Yuan. When this happens, in people's minds, the Bitcoin project turns from a spectacularly successful science project to a serious contender to claim the reserve currency status. What's more terrifying for current powers is that all odds are against the incumbents on all fronts.

When Bitcoin goes 10x or more from the current price, it will reach the range of market capitalization of the largest currencies in the world including Pound Sterling, Japanese Yen, Euro, US$ and Chinese Yuan. When this happens, in people's minds, the Bitcoin project turns from a spectacularly successful science project to a serious contender to claim the reserve currency status. What's more terrifying for current powers is that all odds are against the incumbents on all fronts.

Why Bitcoin is winning?

- Bitcoin carries less risk, because it's international and not dependent on the natural, economic, or political events within a single country (or even continent) as opposed to every other fiat currency. Bitcoin's risk is decentralized among 195 countries. Ineviably there will always be a few countries where unfortunate events happen, but there will always be other countries where things go well. Being 100% invested in Bitcoin means you're diversifying across the globe. Bitcoin outcompetes fiat currencies in terms of long term stability, especially during black swan events.

- Bitcoin fits the modern age, because it's designed to be the currency of the internet. The foundations are built on strong cryptography, thus it's significantly safer to transfer between parties across the globe. Compare Bitcoin's strong security to the most videly used legacy payment systems, the credit and debit cards that expose your private key (card number) to every single person and business you pay to. Bitcoin is also faster with settlement reached within seconds on the Lightning Network (LN) for smaller amounts, and within minutes on the base layer for any amount. Fiat systems are much slower, and settlement normally takes days. Bitcoin is also cheaper to send because sending smaller amounts on LN takes fractions of cents, and less than a dollar on layer one. Bitcoin outcompetes fiat currencies in features.

- Bitcoin has better monetary policy, because it's reliable and predictable for decades and even centuries to come. It doesn't bend to the whims of any politician, or anyone else. Bitcoin can't be mined faster no matter how high the price is as opposed to gold. The concensus rules can't be corrupted no matter how much of it you own. Bitcoin outcompetes every other fiat based reserve asset in terms of management of money supply.

- Bitcoin has the moral highground, because it's permissionless and maximally inclusive. Anyone with access to most basic, widely available cheap technology can open a Bitcoin and LN account and participate in the network and thus join the global economy ensuring they can provide for themselves and their families. It doesn't matter how poor, how uneducated, how old, or culturally supressed you're: you're welcome to use Bitcoin. Bitcoin outcompetes legacy systems in terms of serving humanitarian values.

- Bitcoin is more efficient, because despite the critics who focus on the energy expenditure required for Bitcoin mining, the overall cost of securing Bitcoin is minuscule (similar to the energy required to run Christmas lights), compared to what is required to secure legacy fiat based system. Legacy systems require massive armies, and law enforcement agencies just to ensure the currencies aren't counterfeited and continued to be accepted for valueable commodities. Bitcoin outcompetes legacy fiat systems on cost effectiveness.

Can fiat be fixed?

Legacy fiat systems are only better than Bitcoin in one aspect: they are more widely accepted. But this advantage is evaporating as Bitcoin is growing in terms of usage. Bitcoin is superior and is winning overall. And this reality can not be changed. You can't fix fiat. You can't replace Bitcoin. The discovery of digital scarcity was a single historical event. It's not a technology that can be copied. Blockchain, the technology existed long before Bitcoin. Blockchain is just one of the several aspects and technologies which made Bitcoin's discovery possible.

Even if hypothetically a leading fiat currency was turned into a crypto coin which copied Bitcoin's properties perfectly, it would just be one of the many 10K+ copies (altcoins) that have been created that all failed to overtake Bitcoin. However, this hypothetical scenario can't even happen, because the huge amounts of debts need to be repaid and inflation generating money printing is the only way to do it. You can't tax your citizens more to create more fiat, because everyone either will go bankrupt or leave. You can't not repay the loans because the country goes bankrupt. The only remaining option is to inflate the currency away.

Also, if a hypothetical central bank digital currency (CBDC) was created, nobody would have the means to force it on other nation's governments, and all the citizens of every nation.

Even if hypothetically a leading fiat currency was turned into a crypto coin which copied Bitcoin's properties perfectly, it would just be one of the many 10K+ copies (altcoins) that have been created that all failed to overtake Bitcoin. However, this hypothetical scenario can't even happen, because the huge amounts of debts need to be repaid and inflation generating money printing is the only way to do it. You can't tax your citizens more to create more fiat, because everyone either will go bankrupt or leave. You can't not repay the loans because the country goes bankrupt. The only remaining option is to inflate the currency away.

Also, if a hypothetical central bank digital currency (CBDC) was created, nobody would have the means to force it on other nation's governments, and all the citizens of every nation.

What's next for central banks?

I can think of three scenarios that central banks can follow:

- Fight Bitcoin to death. This will be bloody for everyone involved, but eventually there is no way for fiat to win, because of the fundamentally inferior properties that can’t be changed as discussed above. In fact, such a fight may accelerate the adoption of Bitcoin, because it will bring the issues currently hidden from a big part of the population into the forefront.

- Embrace Bitcoin as soon as possible. This means current powers will have to buy in and play by Bitcoin’s consensus rules. This would be beneficial for all participants, because we could inflate away the fiat debt and at the same time transition economies into a stable and fair Bitcoin standard that can last for centruries.

- Take control of custodial services. Governments and international agencies can take over exchanges and turn legacy banks into holders of Bitcoin. This way they can indirectly take control of Bitcoin without the need to buy in. This can be done through very strict regulation or literal takeovers. Self custody of Bitcoin and proof of reserves will however keep such actions in control.

Since I'm not aware of the existence of a world government or a coordinated power structure behind the curtains that can pull all the ropes, a single coordinated strategy isn't likely to play out. It's likely that all above strategies will happen at the same time. Either way, eventually the Bitcoin Standard and hyperbitcoinisation is inevitable in all scenarios. (Do let me know if there are other scenarios I didn't consider.)

What can you do?

What to do as an individual to survive the likely tumultuous transition towards the Bitcoin Standard?

- Take self custody of as much bitcoin as possible as fast as possible

- Learn how to secure your coins best

- Learn how to run your own Bitcoin and Lightning node

- Help the Bitcoin ecosystem as much as possible through development, education, participation, ideas, etc.

LnRouter can help you become a profitable routing node

Posted about 4 years ago

When you're running a Lightning Network Node you have the opportunity to earn SATs by routing money for other people. Routing means you receive SATs from one node on one channel and pass the funds on to another node on another channel. For this service you can charge a small fee. If you route a lot, these fees add up to considerable revenue.

Each channel you open to a node has a certain capacity and the funds are partially on your side and partially on the other node's side. In order to route effectively you need to ensure you have capacity in the directions people want to send funds.

The Lightning Network traffic is not public and the channel balances are not public either. So, it normally requires a node operator to guess which nodes need capacity and in which direction.

The LnRouter App, a paid service by the swiss developer Severin Alex Bühler aims to help node operators with the above problem, and some more.

Each channel you open to a node has a certain capacity and the funds are partially on your side and partially on the other node's side. In order to route effectively you need to ensure you have capacity in the directions people want to send funds.

The Lightning Network traffic is not public and the channel balances are not public either. So, it normally requires a node operator to guess which nodes need capacity and in which direction.

The LnRouter App, a paid service by the swiss developer Severin Alex Bühler aims to help node operators with the above problem, and some more.

Signing Up

In order to use LnRouter, first you need to sign up with your LN node by signing a message and then providing a contact email. Then, you need to sign up for a pro package which costs 16,800 SAT (at current Bitcoin prices: ~$8).

Now, you can search for medium and larger nodes (Tungsten and higher in LN+ ranking) and the app will provide you with several pieces of information as follows.

Now, you can search for medium and larger nodes (Tungsten and higher in LN+ ranking) and the app will provide you with several pieces of information as follows.

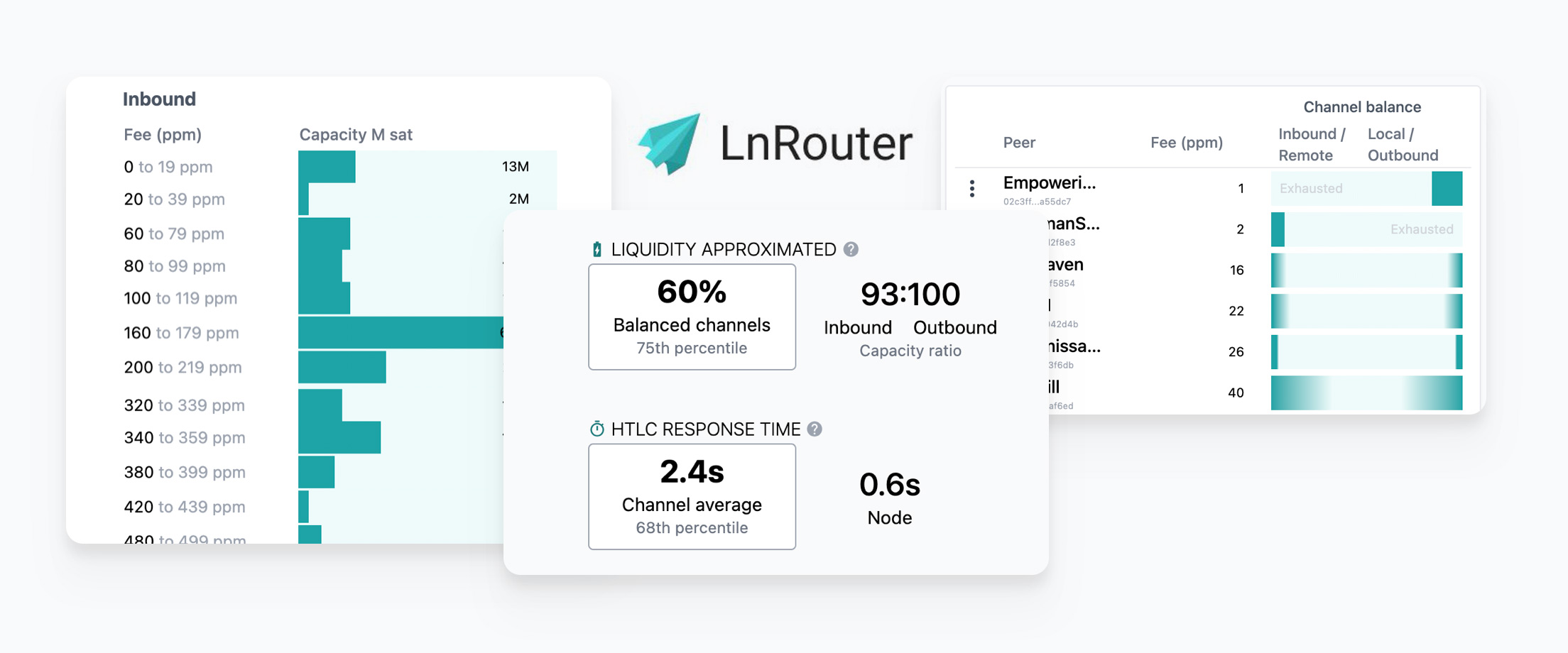

Liquidity

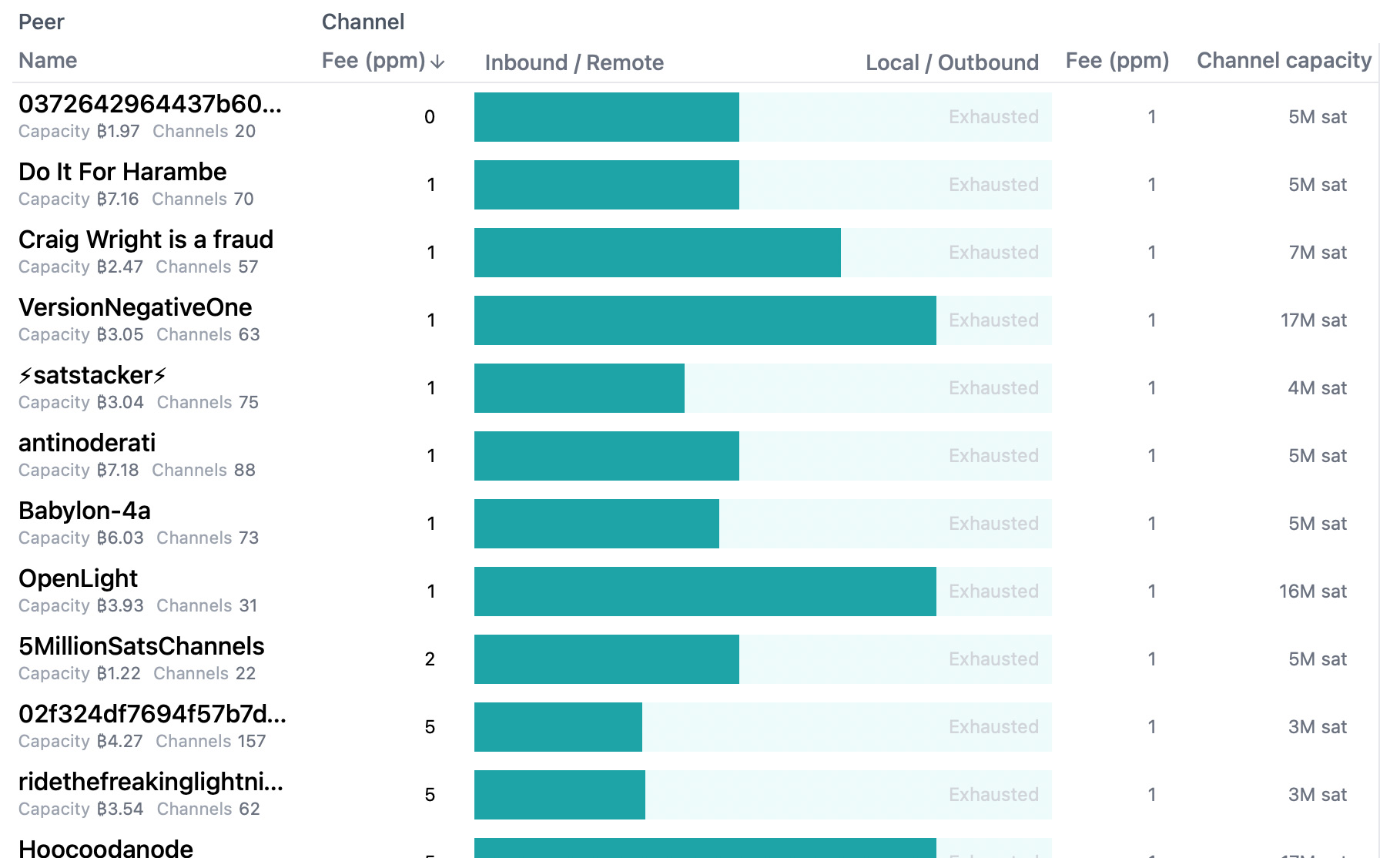

The exact amount in channels is not public information as mentioned above, but the LnRouter app by probing the nodes with routing transactions is able to estimate roughly the capacity of channels on each side and whether the channels are balanced or not.

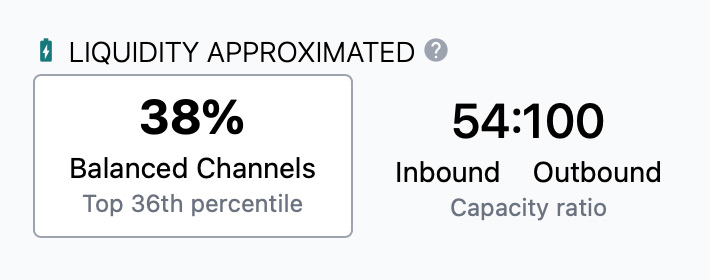

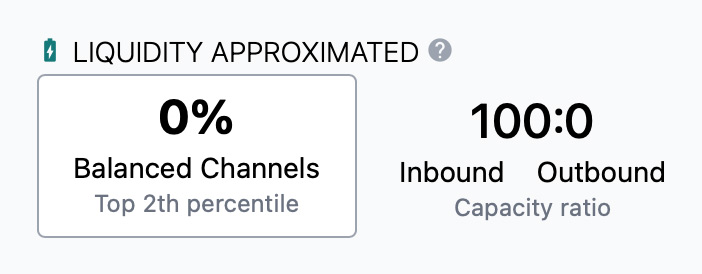

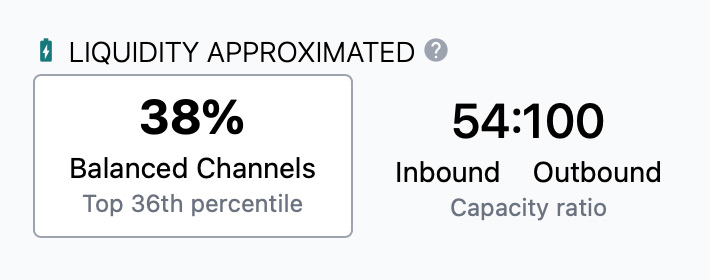

Ideally every single channel on a node would be balanced (100%), but that's not necessarily a requirement for a node to be an efficient routing node. As long as the node has capacity to receive on channels where SATs want to come through, and also has sending capacity on channels it wants to forward to, the node will work very well for forwarding. However, it's definitely not ideal if the node's capacity is all on one side on all their channels. For example, either all channels are only able to receive or only able send. An efficient routing node would have a balanced capacity ratio.

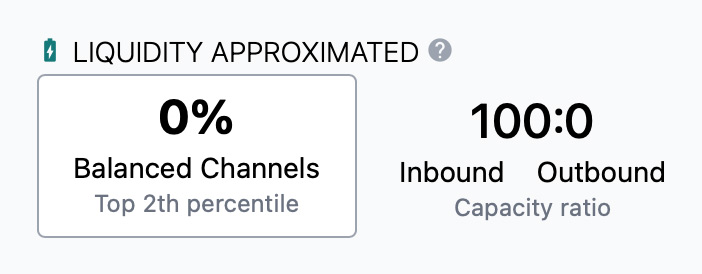

In the first example above, a large node only has many incoming channels, and virtually no outgoing capacity. This means the node is not effective for routing purposes (but it's very effective for receiving payments if it's a merchant). If you're expecting to route or even just send SATs through this node you will be out of luck. It's better to avoid connecting to such a node, unless you're planning to pay invoices to this node.

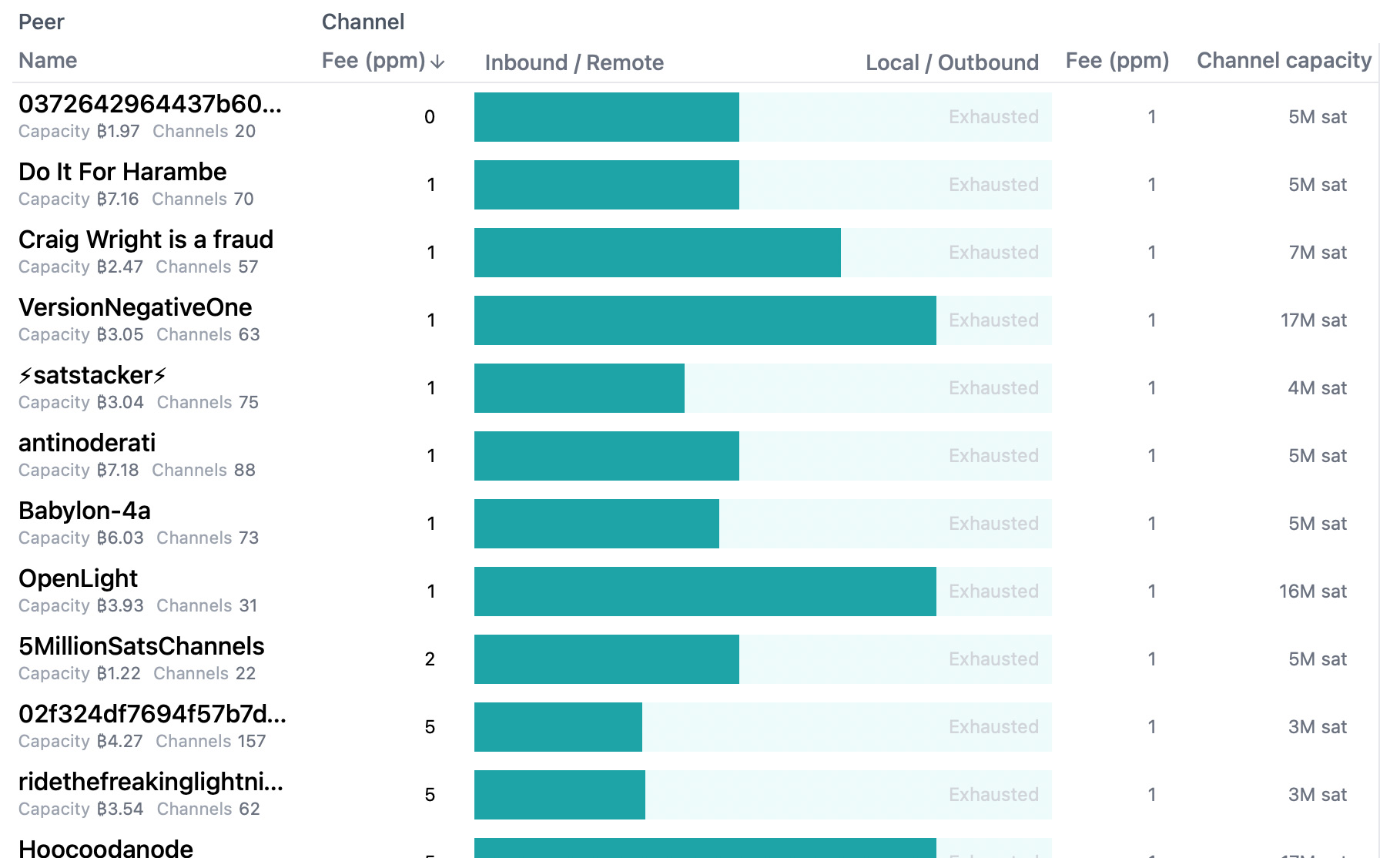

As you can see on the image above, LnRouter gives a per channel breakdown of estimated capacity. You can have a rough idea about what's happening on a given node in terms of channel balances, and you can see if your node can complement the given node.

Ideally every single channel on a node would be balanced (100%), but that's not necessarily a requirement for a node to be an efficient routing node. As long as the node has capacity to receive on channels where SATs want to come through, and also has sending capacity on channels it wants to forward to, the node will work very well for forwarding. However, it's definitely not ideal if the node's capacity is all on one side on all their channels. For example, either all channels are only able to receive or only able send. An efficient routing node would have a balanced capacity ratio.

In the first example above, a large node only has many incoming channels, and virtually no outgoing capacity. This means the node is not effective for routing purposes (but it's very effective for receiving payments if it's a merchant). If you're expecting to route or even just send SATs through this node you will be out of luck. It's better to avoid connecting to such a node, unless you're planning to pay invoices to this node.

As you can see on the image above, LnRouter gives a per channel breakdown of estimated capacity. You can have a rough idea about what's happening on a given node in terms of channel balances, and you can see if your node can complement the given node.

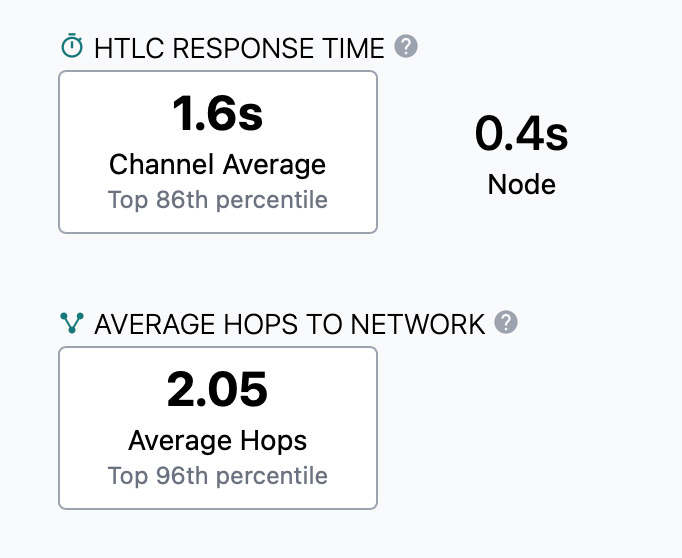

Speed and Connectedness

Besides liquidity, it's important to know the reaction speed of a node and how well connected it is to the rest of the network through its channels. The faster and more connected the node, the quicker the payments go through it, and thus the more likely it will be chosen by the payment routing algorithms.

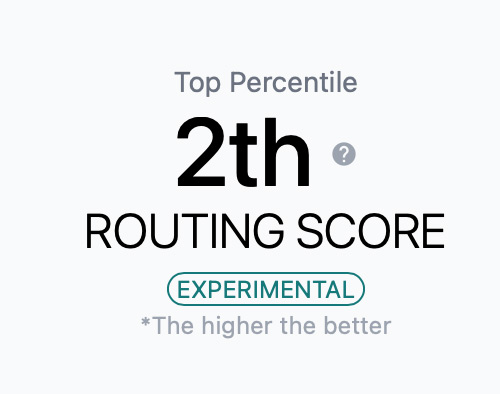

Routing Score

The routing score is an aggregation of the data explained above and gives you a quick understanding how good the node is in terms of routing.

Conclusion

So, how do you make sense of all this data as a node operator, and how to decide what node to connect to? There are many strategies, but here are three possible ideas:

- Find nodes that have a lot of local capacity and not enough incoming capacity, and open a channel to them. Any node that receives a lot of SATs and doesn't send a lot out will have this property and problem you can relieve.

- Find nodes that have lots of incoming capacity but no local capacity. Establish a channel with such a node, and ensure to push capacity to their side, so you have an empty channel from your side. This can be achieved by asking them to open to you, or by rebalancing which could be difficult if the node is very unbalanced.

- Look for well balanced and fast nodes. Connecting to them will increase the chances that the channels will be well managed from their side without you needing to do anything. And since the node is likely routing funds regularly, you will receive some of that traffic too.

Whenever you are opening channels, it's best if you open to a node within a swap right here on LN+, so your own node doesn't become unbalanced. However, that's no always possible, so you may need to find intermediate nodes to open to achieve your rebalancing needs.