Latest Highlighted News

Introducing LN+ Pro Membership: Elevate Your Node to New Heights

Posted almost 2 years ago by LN+

MicroStrategy's Impact and Potential in the Bitcoin Ecosystem

Posted almost 2 years ago by LN+

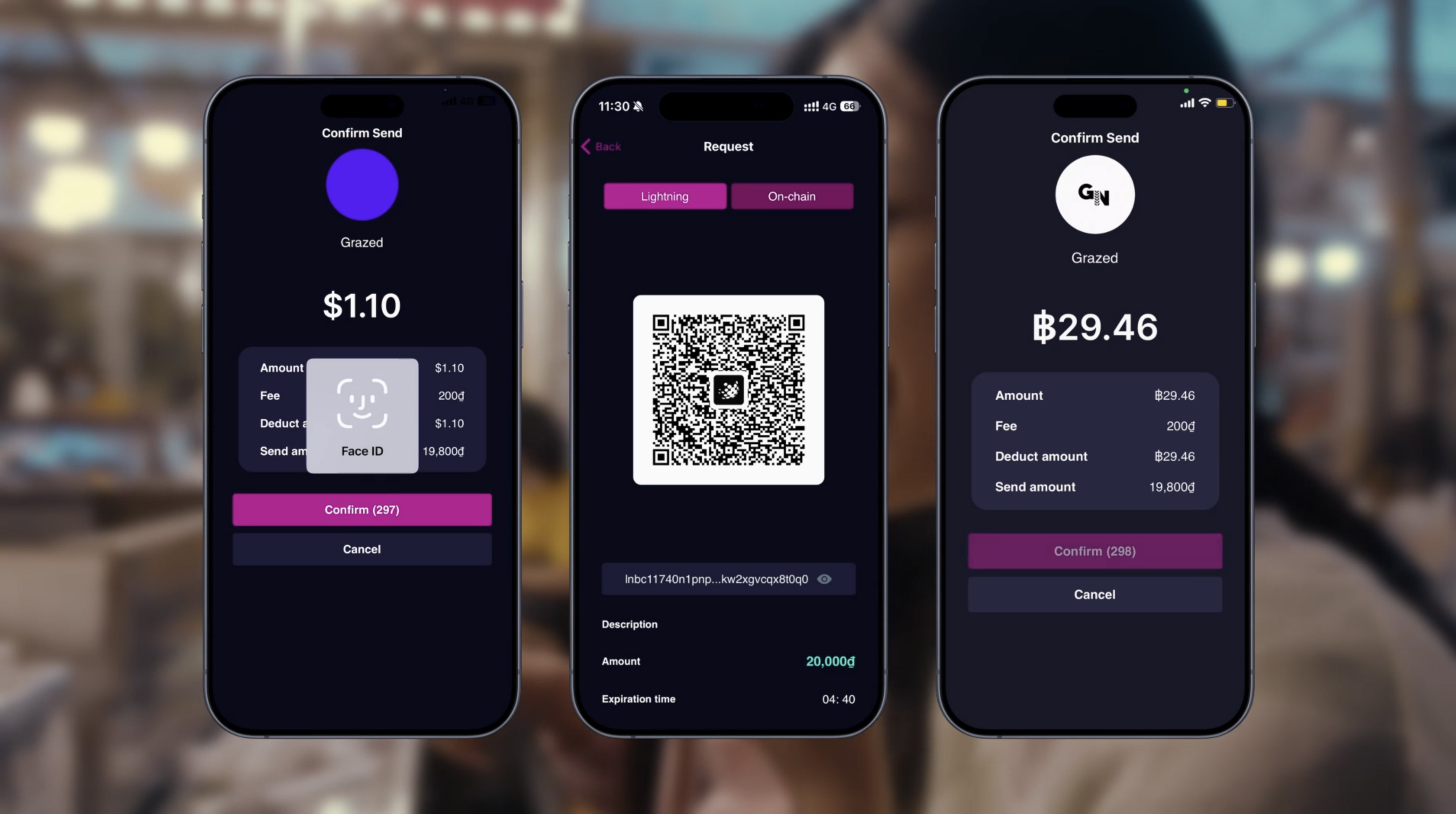

Neutronpay Expands to Southeast Asia, Harnessing Lightning Network for Advanced Payment Solutions

Posted almost 2 years ago by LN+

What the Drop in Lightning Nodes Means for LN's Future?

Posted almost 2 years ago by LN+

Understanding the Lightning Network - Where Did My Sats Go?

Posted almost 2 years ago by LN+

What is a Bitcoin Lightning Network Channel Backup and How To Use It?

Posted about 2 years ago by LN+

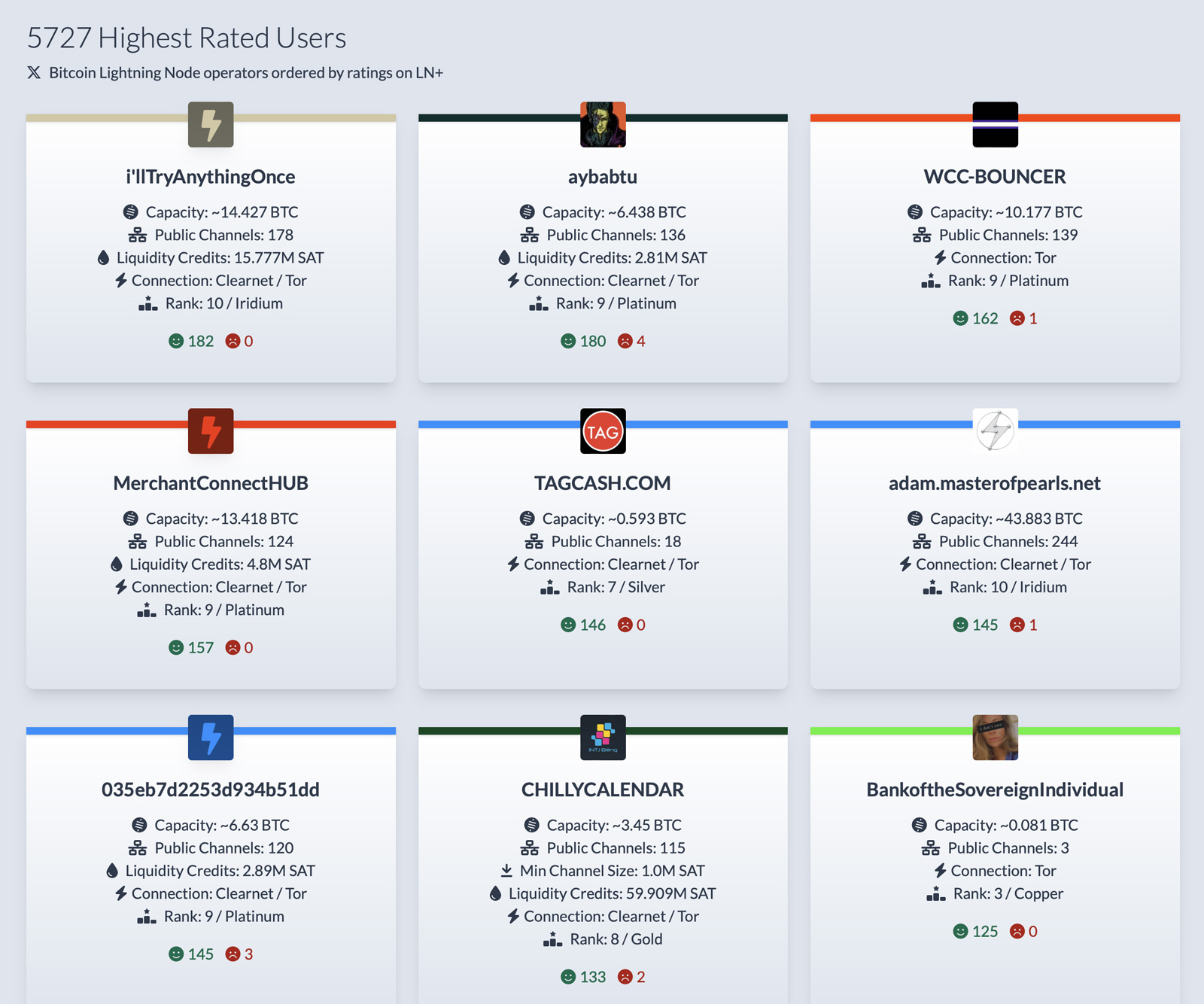

The INTJ Billing Bitcoin Lightning Network Grafana Dashboard

Posted about 2 years ago by CHILLYCALENDAR

A Guide for Situations Where Your Lightning Close-Transaction Fails to Close the Channel

Posted about 2 years ago by HODLmeTight

Simple Introduction to Understanding Elliptic Curve Cryptography in Bitcoin

Posted about 2 years ago by LN+

I'm working on building up capacity on this my secondary node CHILLYCALENDAR2

Posted about 2 years ago by CHILLYCALENDAR2